Stockwatch: how plunging confidence might hit company profits

1st July 2022 12:54

by Edmond Jackson from interactive investor

With US earnings season fast approaching, companies analyst Edmond Jackson discusses how things might unfold and names sectors and stocks that investors should focus on.

On 13 May, I drew attention to a claim from Bank of America (BofA) strategists, how a drop in the S&P 500 index below 4,000 would be a “tipping point”, potentially triggering a mass exodus from equities.

It remains early to assess this claim, but equity charts do affirm an overall bearish trend – with added grist this week from poor consumer sentiment readings. Then on Thursday, first-quarter US consumer spending numbers were revised sharply lower – as if already reflecting the early stage of recession.

Strictly, a recession is defined as two consecutive quarters of contraction in gross domestic product (GDP).

Critical to figuring the risk/reward profile on equities

All eyes are on whether the US Federal Reserve can navigate a soft landing for the economy, as it tightens monetary policy. It has already made a colossal mistake with the largest-ever central bank response in an inflationary cycle.

Excess stimulus in response to Covid-19 persisted, then a ground war on Europe’s fringe has exacerbated supply chain issues and re-rated the cost of energy and fuel.

If the Fed does not act aggressively on interest rates, inflationary expectations will get entrenched, but this will not temper commodity supply issues if war in Ukraine drags on.

A scenario of the US central bank as trapped, chasing inflation, presents a radically different environment – from a low-inflation, low-interest rate, well-supplied, global economy that took decades to achieve after 1970s chaos.

Inflation is likely to dominate headlines for some time, and higher wage awards add to difficulties controlling it.

Trade union power may not be as strong as during the 1970s, but parallels to that era look ominous: excess money supply causing inflation, then (a Middle Eastern) war and energy price shock, now wage rises.

If a recession follows, then 2022-23 corporate earnings estimates need cutting, and it could be some time before “trough earnings” are reached, which is classically when the market starts to price for recovery.

On such reasoning, the odds imply another leg down for equities in months ahead.

- What happens to UK bank shares in a recession?

- How you can own three great businesses for the price of one

Consumer indicators dented an earlier attempt to rally

The S&P 500 actually rallied to 4,177 by 2 June, put in a mini “head-and-shoulders” pattern then fell to 3,667 by 16 June. A rebound to 3,912 by 24 June followed, but fear prevailed last Tuesday after a US consumer sentimentreading plunged.

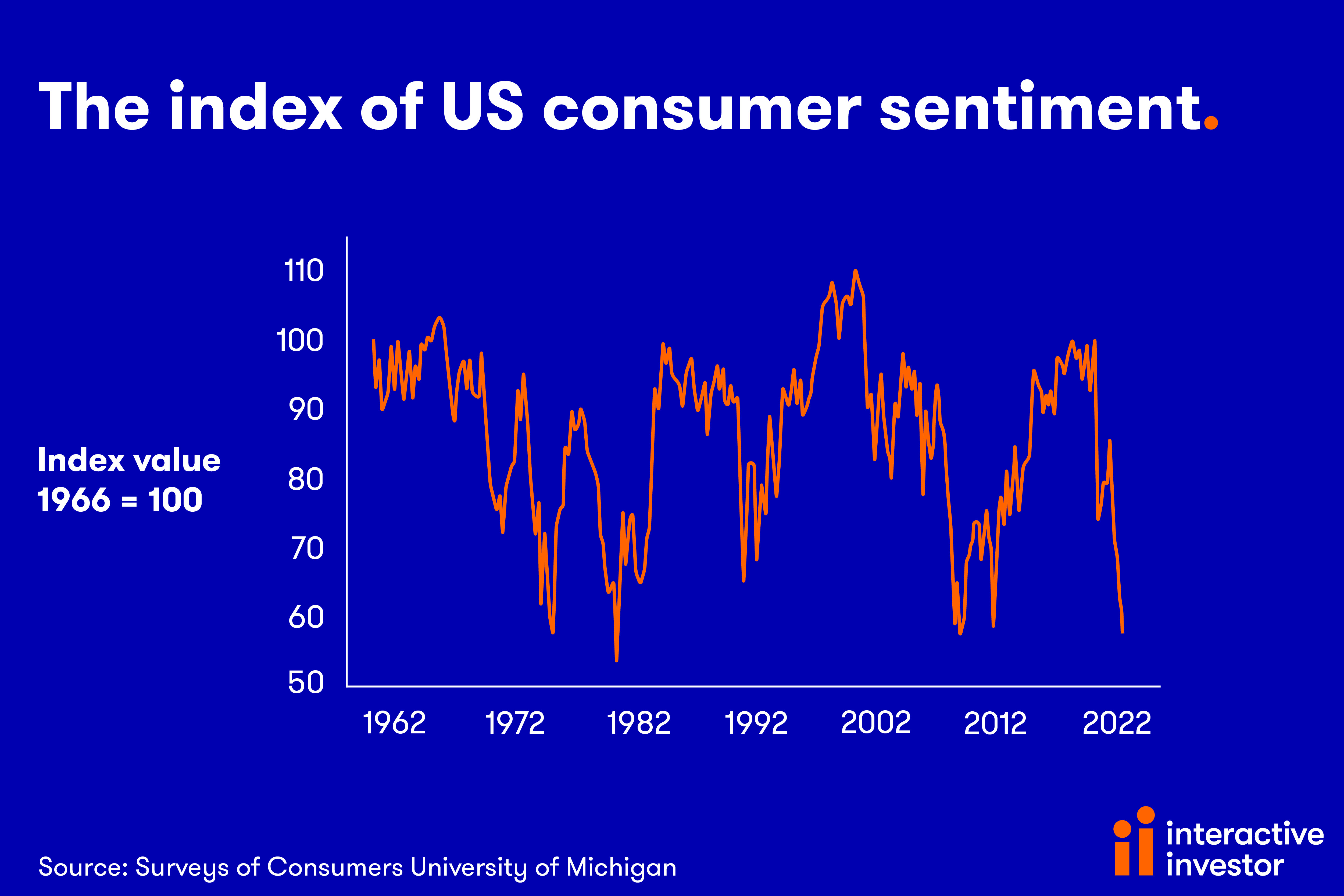

The University of Michigan measures tend to be most respected on this score, which now matches low levels around 2008 and the late 1970s.

What is concerning is the severity of drop and to the lowest reading on record. Moreover, it was broadly based across income/asset/age groups, with 47% blaming inflation.

Jobless claims are yet to worsen and truly portend recession

Meanwhile, Deutsche Bank economists regard continuing jobless claims as the most reliable forward indicator of recession.

They consider a rise over 11.5% above the minimum level over the previous year has provided the most accurate and timely signal of recession since data became available. It applies to each historic US recession, with a two-month lead time.

A low of 1,306k was reached last 20 May and to date is only up to 1,316k versus a need for 1,456k to start the countdown to recession.

A mixed picture is also conveyed by other macro indicators liable to turn down six to 14 months before a recession, flashing red. While those normally on a one- to five-month outlook are mixed, late-turners show no signs of recession (but so they might).

- What an inflation shock really looks like

- Want to buy and sell international shares? It’s easy to do. Here’s how

US S&P 500 earnings estimates look exposed

Consensus is for 4.8% growth in respect of second quarter 2022 earnings, then a remarkable 10.6% for Q3 and 10.1% for Q4.

Helped by such a trajectory, the index’s 12-month forward price/earnings (PE) is 17.6x, which is below the five-year average of 18.6 but above the 10-year average of 16.9x.

So not only do forecasts need downgrading but also the PE, warranted by a stubborn inflationary environment liable to compromise margins.

A similar if not worse story in the UK

Consumer sentiment readings have fallen to the lowest levels since records began in 1974. A longstanding Growth from Knowledge index dropped one point in June to minus 41, a new record low for a second successive month.

Confidence in personal finances and the wider economy is also heading down, despite lockdowns and government hand-outs having achieved the biggest-ever reduction in UK household debt.

More positively, employment remains high and people appear willing to spend on experiences – supporting aspects of hospitality/travel - and also clothing and footwear.

But this could be seasonal and a tough autumn/winter beckons, especially after the energy price cap rises over 50% in October.

The Bank of England governor has sounded off about how a UK downturn will be relatively worse. The economy is weakening earlier and greater than elsewhere. The bank expects a second-quarter fall in GDP and another later this year as the cost-of-living crisis deepens. Inflation will likely hit 11% in October.

- Top 10 things you need to know about investing in the US

- Richard Beddard: what’s a $19bn company doing in my portfolio?

Retailers have also changed their tune, from absorbing higher costs in order to conserve revenue, to passing them on to shoppers. Bosses reckon the biggest slide in consumer spending lies ahead.

UK economic output in June did however remain unchanged from a 15-month low in May, according to S&P Global’s purchasing managers’ index - which covers services and manufacturing firms.

Yet this reflects orders placed months ago, whereas demand is now stalling.

Such indicators imply patience is needed to buy UK mid and small-cap equities, relatively more exposed to the domestic economy than FTSE 100 companies.

US smaller companies look no better, where a key confidence indicator is below its 48-year average of 98. Smaller firms employ over 98% of the US workforce, so there’s a potentially wide economic effect here.

BofA’s chart call therefore looks supported by fundamentals

“Exodus” may have over-egged the near-term downside of breaching 4,000 on the S&P 500, but on a medium-term view the evidence mounts in favour of a bearish call.

The economic impact is likely to take until 2023 to fully manifest itself, albeit potentially with markets starting to price in recovery beforehand. It is hard to find liquidity estimates, but a great amount of cash now rots in the bank, waiting for a buying opportunity.

More positively for shareholders, downside appears limited in sectors (ironically) such as healthcare and smoking, where resilient demand for products implies sound yields.

AstraZeneca (LSE:AZN) has just declared positive progress on four key drugs and its chart remains relatively robust. Likewise, British American Tobacco (LSE:BATS), which looks set to benefit from rival Juul’s e-cigarettes being banned in the US.

Technology will always offer something new. Goldman Sachs argues semiconductor innovation is overlooked, specifically silicon carbide, a chemical compound that is more efficient than standard silicon. Wolfspeed (NYSE:WOLF) and German manufacturer Infineon Technologies (XETRA:IFX) are cited as two means to play this – offering 70% share price upside from current levels.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.