Stockwatch: a buy after strongest numbers this results season?

Of all the results published in the past few months, analyst Edmond Jackson is most impressed with this set from a successful mid-cap business in a popular sector.

24th May 2024 11:30

by Edmond Jackson from interactive investor

One of the intrinsically strongest set of results I have seen this latest reporting season was yesterday’s annual numbers to 31 March from QinetiQ Group (LSE:QQ.), a mid-cap defence and security group.

This Farnborough-based multinational engages in critical national infrastructure and testing for air, land, sea and target systems. Aligned closely to the changing nature of modern warfare, it is therefore benefiting and looks poised to gain significantly more in years ahead, from global instability driving government defence spending.

- Invest with ii: Top UK Shares | Free Regular Investing | Open an investment Account

Unless a second Trump presidency turns the US ridiculously isolationist, this trend looks set up and well-insulated from any recession.

I initially drew attention as a “buy” at 260p in September 2020 on around 13x expected earnings and given Qinetiq’s strong conversion of operating profits to cash (aiding investment without much resort to debt). I reiterated “buy” last November at 319p given it appeared better value as a defence stock than BAE Systems (LSE:BA.) – which I regularly covered and re-rated to fair value.

Re-rating justified by underlying dynamics

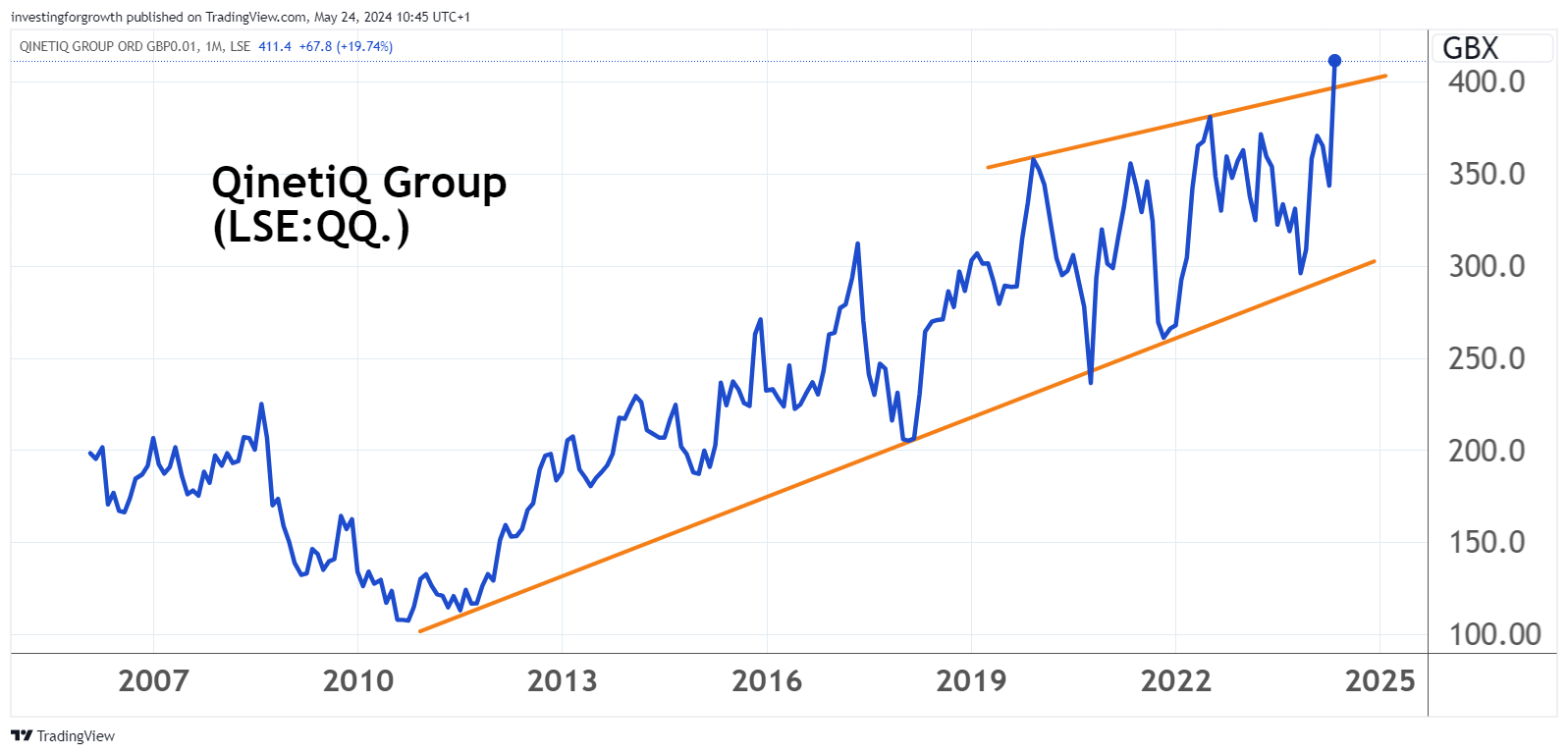

Qinetic yesterday leapt 13% to an all-time high of 424p relative to the 385p highs achieved in July 2022 and February 2020. We are seeing a mass of 10% and even 20% re-ratings currently, although it’s unclear quite whether that signals a major turning point for the economy and stock market (my 17 May article), or investors waking up to undervaluation amid a plethora of takeover approaches for UK-listed firms.

Source: TradingView. Past performance is not a guide to future performance.

But this appeared well-justified by the all-round progress which raised guidance for the March 2025 year and reinforced confidence in bold targets towards 2027. It puts Qinetiq possibly on a 12-month forward price/earnings (PE) ratio of 14x relative to BAE on 20x. currently with their share price at around 1,400p.

Last November, Qinetiq’s forward PE was under 12x for March 2024 versus BAE on around 16x – their re-ratings showing how defence stocks have been in demand over the last six months.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- How to invest ahead of the general election

Yields compare at 2% and 2.4% respectively, so this is significantly about a perceived earnings valuation gap. Both companies have a strong record of profit conversion to cash with moderate capital expenditure needs – as can be expected from engineering-technology groups – yet with sound and useful free cash flow.

Qinetiq - financial summary

Year end 31 Mar

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 764 | 756 | 783 | 833 | 911 | 1,073 | 1,278 | 1,320 | 1,581 | 1,912 |

| Net profit (£ million) | 105 | 106 | 123 | 138 | 114 | 106 | 125 | 90.0 | 154 | 140 |

| Operating margin (%) | 14.4 | 9.8 | 16.8 | 17.4 | 13.5 | 11.6 | 9.3 | 9.6 | 12.6 | 10.1 |

| Reported earnings/share (p) | 18.5 | 16.7 | 21.3 | 24.3 | 20.0 | 18.6 | 21.6 | 15.5 | 26.5 | 23.8 |

| Normalised earnings/share (p) | 22.2 | 23.1 | 19.2 | 21.1 | 20.5 | 19.2 | 20.8 | 14.5 | 23.3 | 29.0 |

| Operational cashflow/share (p) | 17.6 | 27.4 | 18.9 | 20.6 | 21.6 | 27.3 | 31.5 | 32.6 | 35.4 | 42.6 |

| Capital expenditure/share (p) | 4.6 | 5.1 | 5.7 | 9.6 | 15.4 | 19.1 | 13.8 | 14.5 | 18.7 | 17.4 |

| Free cashflow/share (p) | 13.0 | 22.3 | 13.2 | 11.0 | 6.2 | 8.2 | 17.7 | 18.1 | 16.7 | 25.2 |

| Dividend per share (p) | 5.4 | 5.7 | 6.0 | 6.3 | 6.6 | 6.6 | 6.9 | 7.3 | 7.7 | 8.3 |

| Covered by earnings (x) | 3.4 | 2.9 | 3.6 | 3.9 | 3.0 | 2.8 | 3.1 | 2.1 | 3.4 | 2.9 |

| Cash (£m) | 199 | 276 | 224 | 272 | 191 | 102 | 191 | 102 | 191 | 231 |

| Net debt (£m) | -197 | -276 | -224 | -272 | -160 | -74.2 | -163 | -226 | 212 | 153 |

| Net assets (£m) | 298 | 325 | 532 | 744 | 777 | 885 | 883 | 1,041 | 968 | 926 |

| Net assets per share (p) | 49.0 | 55.3 | 93.9 | 131 | 137 | 156 | 155 | 182 | 169 | 162 |

Source: historic company REFS and company accounts.

Strictly, a PE around 14x is fair enough versus underlying earnings per share (EPS) up 11% at 29.4p – with an aspect of upside in the trend as 2025 forecasts are upgraded (albeit with no published specific numbers). After recent consensus for March 2025 EPS of 30.6p, if we say 32p, that implies a 13.25x multiple which is arithmetically in line. As we see with BAE, however, when a sector comes into vogue it is quite easy for momentum buyers to bid up ratings.

Mind how Qinetiq's 21% headline revenue growth this last year benefits from the full effects of the 2022 acquisition of Avantus Federal in the US, although 14% organic growth bodes well after the underlying operating profit margin rose 16%. That it was stable at 11.3% at the reported level implies lower historic margins at Avantus, which possibly Qinetiq can improve.

While the CEO’s narrative is “strong momentum and increased spending in our major markets” I would note the actual order intake is up only very slightly – not even matching inflation – to £1,740 million, and the funded order backlog is down 6% to £2,873 million. If you listen to the very good results presentation and Q&A with analysts on Qinetiq’s website, the CEO’s wrap-up expresses confidence about the “unfunded” side to this.

- Stock markets at records and cash at 5%: what will happen next?

- Sector Screener: financially sound stocks with growth potential

It can seem as lacking financial specificity, but if the West is to manage modern threats from a Russia/Iran/China “axis”, then defence spending is going to remain elevated. Qinetiq’s technology is a key enabler for example of NATO’s “formidable shield” against missile threat scenarios, a parallel to Israel’s “iron dome”. In the UK, Qinetiq has developed “dragonfire” – a high-power firing of a laser weapon against aerial targets, to be installed on Royal Navy warships from 2027.

A growth story like this is easily-assimilated by investors versus “backlog” obscurities.

Management’s target is to nearly double revenue from near £1.6 billion over four years, which is potentially attractive given a double-digit operating margin. Guidance appears realistic if not conservative given March 2024 organic revenue was suggested in high single digits but came in at 4%, with total revenue tipped to be in the high teens coming in at 21%. It implies attractive return on capital employed at or above the upper end of a 15-20%+ range.

How might Trump affect revenue in ‘difficult’ US markets?

While revenue has jumped 23% on the “global solutions” side due to the full-year effects of buying Avantus, it slipped 3% organically with the second half better than the first (for Avantus). Revenue was otherwise broadly flat, so it appears a classic example of how an acquisition is made to boost a relatively underperforming division.

Not to pour cold water on what I think is overall a growth company, but the following needs a risk caveat:

Under “trading environment” in the operating review, a US section refers to the US “continuing to address the comprehensive and serious challenge of China, while tackling the acute threat of a highly aggressive Russia, and increasing vigilance against the persistent threats of North Korea, Iran and transnational terrorist networks.” In support of all such, the US defense department is funding $841 billion (£662 billion) with research, development, test and evaluation (where Qinetiq comes in) the largest-ever budget at $145 billion.”

- Stockwatch: what now after ISA tip’s 70% profit in two months?

- Insider: boardroom buying at AIM company with royal approval

This may well set up the next two years nicely for Qinetic, given such spending will be hard suddenly to quash. Yet it is the product of a Biden administration; Trump is notoriously isolationist in US foreign policy and indeed this will be a key global risk if he gets re-elected. On his wishes, the US would not intervene in major conflicts as “global hegemon” to the extent it is currently doing in the Middle East for example.

Trump’s antics may however be checked by a shared defence and security mission known as AUKUS, which is behind the ramp-up in US spending. For its part, the UK is investing £6.6 billion in research & development over four years, and the Australian government is raising defence spending by 7% to £42 billion equivalent.

£100 million buyback programme should help support the stock

With cash up from £151 million to £231 million, and despite a modest rise in long-term debt from £362 million to £384 million, Qinetiq is well-placed for shareholder returns. The total dividend is up 7% to 8.25p, but with capital growth the main target of investors here, 4% of market value is taken out via buybacks. This would seem a modest if supportive effect.

Despite trading firmly in a 420-425p range most of yesterday, the stock is down 3% to 212p this morning – possibly in sympathy with the US market sell-off on inflation concerns, but showing how stock spikes this May can pull back after excitement of the day. BT Group (LSE:BT.A) and Vodafone Group (LSE:VOD) have likewise eased a tad after jumping on better-than-expected results.

Qinetiq now looks broadly fair value, but I think it is in that category of “growth at fair price” given the industry context. I therefore retain a long-term “buy” stance, but apply your own discipline to near-term trading.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.