Stockwatch: bulls, bears and a global banking crisis

9th May 2023 11:44

by Edmond Jackson from interactive investor

The implications of stress among US regional banks stretches far beyond America’s borders. Analyst Edmond Jackson examines opposing views and what it might mean for the UK bank sector.

What should we make of the situation with regional banks in the US? Is it really a crisis, or is it chiefly financial media fanning uncertainty?

Amid a “May Day” rescue of First Republic Bank by JPMorgan Chase & Co (NYSE:JPM), America’s largest bank, its boss Jamie Dimon declared it “pretty much resolves” those banks financially offside - even if there might be another smaller one - and the health of the US banking system remains “strong”.

- Learn more: SIPP Portfolio Ideas | How SIPPs Work | Transfer a SIPP

Gerard Cassidy, head of US bank equity strategy at RBC Capital Markets, further argues the issue is sentiment not fundamentals. “Recent failures were due to mismatch between assets and liabilities, then deposit runs,” he said. “Core fundamentals of the regional bank industry are healthy and good.”

Cynics may feel that chimes with President Hoover’s memorable October 1929 faux pas – “Economic fundamentals are on a sound and prosperous basis” – a day before the US stock market slumped 9%.

Cassidy backs his contention, saying recent results from regional banks were pretty good. Demand for credit remains strong and liquidity is healthy, as deposits stabilise to “slightly growing” after mid-March withdrawals in reaction to Silicon Valley Bank failing.

Key risk factors for the US and international economy

Some observers – not ‘of’ the banking industry – are more sceptical, given any tightening of bank lending coincides with central banks raising interest rates at the swiftest pace in history.

Just over a year ago, interest rates were close to zero. Ten rate rises have been initiated by the US Federal Reserve since then and 11 by the Bank of England. In principle, this initially affects big ticket items such as homes and vehicles, making them less affordable, but potentially spreads to the wider economy. Low unemployment currently plus rising wages are softening this effect, but it is underway.

Pessimists therefore reckon things will get worse before they get better, so strap yourself in for earnings disappointments, especially in cyclical stocks.

Such reasoning is supported for example by a 16% drop in Marshalls (LSE:MSLH) building supplies this morning, after an update guiding profits lower. It is hurting other construction equities, so take your view whether that’s purely “sentiment” or justified pricing of a deterioration in fundamentals.

Optimists argue that a modest credit crunch arising from bank strains would help the Federal Reserve achieve its 2% inflation target sooner than its chair Jerome Powell has guided for (that US interest rates may need to remain elevated, the rest of this year). If we do incur a genuine crisis, the Fed will start cutting rates.

‘When America sneezes, the rest of the world catches a cold’

This adage may be less pertinent given China’s importance nowadays to the global economy, but I think it still applies.

Bank of England data shows households already withdrew a record £4.8 billion from bank accounts this March – over 50% more than in October 2008 during the financial crisis.

It was only 0.3% of total household deposits but represented the first data since US banking strains and the Credit Suisse Group AG (SIX:CSGN) takeover, although it’s unclear to what extent it may also reflect cost of living issues.

We need to watch this because unless it promptly stabilises, then a commensurate effect on lending is likely.

Why monetary policy excesses are largely to blame

The Covid era of excess stimulus measures triggered a savings boom, especially in the US, where bank deposits soared 37% versus loans up only 3%. Such deposits went largely into low-yielding government bonds, but when interest rates started rising the banks could not meet depositor expectations of higher returns.

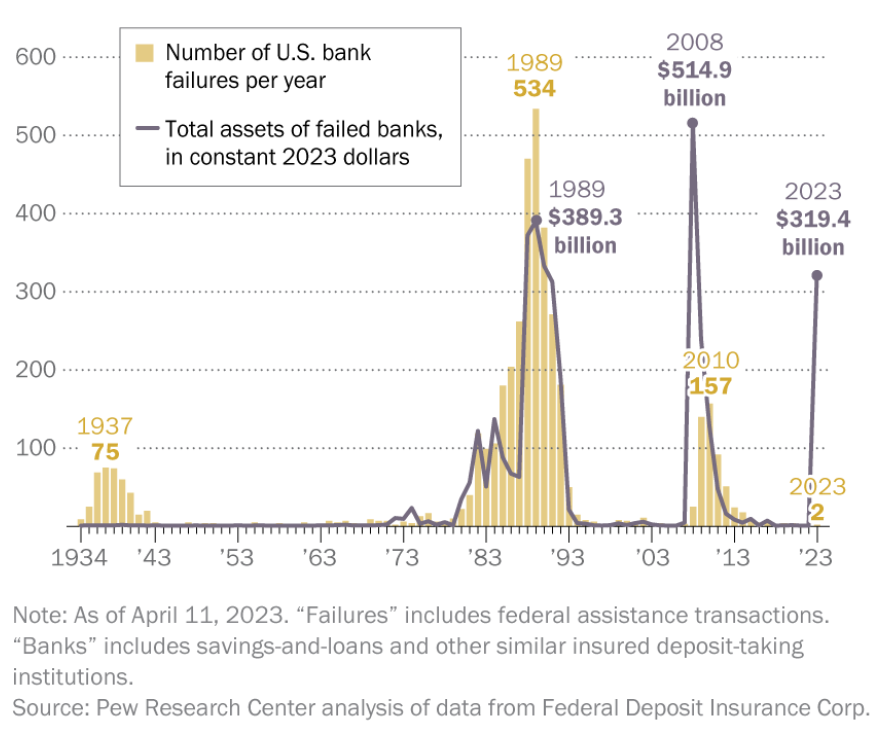

Once banks started disclosing theoretical bond portfolio losses, Silicon Valley Bank saw a run and Signature bank was closed by regulators.

The Fed offered bail-outs where banks could sell their assets at purchase price rather than market price, for cash. But this was a “sticking plaster” solution given the key central bank interest rate is now significantly above the rate passed on to depositors.

Barry Norris, the UK manager of hedge fund VT Argonaut Absolute Return, profited from short positions in Silicon Valley, Signature and Credit Suisse, and remains short of selected regional US banks.

He contends, banks will not be able to pass on higher interest costs to their borrowers without causing defaults. Nor will they be able to chase higher yields for their assets, without raising their own default risk.

I think much also depends on the wider economy, but this wider evolutionary analysis is a better explanation than the banking industry blaming “sentiment”.

The Argonaut Absolute Return Fund is reducing cyclical exposure while also still running a relatively generous net long exposure, including precious metals.

- Put your questions to Lloyds Bank, Shell, L&G and Next

- Lloyds Bank and NatWest among FTSE 100 mega-dividend payouts in May

- Are Lloyds Bank shares a ‘buy’ after profit soars 46%

Norris’s end-April newsletter concludes:

“We see more short opportunities than long though still think we may need some patience before the dam finally busts. Bankruptcy is a gradual process, until it is sudden.”

“The best of 2023’s stock market returns are likely now behind us: uncorrelated positive returns are probably about to become more valuable again.”

By “uncorrelated” he means positions in industries behaving differently, a classic way for hedge fund managers to focus their portfolios yet contain risk.

That means stock-picking should be a priority in context of macro awareness.

Regulators need to increase credit insurance

In the US, Nelson Peltz, an activist investor with an industrial background, warns that more US regional banks will fail unless regulators insist depositors over the $250,000 insured threshold pay a small premium to the Federal Deposit Insurance Corporation.

His proposal is aimed at thwarting deposits outflow from smaller and regional banks.

Last Thursday, PacWest Bancorp (NASDAQ:PACW) fell 60% as it disclosed it was exploring a potential sale as lifeline. This Los Angeles-based bank is only a fifth the size of the three regional US banks that failed, and saw significant outflows after Silicon Valley’s debacle, yet from April deposits increased.

Western Alliance Bancorp (NYSE:WAL) fell similarly and First Horizon Corp (NYSE:FHN) by 40%. Western Alliance recovered to a 30% drop after denying speculation of a sale.

A common factor of all these banks, as with Silicon Valley and First Republic, is a high proportion of uninsured deposits.

US and UK inter-bank rates are still ‘only’ 5% and 4.25%

In long-term context, current US and UK inter-bank ratesare modest versus the 20%-plus in the US and 10%-plus in the UK required to settle inflationary consequences of the 1970s.

Yet debt levels have massively expanded since then, offering less scope for central banks to wield a monetary policy bludgeon without triggering a slump.

- How to protect and grow wealth in turbulent times

- Stockwatch: six share tips including a FTSE 100 stock to buy

- The secrets of investing when inflation is high

Interest rates have not truly been “normalised” as much as some would say is necessary to provide banks with a long-run sustainable business operating model. The case against holding bank equity, even main banks in the UK, is the sector lurching from one crisis to another on a multi-decade view.

Time will tell whether the current approach of central banks tempers inflation, or squeezes some (over-borrowed) areas of the economy more, while others raise prices and pay employees more, ingraining inflation in mid-single-digits.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.