Stockwatch: buy or sell Vistry shares after accounting shock?

This housebuilder was doing well and trading near a record high, but problems in the finance department hammered the shares. Analyst Edmond Jackson gives his opinion on prospects.

11th October 2024 11:21

by Edmond Jackson from interactive investor

A 30% plunge in the FTSE 100 shares of housebuilder Vistry Group (LSE:VTY) begs the question: to what extent should one panic on revelations about accounting issues?

Vistry plunged as much as 38% to 810p in early dealings the other day, offering canny traders the chance to seize a 20%-day trade as the price rebounded above 990p.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

It was down to 880p mid-yesterday, however, despite a non-executive director buying £57,000 worth at 967p. Then came a rise to 900p after Browning West, a US shareholder, bought nearly £7.5 million of stock at 931p, raising its stake from 8.2% to 9.1%. The chief investment officer of this hedge fund is also a non-executive director of Vistry. This initially prompted buying up to 930p in early dealings this morning. They’re at 915p as I write.

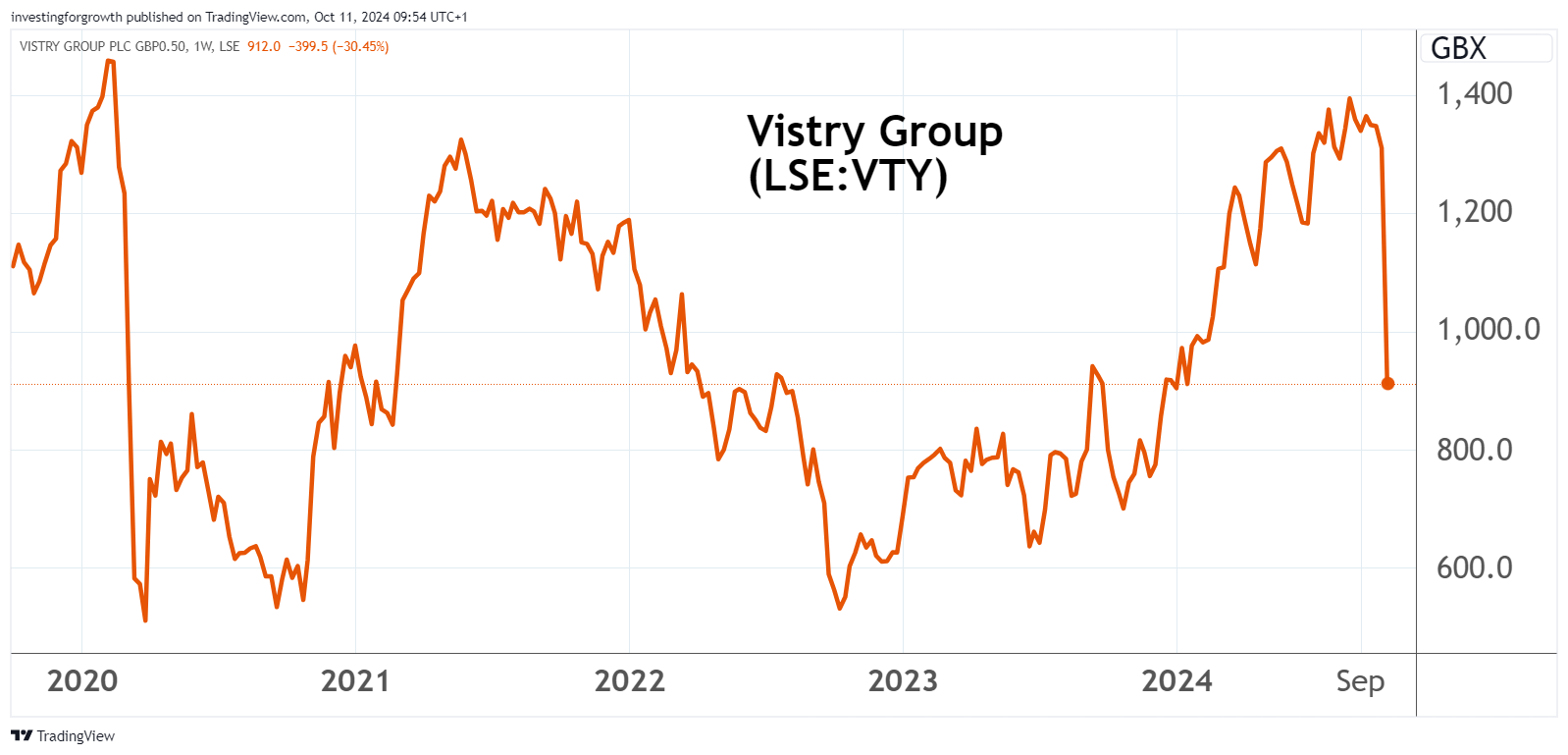

Yet the five-year chart implies such volatility as within this housebuilder’s norms.

Source: TradingView. Past performance is not a guide to future performance.

I last wrote in July 2022 with a “buy” stance at around 830p after a bullish update cited sales and margins strengthening. The stock fell to 530p that October but was up to 1,370p only last August.

A stunning blow from a perceived consistent company

Build costs have been understated by 10% in nine out of 46 developments in Vistry’s South division, meaning an £80 million profit hit this year, around £30 million in 2025 and £5 million in 2026. There has been speculation about failure to reflect inflation into costing.

Adjusted pre-tax profit is guided at £350 million, implying 2024 earnings per share (EPS) of near 79p – for a price/earnings (PE) ratio of 11.4x and a near 4% yield if a consensus 35p dividend is paid. The payout had been targeted at over 60p in 2025, implying a 6.7% yield.

- ii view: Vistry’s mistake triggers profit warning plunge

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Last June’s balance sheet had net asset value of 1,003p a share albeit 637p on a tangible basis.

The update re-iterates a medium-term target for £800 million operating profit and a £1 billion return to shareholders (dividends and buybacks) relative to a £3.2 billion market cap currently. But how secure is this if the costing failure is replicated across a group that has an ambitious operating margin target at over 12%? Did the error at all reflect pressure to meet high demands from head office, in which case showing cracks in Vistry’s “partnerships” model?

Working with local authorities and housing associations on large projects of affordable housing enables Vistry to scale up, given the partners are providing most capital. It is also in tune with the new government’s objective for 1.5 million new homes during this Parliament. But lower margins imply no room for errors.

Vistry - financial summary

Year-end 31 Dec

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 1,055 | 1,028 | 1,061 | 1,131 | 1,812 | 2,407 | 2,729 | 3,564 |

| Operating margin (%) | 15.2 | 11.8 | 16.4 | 15.8 | 5.1 | 11.9 | 7.8 | 8.2 |

| Operating profit (£m) | 160 | 121 | 174 | 179 | 91.7 | 285 | 212 | 292 |

| Net profit (£m) | 121 | 91.3 | 137 | 138 | 76.8 | 254 | 204 | 223 |

| EPS - reported (p) | 84.2 | 63.5 | 95.0 | 97.7 | 34.7 | 114 | 86.3 | 64 |

| EPS - normalised (p) | 84.2 | 67.3 | 94.7 | 107 | 43.1 | 118 | 143 | 78 |

| Operating cashflow/share (p) | 43.1 | 109 | 90.9 | 153 | 82.2 | 119 | 29.9 | -20.6 |

| Capital expenditure/share (p) | 1.2 | 1.0 | 1.3 | 0.4 | 1.2 | 0.7 | 0.7 | 0.8 |

| Free cashflow/share (p) | 41.9 | 108 | 89.6 | 153 | 81.0 | 118 | 23.2 | 21.4 |

| Dividends per share (p) | 42.1 | 44.4 | 53.3 | 19.2 | 20.0 | 60.0 | 55.0 | 0.0 |

| Covered by earnings (x) | 2.0 | 1.4 | 1.8 | 5.1 | 1.7 | 1.9 | 1.6 | 0.0 |

| Return on total capital (%) | 13.5 | 10.3 | 13.6 | 12.7 | 3.4 | 10.0 | 4.8 | 6.5 |

| Cash (£m) | 38.6 | 170 | 163 | 362 | 341 | 399 | 677 | 418 |

| Net debt (£m) | -38.6 | -145 | -127 | -339 | 4.3 | -201 | -31.6 | 187 |

| Net assets (£m) | 1,016 | 1,057 | 1,061 | 1,272 | 2,195 | 2,391 | 3,250 | 3,319 |

| Net assets per share (p) | 727 | 756 | 760 | 828 | 988 | 1,075 | 940 | 960 |

Source: historic company REFS and company accounts

Combined chair/CEO role has proven consistent with trouble

This was the outstanding issue behind a remarkable series of UK company collapses in the early 1990s. Focused power led to overstretch, with disastrous consequences for shareholders.

Hence, the “corporate governance” movement to address the dilemma about how shock revelations could follow seemingly strong accounts. Boards became better balanced with independent non-executive directors to check flamboyant CEOs. A combined chair/CEO is nowadays rare except at a very few smaller companies and the person is typically the founder.

Vistry has engaged sizeable acquisitions but is not financially stretched: end-June net debt including leases was just £417 million. The interim statement has no red flags as to aggressive accounting. Increases in inventories and loans to subsidiaries explained the first-half-year being cash-absorbing. Vistry does not strike me as over-extended like corporate fatalities of yesteryear.

It remains a monumental failure for head office not to have sooner picked up on the costing matter, if attuned to group-wide trends.

Past accounting woes

Recalling a quite similar episode in 2018 at Air Partner, a small-cap aviation services group, errors in accounting for receivables and deferred income were uncovered going back to 2011. This did at least show how, if concealed fraud is involved, then it can be hard to detect, even by auditors, on some matters. The stock more than halved to below 30p but recovered and Air Partner was acquired in 2022 at 125p a share.

There are two examples in plant hire. In 1992, a combined chair/CEO of BM Group suddenly resigned, and its shares plunged from about 250p to below 100p, rebounding to over 150p after he bought around £200,000 worth – just as the CEO/chair of Vistry has done this week at 966p.

(Mind, a private housebuilding firm where Vistry’s CEO is a director/shareholder, sold its £6 million holding in Vistry last January in a 960p range.)

- Two UK shares with recovery potential

- Labour’s first 100 days in power

- eyeQ: keep powder dry for this post-Budget move

Yet BM was riddled with aggressive accounting and debt after two major and problematic acquisitions. When the extent of trouble was finally laid bare, over six months after a new and independent chair was appointed, the shares plunged to below 10p. Re-named Brunel Holdings, it was acquired some seven years later at around 35p a share.

That episode made me cautious when Ashtead Group (LSE:AHT) plunged to as low as 2.5p in March 2003 after an audit investigation showed a US subsidiary had inflated profits by £11.5 million over three years. There were fears as to whether banks would be supportive, but the shares soared on approval of an essential £410 million debt facility. It marked the start of a long bull market - Ashtead is currently 5,558p.

Accounting discrepancies are therefore no impediment to long-term success, but investors are justifiably cautious when they coincide with a combined chair/CEO, and there is a toxic mix of takeovers plus debt.

Most likely, Vistry’s institutional shareholders will insist on an independent chair, perhaps with the senior non-executive director stepping into that role before any candidate is finalised.

Vistry’s partnerships model now in question

This appears the chief upshot. Vistry’s strategy was meant to involve better risk/reward than standard housebuilders exposed to sensitivity of demand by way of mortgage rates and consumer confidence.

For most in the sector, expectations for prices sold are the major determinant of profit. A major study showed how the Help to Buy scheme from 2013 did most to raise UK house prices and builders’ profits. From 2022, with interest rates rising, traditional housebuilders have felt headwinds, but Vistry has been able to leverage scale due to fixed-price contracts with its partners. Last September’s interim results said the company was “on track to deliver more than 18,000 completions this year”.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Trading update preview: still confident about Rolls-Royce?

Without seeing the details on margins within these contracts, it gets harder to project profit when – if the innocent explanation of failing to budget for inflation is true – a modest variance in costs can have a big impact on the group. Suddenly, this housebuilder feels like an infrastructure contractor on tight margins where one significant project dilemma generates losses.

If reasonable to project a 2025 dividend around 50p per share, possibly in line with historic earnings cover around 1.7x, then a yield above 5% implies support for the shares currently at around 915p. I would, however, expect the market to price for a material yield unless management can thoroughly dispel uncertainty and establish a consistent track record.

Investors became used to housebuilders offering yields above 6% due to cyclical risks, which became reality as companies trimmed guidance. Dividend expectations for Barratt Redrow (LSE:BTRW) have halved, such that at 460p, the 2025 prospective yield looks around 3.5%, and for Persimmon (LSE:PSN) at 1,585p it is 4.1%.

Vistry thus has a current valuation advantage on such comparison, assuming no further shortfalls.

Next trading update due 8 November

A month should be fair time for the audit committee to ascertain any further issues. Properly, you would wait to see its conclusion rather than buy now. There is rarely just one skeleton in the cupboard.

Yet Vistry’s dilemma looks more like Air Partner and Ashtead years ago, certainly not BM Group. You have to decide your risk appetite; Vistry’s execution risk is already higher now – but I retain a “buy” stance.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.