Stockwatch: what now after ISA tip’s 70% profit in two months?

An AIM stock that caught Edmond Jackson’s eye in March has just surged in value. Reassessing the situation, the analyst discusses what he’d do with the shares now.

21st May 2024 11:15

by Edmond Jackson from interactive investor

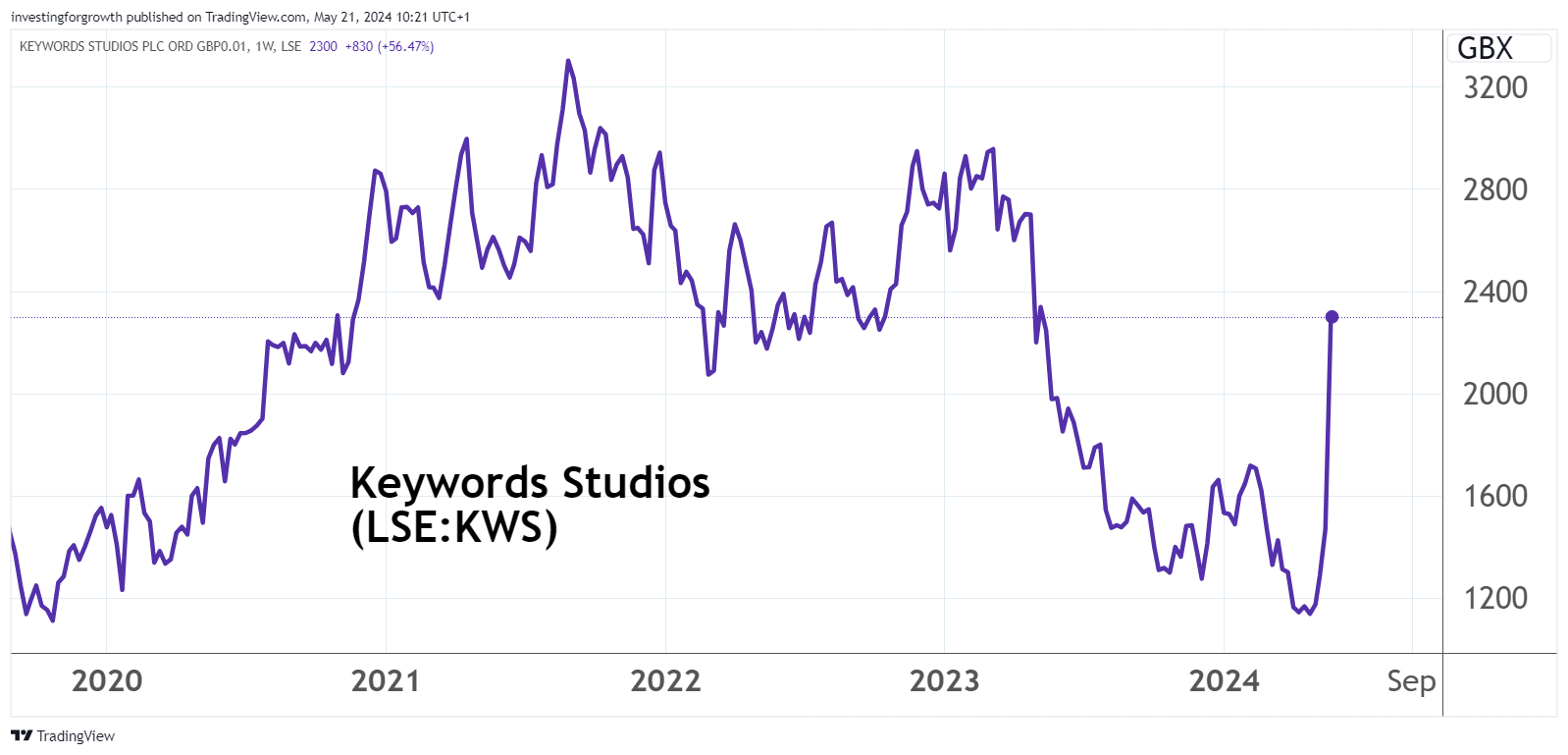

There could be a bumper payday from AIM-quoted Keywords Studios (LSE:KWS), which I highlighted on 15 March as one to consider for your ISA, having the potential to re-rate from 1,420p. Takeover approaches currently seem like buses in the UK stock market, now a possible offer has come along here too.

This is an Ireland-based provider of technology solutions to the global video games and creative industries. Last March its shares had halved from their highs reached in September 2021 when lockdowns boosted video gaming.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Since the industry was consolidating and there were accounting issues, I was wary of an outright “buy” stance lest the stock dropped further. Yet Keywords merited attention as “a well-established market leader in its field, with a scenario where financial returns kick in from 2024”.

Despite ongoing industry softness and risks integrating five latest acquisitions, I concluded: “there is a scenario where this industry improves and with Keywords more strongly placed – such that earnings and cash flow materially advance and its stock rises”.

Making a nonsense of ‘market efficiency’ hence a stop-loss approach

The stock then fell 20% over six weeks to 1,136p with the non-executive chair buying 4,700 at 1,189p on 7 May – which looks odd considering we are now told that takeover approaches had been happening for several months.

Anyway, if you had bought around 1,420p in March and then respected a stop-loss approach you would have bailed out whether respecting 10% downside or the 1,136p low, which represented a 20% paper loss.

Yet a private equity operator sees things differently from the market having run its own numbers and believes now is the time to pounce before a positive scenario materialises.

Yesterday, Keywords declared “advanced discussions” with a Swedish investment group EQT about a 2,550p a share possible offer. EQT has form to close on such a deal, having consummated a £4.5 billion takeover of UK veterinary drug-maker Dechra Pharmaceuticals last July.

Seriousness is conveyed given terms for Keywords have been raised after four previous unsolicited proposals from EQT in recent months that the Keywords board rejected. However, 2,550p represents “a significant increase from the initial proposal...the board is minded to recommend the terms if such an offer is made”.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Insider: boardroom buying at AIM company with royal approval

It shows how the market is not necessarily efficient, especially around major low points when sentiment is jaundiced and opportunistic short-sellers may try their luck. The disclosed short position here rose from 3.1% in late March to 3.8% as of 8 May, but could be higher overall as such data represents sales greater than 0.5% of Keywords’ issued share capital.

Yesterday, the shares opened at around 2,435p, a 71% gain on the level in March and 114% higher than earlier this month, before easing gradually to close at 2,280p. There has been a 2% or so rise this morning to around 2,330p. It reflects the new risk/reward profile on the stock: roughly 30% downside if no offer materialises, but maybe 10% upside if this approach leads to a firm bid.

So, it depends what probability is involved, about where I believe investors are right to be cautious after this extent of price jump given there is no genuine offer. If another party declares interest, that will change things positively.

Mean-reversion from autumn 2019 low and spring 2024

Mind that levels over 2,500p were achieved during the boom in video gaming – also stock speculation – during Covid lockdowns.

Source: TradingView. Past performance is not a guide to future performance.

EQT will have run its sums and obviously tried to acquire the business at lower levels. A question is whether this possible 2,550p a share offer is what its “Young Turks” were sent in to establish as do-able, yet the “wise grey hairs” at EQT have next to provide scrutiny and checks.

My piece examined how Keywords’ 2023 adjusted earnings had questionable aspects: a remarkable €22 million (£19 million) share-based payments expense; €27 million for acquisitions integration; only €26 million amortisation seems fair. Yes, the first two blur underlying performance but remain costs in the value equation.

This company reports in euros and, if expectations are fair, is due to make the equivalent of near £86 million net profit this year, rising to £95 million in 2025. It’s unclear how generous these numbers might be with “adjustments” and could reflect guidance from management, with their perspective. This implies earnings per share of 106p to 115p in 2025, so taking around 130p as median for a 12-month forward basis, a 2,550p a share offer implies a 20x exit price/earnings (PE) multiple.

It would be full and fair terms right now

Shareholders are lucky this approach has manifested, given it seems also based on a “best case” view of earnings power. Yet like my last article explored, stock re-ratings and takeover attempts do tend to exemplify a cyclical turning point.

Remember how a private equity group quite similarly examined engineering and consulting group John Wood Group (LSE:WG.) a year ago, making four approaches – yet when the books were opened, it did not result in a sufficiently high offer. Private equity is – or should be – more disciplined than a similar industry operator, because its modus operandi is usually to buy companies and run them on a stand-alone basis, then (re) float or sell them on. Private equity therefore needs a margin of safety in its purchase price whereas an industry operator can identify synergies and perhaps pay higher.

Another key uncertainty, besides accounting matters, and why different views can be taken on Keywords’ earning power, is the extent that AI might compromise aspects of the service – such as linguistic quality assurance (LQA) when games and entertainment content are re-developed internationally. Rival AI services (yet to materialise) could poach business away, although this fear has probably been overdone lately.

Keywords clients include Activision Blizzard, Electronic Arts Inc (NASDAQ:EA) and Tencent Holdings Ltd (SEHK:700), with work on games such as Fortnite and League of Legends. It also provides services to film and TV production, blaming a US writers’ strike for €20 million lost revenues in the second half of last year. So yes, AI is likely to have some effect, although it’s tricky to quantify in anticipation.

EQT has until end of 15 June to declare its hand, and in accordance with takeover rules could offer a lower value (though still to be agreed, like selling a house when the survey uncovers issues).

Keywords Studios - financial summary

Year end 31 Dec

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (€m) | 151 | 251 | 326 | 374 | 512 | 691 | 780 |

| Operating profit (€m) | 16.4 | 22.7 | 21.5 | 41.1 | 50.4 | 71.8 | 46.8 |

| Net profit (€m) | 7.3 | 14.9 | 10.0 | 21.6 | 34.2 | 47.4 | 20.0 |

| Operating margin (%) | 10.9 | 9.0 | 6.6 | 11.0 | 9.8 | 10.4 | 6.0 |

| Reported earnings/share (euro cents) | 11.9 | 22.2 | 14.9 | 28.8 | 43.1 | 58.9 | 24.9 |

| Normalised earnings/share (cents) | 14.9 | 27.6 | 18.6 | 24.8 | 50.2 | 66.2 | 44.3 |

| Operational cashflow/share (cents) | 22.3 | 48.0 | 48.7 | 102 | 114 | 154 | 138 |

| Capital expenditure/share (cents) | 6.2 | 16.5 | 20.1 | 18.9 | 24.8 | 34.2 | 42.2 |

| Free cashflow/share (cents) | 16.1 | 31.5 | 28.6 | 83.3 | 89.3 | 120 | 95.8 |

| Dividend/share (cents) | 1.7 | 1.8 | 0.6 | 0.0 | 2.6 | 2.7 | 3.0 |

| Covered by earnings (x) | 7.2 | 12.4 | 25.7 | 0.0 | 16.8 | 22.0 | 8.3 |

| Return on total capital (%) | 9.6 | 11.1 | 7.0 | 10.1 | 9.4 | 11.5 | 6.0 |

| Cash (€m) | 30.4 | 39.9 | 41.8 | 103 | 106 | 81.9 | 59.9 |

| Net debt (€m) | -11.1 | 0.4 | 39.8 | -74.0 | -67.9 | -39.3 | 114 |

| Net assets (€m) | 161 | 192 | 223 | 371 | 472 | 557 | 599 |

| Net assets per share (cents) | 262 | 303 | 351 | 501 | 619 | 714 | 756 |

Source: company accounts.

Stock remains volatile as investors divine probabilities

Keywords shares opened up around 2.5% at over 2,330p this morning on no extra news and no report that I have seen, hinting at further interest.

I would not read anything into yesterday’s statement saying “shareholders are strongly advised to take no action” as if the board knows of another approach. If it does, then this should be disclosed already.

A risk management compromise would be for investors to sell half at this stage, maybe waiting a few days to see what else could materialise. A conservative mindset would sell out, especially if they’d bought recently, as downside risk is greater than upside right now, and this is a “possible” offer that surprises me how full it is.

If you have risk tolerance enough and understand the industry, do not let me dissuade you from holding. Given capital protection is the first objective in the equities game, however, I believe the overall stance tilts to Sell.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.