Two AIM stocks, funds and a ground-breaking technology

Both these companies are soaring in value, but Saltydog analyst asks, have we missed an opportunity?

27th January 2020 11:45

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Both these companies are soaring in value, but Saltydog analyst asks has this boat sailed, and have we missed an opportunity?

In search of clean energy

Since leaving University some 50 years ago, where I studied Theoretical Physics, I have always held the belief that, sooner or later, some clever people would devise a method of giving the world free “green clean” energy. This I thought would come from mastering fusion or from the ability to capture neutrino radiation emitted by the sun.

In the future, new quantum computers may well allow the formulation of new materials capable of withstanding the heat involved in the fusion process, but they are not there yet. Similarly, I have not read about any pioneering means of neutrino capture coming onto the scene anytime soon.

However, solar panels and wind farms do exist, and certainly produce green energy when the weather conditions are favourable, but storing the surplus when conditions are good, to use when they are not, is still the problem (or at least it was!)

There is now a new kid on the block called “Waterfuel”. This involves using Electrolysis to cheaply, efficiently and safely split water into Hydrogen and Oxygen. The hydrogen can then be stored for use in the future. It can be fed into existing gas installations and used to power hydrogen driven engines. This process is perfect for when there is an oversupply of electricity which normally has nowhere to go. Now you can use it to create hydrogen for future use.

- A successful share tip still undervalued

- An 'oddball' AIM share worth watching closely

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

There is an island in the Orkneys that derives its electricity from wind and tidal power and, due to a small population, it has an oversupply which has been linked up with hydrogen generation. They have now converted all the schools, government buildings and vehicles to be gas powered. Green and Free with a surplus to sell. What is there not to like?

The point is, of course, how can we investors benefit from this new ground-breaking technology? There are several companies on the AIM Market which are actively involved. One is called ITM Power (LSE:ITM), and another is Ceres Power Holdings (LSE:CWR).

Both of these companies are soaring in value.

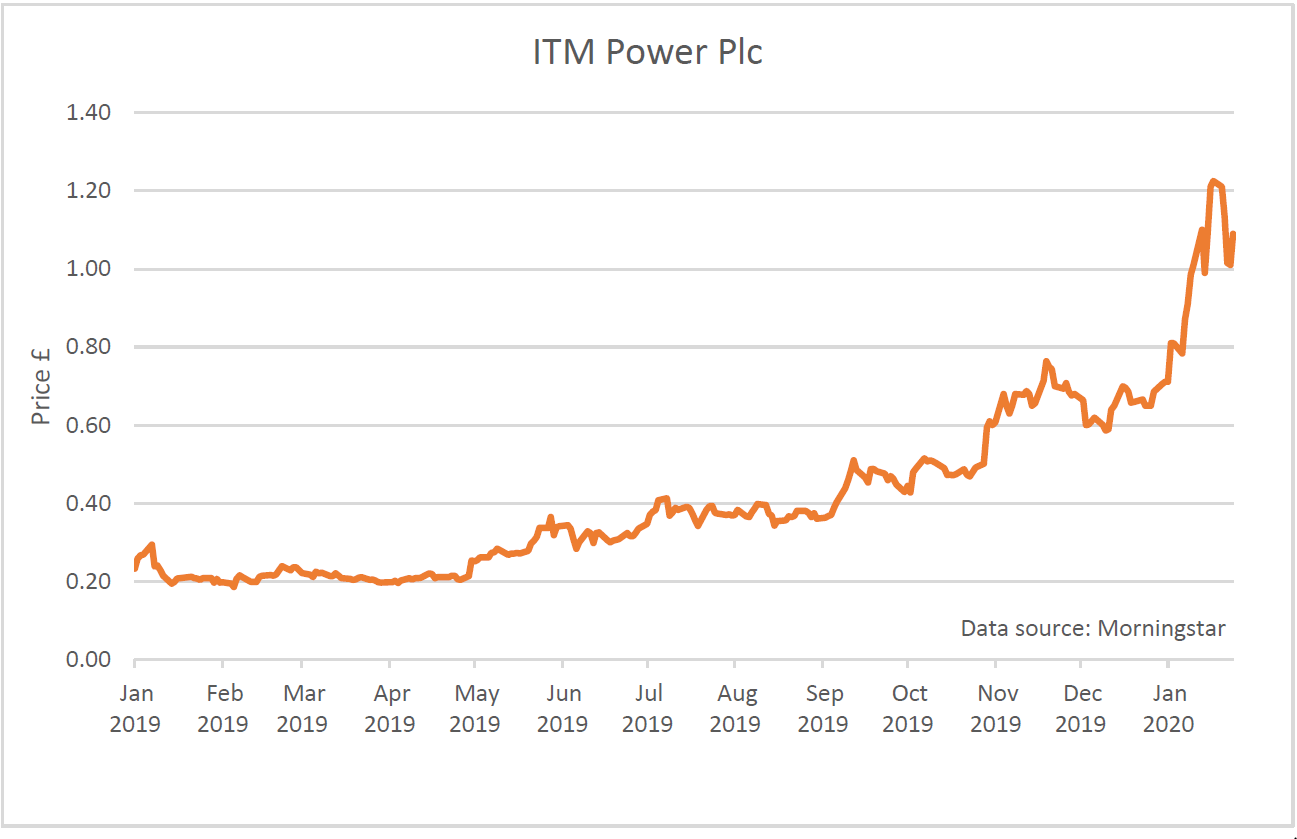

ITM designs and manufactures integrated hydrogen energy solutions for energy storage and clean fuel production. Their share price trebled in 2019 and is up 40% so far this year, even though it did fall quite significantly last week.

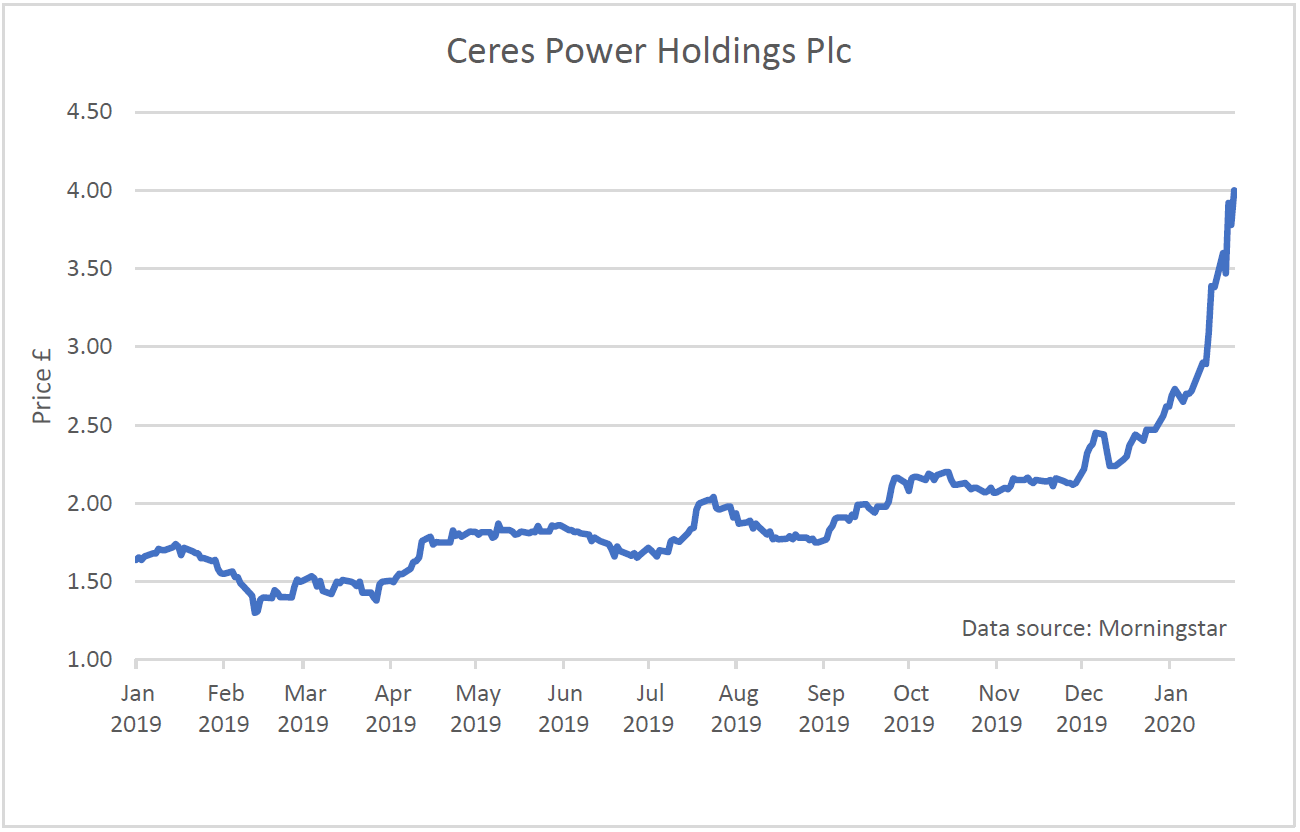

Ceres is developing fuel cell technology and its main project is their SteelCell fuel cell that can convert natural gas, or hydrogen, directly into electricity. They can be used to provide combined heat and power solutions for commercial and residential buildings, generate electricity for data centres, and power for electric vehicles. The company’s share price has more than doubled since the beginning of last year.

The question is, has this boat sailed, and have we missed an opportunity?

Hopefully, if this is the innovative discovery it appears to be, then the answer is no, and further growth is still to come. What I am sure of is that there must be other businesses working in this field. It would be nice to think that some of the technology funds that we analyse are already invested, so we could be there by default.

It is an interesting thought that the future world could be powered by water!

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.