Stockwatch: a small-cap share with robust prospects

A recent sell-off was an overreaction, argues analyst Edmond Jackson, who believes the investment rationale for this company looks attractive for some years.

3rd June 2025 10:57

by Edmond Jackson from interactive investor

In my last piece, I noted shares in two radically different industries both sporting an upwards spike, making them potential recovery plays.

Right now, a key challenge seems to be discerning whether this is really saying much about fundamentals or is an overdue re-rate. Or, does it largely represent big swings in the wider market mood according to the tariffs story?

Jamie Dimon, the boss of JP Morgan, has appeared in the media in recent days, warning that investors are being “extraordinarily complacent” pushing shares higher than where they traded before President Donald Trump first declared protective tariffs on 2 April. But he does tend to sound out negatively.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

A UK survey suggests 38% of the buying was driven by Millennials versus 16% by Baby Boomers aged 60 to 78. It’s as if there’s been a knee-jerk reaction by a generation conditioned to rely on “buy the drop” since the 2008 crisis.

So, it does seem worth looking critically at company data rather than assume various rallies are set to continue.

Another interesting challenge in this respect is Gulf Marine Services (LSE:GMS), a small-cap offshore energy services provider specialising in self-elevating support vessels. It chiefly supports oil & gas in the Middle East, South East Asia, West Africa and Europe, but also offshore wind, hence it can adjust to changes in energy policy.

I drew attention to the stock as a medium-term “buy” last February at 18.8p, testing a rationale of a near 30% discount to net tangible assets equivalent to 26.6p a share. It also had a fleet of 14 vessels with an average age of 15 years (skewed by one at 28 years) versus 40 years overall potential despite being depreciated at 30. This should enable strong free cash generation at high margin until the fleet either needs substantiating or replacing, hence, and for so long as demand holds up, this is a theme of debt de-leveraging morphing to shareholder returns.

- Insider: boss buys shares so cheap it’s a joke

- Shares for the future: uncertainty drew me to this AGM

GMS was performing very well when it floated in 2014 having made $81 million (£60 million) net profit. That compares with $51 million consensus for this year and $59 million predicted in 2026. Its shares traded above 100p, but energy prices then fell and together with the Covid downturn meant a dilutive issue of 370 million shares at 3p to cut debt and prepare for recovery. That episode reminds us how oilfield service businesses can bite.

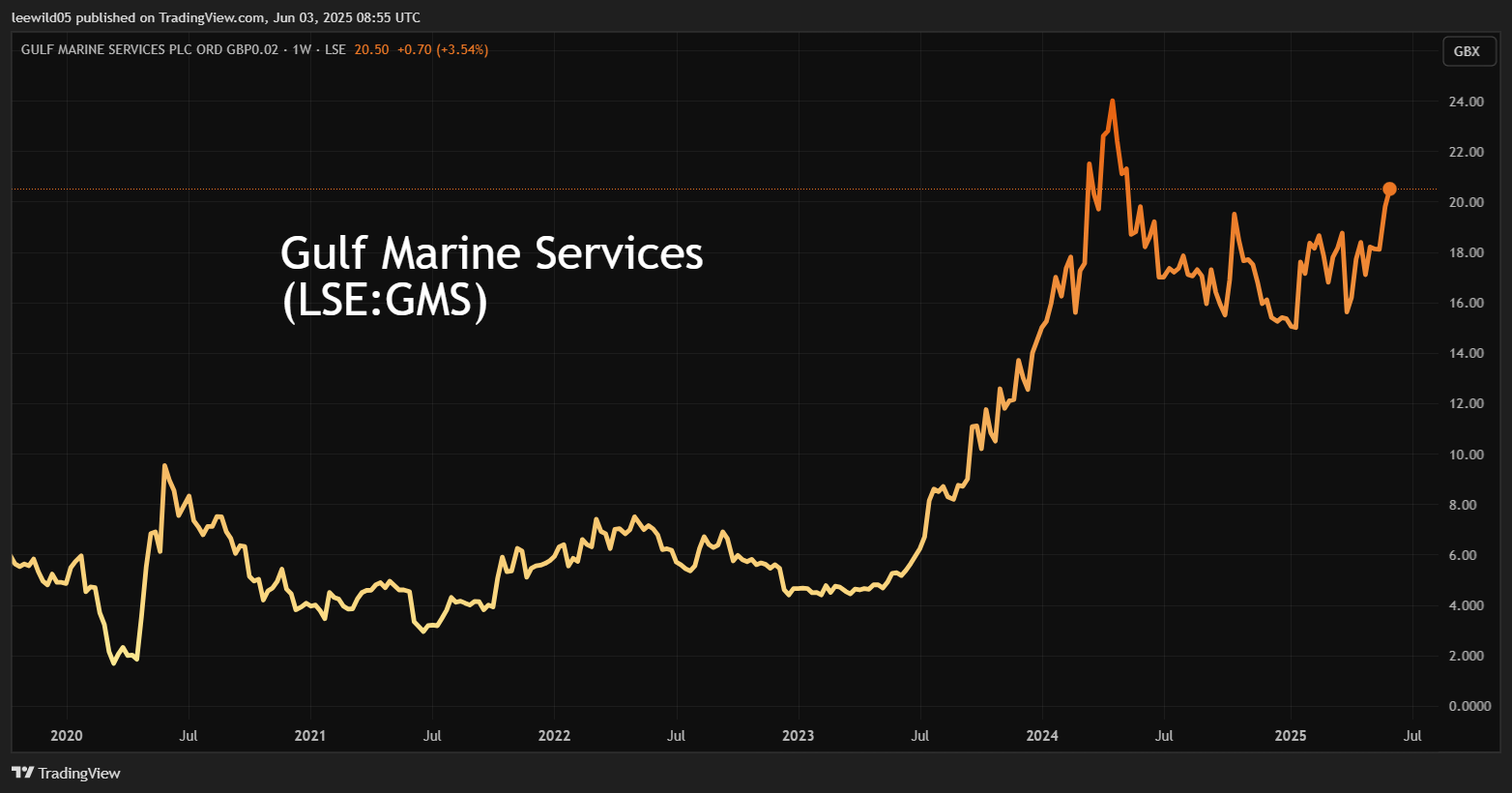

Yesterday, the shares rose 3% to 20.5p despite weaker stock markets, as the China/US trade stand-off re-intensified over the weekend. There was no company-specific news or weekend press tip, it just extends a recovery rally from 15.2p on 7 April. The one-year chart implies mean-reversion in a volatile-sideways trend, with distinguished momentum lately:

Source: TradingView. Past performance is not a guide to future performance.

Positive news context ironically became mixed as shares took off

The share price rally sharpened from 18p on 23 May despite news on 14 May that the company had lost a final appeal over a £6.8 million equivalent tax bill in Saudi Arabia going back to 2017-19. That’s relative to Gulf’s £230 million market cap. During May, and announced a third time yesterday, there have been attempts “by certain parties” to call a shareholder meeting for changes to the board and to pay a dividend. Such requests have been rebuffed as legally invalid.

None of this is really negative compared with change in the company’s dynamics. So, is GMS's current momentum chiefly an overdue reaction to the 9 April annual results and 7 May first-quarter update, or is it more like a general rise in risk appetite?

The 2024 numbers enjoyed a 10% rise in revenue to $152 million due to a 9% rise in average day rates across the fleet to $33,100. Demand/rates were strongest in the larger vessels and an additional has been leased, although it’s unclear whether it implies the company needs to buy another to capitalise on expected production increases in the Middle East in years ahead.

- 10 hottest ISA shares, funds and trusts: week ended 30 May 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Complicating the income statement are impairment charges on the vessels, explaining a 9% fall in reported net profit to $38.3 million. These even include impairment reversals such as a $33.4 million actual credit, which fell to $18.6 million last year albeit partly offset by $9.4 million new charges. It can be justified to “adjust” perception of earning power given these are non-cash items, but it’s not clear if that would result in a truly “normalised” view as ultimately value has to reconcile fleet maintenance.

On such a view, 2024 underlying operating profit rose 16% to $63.8 million, implying GMS offers operational gearing. The margin has risen 5% to 37.8%, which is at first sight excellent, although benefits from having assembled a fleet with no major maintenance needs, possibly for some years.

Gulf Marine Services - financial summary

Year end 31 Dec

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover ($ million) | 123 | 109 | 102 | 115 | 133 | 152 | 167 |

| Operating margin (%) | 23.1 | -45.1 | -72.0 | 42.0 | 35.5 | 58.2 | 43.3 |

| Operating profit ($m) | 28.5 | -49.1 | -73.7 | 48.4 | 47.3 | 88.2 | 72.6 |

| Net profit ($m) | -6.1 | -85.8 | -124 | 31.0 | 25.3 | 41.3 | 38.0 |

| Reported earnings/share (US cents) | -1.2 | -16.2 | -23.5 | 4.5 | 2.5 | 3.9 | 3.4 |

| Normalised earnings/share (cents) | -1.2 | -8.2 | -11.6 | 2.4 | 1.8 | 1.0 | 2.7 |

| Operating cash flow/share (cents) | 5.5 | 9.7 | 8.4 | 5.8 | 8.1 | 9.0 | 9.2 |

| Capital expenditure/share (cents) | 4.4 | 1.8 | 2.5 | 1.7 | 0.6 | 1.2 | 0.8 |

| Free cash flow/share (cents) | 1.1 | 7.9 | 5.9 | 4.1 | 7.5 | 7.7 | 8.4 |

| Return on Total Capital (%) | 6.8 | -14.8 | -12.4 | 7.8 | 8.0 | 15.5 | 12.5 |

| Cash $m) | 11.0 | 8.4 | 3.8 | 8.3 | 12.3 | 8.7 | 40.0 |

| Net debt ($m) | 400 | 392 | 410 | 374 | 319 | 271 | 200 |

| Net assets/share (cents) | 78.4 | 61.9 | 38.7 | 25.7 | 28.1 | 32.2 | 35.5 |

Source: company accounts.

Encouragingly – if operational gearing is sustained – the contracted backlog (or work in progress) rose 24% to $570 million, representing around 3.5 years of work. “Demand in the market remains strong due to a combination of high market activity and limited vessel availability,” it said, with an estimated 18 new vessels due to be operational over the next two to three years. The company added: “Provided the recession fears don’t materialise, we expect market growth and retirement of aged assets from 2025-27 to absorb the supply increase.”

This augurs well, so long as trade tariff realities do not disrupt the global economy if the Trump administration broadly sticks to its guns. That was why GMS dipped to 15p with the market in early April. Oil prices would fall and my past experience of following the services companies is that it's very hard for their shares to buck a weak oil price. Such is a worst-case scenario and Trump’s style is to threaten woe but ultimately compromise in a deal.

Free cash flow bonus

Continuing with the adjusted view implies over $62 million free cash flow for 2024, which aided a 25% reduction in net debt to $201 million (gearing of 52%). This supports the board’s indication for a “future dividend policy” to distribute 20-30% of adjusted net profit in a mix of dividends and share buybacks.

This could imply a yield maybe of 2-3% despite the share price rising over 30% since annual results, so it’s odd that rebel shareholders want to make an issue of it now.

The share’s markdown to 15p can therefore be seen as an overreaction by a market now waking up to the reality of robust prospects and margin aiding cash flow to drive de-leveraging and, fairly soon, shareholder returns. Given a discount to net assets of over 20%, and a 12-month forward price/earnings (PE) ratio near 6x, it is justified that the market price is rising above 20p.

Net asset value per share would also obviously benefit from buybacks.

Unless oil prices fall – say in a scenario initially of US recession – the investment rationale for GMS therefore looks attractive for some years, unless capitalising on demand requires at least one costly addition to the fleet.

Q1 2025 revenue was strong

On 7 May, GMS declared revenue up 14% and EBITDA (earnings before interest, tax, depreciation and amortisation) of $105-115 million (a median £81.2 million equivalent) by 7%, although fourth-quarter 2024 growth was a more muted 2% on revenue and 5.4% profit, barely matching inflation. The absence of a first-half 2024 update makes it tricky to judge any seasonality, but the 2024 interim results showed a 9% revenue rise.

At this point management also introduced 2026 guidance for adjusted EBITDA for 2026, implying a near 6% advance on a median £76.8 million for 2025, as conveyed by guidance for $100-108 million.

A near-term twist - but no real setback - would be if the lost tax appeal pushes dividends and buybacks forward, given the chair has emphasised: “We remain committed to our strategy of debt deleveraging...”

Overall, I retain a “buy” stance, mindful how oilfield service shares tend to be volatile with energy prices, and that we are also yet to see the effects of US tariffs globally.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.