Shares for the future: uncertainty drew me to this AGM

It’s normally a money-making machine, but analyst Richard Beddard’s latest score reflects a miserable four months for this billion-pound company.

30th May 2025 15:04

by Richard Beddard from interactive investor

This is the one you may have been waiting for. I delayed re-scoring 4imprint Group (LSE:FOUR) until its annual general meeting, which I attended last week.

4imprint is a supplier of promotional goods, branded freebies organisations give customers and employees, primarily in the US. In 2024, 60% of its revenue came from China via importers based in North America. US tariffs on Chinese imports have ratcheted up this year, briefly to levels that halted the trade in promotional goods. Although tariffs have subsided, this may only be a hiatus.

- Learn with ii: Inheriting an ISA | Can I Transfer an ISA to Someone Else? | Open a Stocks & Shares ISA

Uncertainty is not a word I associate with 4imprint. Barring 2020, when we felt uncertainty about almost every business, 4imprint has been about as bankable as any company on the stock market. However, uncertainty drew me to the AGM.

Tariff trouble

Higher tariffs will increase costs, which may in turn cause 4imprint to raise prices to defend profits. Increasing prices when many customers are also experiencing rising costs might well reduce demand.

On the day of the AGM, 4imprint reported that revenue from January to April 2025 was similar to the same period in 2024. Gross profit margins had been strong.

Good news, perhaps, but tariffs were imposed late in the quarter. The ripples, or waves, will be felt over the summer. Then 4imprint may experience shortages due to a brief cessation of imports in April, as well as price rises. It seems likely the company is in for a rare year of contraction.

- BP, Shell, Rolls-Royce, HSBC and L&G pay big dividends in June

- Watch our video: why I no longer invest in US shares

- Buffett, Wall Street and heroic retail investors: who’s right?

4imprint and its predominantly North American suppliers are sourcing more products from outside China. The company estimates its contribution to revenue will drop 10% to 50% by the end of the year. But it is easier to find alternative suppliers in some categories, like clothing and bags, than others, like drinkware. The process is fraught with uncertainty, because tariffs can be levied on imports from any country.

There is also a doomsday scenario: the potential decoupling of the US and Chinese economies, should the relationship between the superpowers become more adversarial.

Chief executive Kevin-Lyons Tarr says 4imprint has contingency plans for as many scenarios as it can imagine, but he won’t be drawn on what they might be.

I rate 4imprint very highly, but imagine the more extreme scenarios would impact the business severely despite its many qualities.

4imprint: quality in normal times

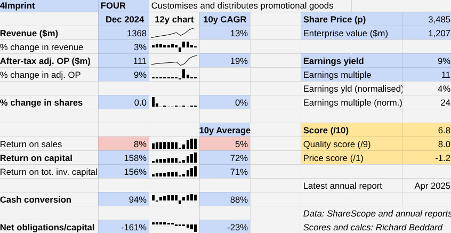

Although revenue only increased 3%, well below par in the year to December 2024, the company lifted profit 9%, also below par. Profit grew faster than revenue because return on capital increased for the fifth consecutive year. It was not only high, but well above the 10-year average.

Double-digit revenue and profit growth and very high levels of profitability and cash conversion are explained in part by 4imprint’s scale.

With about 5% of the North American promotional goods market, 4imprint is the biggest distributor of promotional goods in the world’s biggest market. This means it is an important customer to its suppliers, IT and marketing costs are a smaller proportion of revenue than at rivals, and 4imprint can do things they can’t.

For example, TV advertising is too expensive for companies with small marketing budgets. 4imprint introduced TV advertising into its marketing mix alongside search engine advertising and catalogue sales in 2019. Coincidentally, it has experienced an improvement in earnings per marketing dollar spent from about $6 to about $8 and an improvement in profit margins (after tax) from 5% to 8%.

Scale is the result of 4imprint’s pioneering direct sales and drop shipment business model. Although it customises some apparel, 4imprint is primarily a marketplace, linking customers to distributors who prepare and ship the product. This reduces the risk and capital cost of large inventories, warehouses and manufacturing facilities.

- Why UK market will weather tariff storm, and backing the banks

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

It is also the result of a customer-centric ethos fostered by Kevin Lyons-Tarr, who has run the business since 2004. By video on its website he guarantees customer satisfaction through a money back guarantee (or double the money if the customer can find the product cheaper elsewhere).

4imprint’s staff, located in folksy Oshkosh, Wisconsin, are the other faces of the business. Anecdotally, tenures are long, and 4imprint tells me attrition rates are less than 10%. The company’s golden rule is to “treat others as you would wish to be treated yourself”. When the pandemic struck and staff were not needed, the company paid and retained them so it could emerge in a stronger position.

Barring the doomsday scenario, 4imprint should emerge stronger than its direct competitors from this trade war. Depending on how long tariffs are an instrument of policy, though, they might at the same time damage the whole industry.

Scoring 4imprint

In normal circumstances it is a money-making machine. But we are not living in normal circumstances.

4imprint | FOUR | Customises and distributes promotional goods | 28/05/2025 | 6.8/10 |

How successfully has 4imprint made money? | 3.0 | |||

4imprint has grown revenue and profit at double digit CAGRs by pioneering direct sales of promotional goods in the USA under the constant leadership of ceo Kevin Lyons-Tarr. Its scale is testimony to its success. | ||||

How big are the risks? | 2.5 | |||

4imprint's fortunes are largely in its own hands except for the fact that 60% of revenue was imported from China into the US in 2024. Tariff uncertainty is forcing 4imprint and its predominantly North American suppliers to source elsewhere, testing the flexibility of its supply chain. | ||||

How fair and coherent is its strategy? | 2.5 | |||

4imprint is an archetypal customer and employee centric business that gets more efficient as it scales up. By reducing their dependence on Chinese imports, 4imprint and its suppliers are de-risking the business. It is not clear how comprehensive and cost effective this will be. | ||||

How low (high) is the share price compared to normalised profit? | -1.2 | |||

High. A share price of 3485p values the enterprise at $1,205 million, about 24 times normalised profit. | ||||

A score of 6.8/10 indicates 4imprint is a somewhat speculative investment. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

Tariffs have exposed 4imprint’s China dependency, which is why I have reduced its score by 1 point. More significantly though, despite recent falls, the shares trade at a relatively high multiple of normalised profit.

20 Shares for the future

Here is the ranked list of Decision Engine shares that score more than 7 out of 10. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 7 out of 10 to be good value.

0 | company | description | score |

1 | James Latham | Imports and distributes timber and timber products | |

2 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | |

3 | Dewhurst | Manufactures pushbuttons and other components for lifts and ATMs | |

4 | Churchill China | Manufactures tableware for restaurants etc. | |

5 | Howden Joinery | Supplies kitchens to small builders | |

6 | Oxford Instruments | Manufacturer of scientific equipment for industry and academia | |

7 | Renishaw | Whiz bang manufacturer of automated machine tools and robots | |

8 | Solid State | Assembles electronic systems (e.g. computers and radios) and distributes components | |

9 | Focusrite | Designs recording equipment, loudspeakers, and instruments for musicians | |

10 | Bunzl | Distributes essential everyday items consumed by organisations | |

11 | Renew | Repair and maintenance of rail, road, water, nuclear infrastructure | |

12 | Macfarlane | Distributes and manufactures protective packaging | |

13 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures, fixation devices and dressings | |

14 | YouGov | Surveys and distributes public opinion online | |

15 | James Halstead | Manufactures vinyl flooring for commercial and public spaces | |

16 | Porvair | Manufactures filters and laboratory equipment | |

17 | Games Workshop | Manufactures/retails Warhammer models, licences stories/characters | |

18 | Bloomsbury Publishing | Publishes books, and digital collections for academics and professionals | |

19 | Hollywood Bowl | Operates tenpin bowling and indoor crazy golf centres | |

20 | Jet2 | Flies holidaymakers to Europe, sells package holidays |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

20 more speculative shares

Shares that score 7 or less out of 10 are more speculative, either because their share prices are high in relation to normalised profit or because I am less confident in the businesses than I should be (or both!)

0 | company | description | score |

21 | *Victrex* | Manufactures PEEK, a tough, light and easy to manipulate polymer | |

22 | *Treatt* | Sources, processes and develops flavours esp. for soft drinks | |

23 | Softcat | Sells hardware and software to businesses and the public sector | |

24 | *Tracsis* | Supplies software and services to the transport industry | |

25 | 4imprint | Customises and distributes promotional goods | 6.8 |

26 | Celebrus | Makes marketing and fraud prevention software, sells it as a service | |

27 | Volution | Manufacturer of ventilation products | |

28 | *Marks Electrical* | Online retailer of domestic appliances and TVs | |

29 | Dunelm | Retailer of furniture and homewares | |

30 | Auto Trader | Online marketplace for motor vehicles | |

31 | *RWS* | Translates documents and localises software and content for businesses | |

32 | *Anpario* | Manufactures natural animal feed additives | |

33 | DotDigital | Provides automated marketing software as a service | |

34 | Judges Scientific | Manufactures scientific instruments | |

35 | Quartix | Supplies vehicle tracking systems to small fleets and insurers | |

36 | Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | |

37 | Garmin | Manufactures sports watches and instrumentation | |

38 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | |

39 | Cohort | Manufactures military technology, does research and consultancy | |

40 | Keystone Law | Runs a network of self-employed lawyers |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's score to see a breakdown (scores may have changed due to movements in share price)

Shares in *italics* score less than 6/9 for business quality and may be removed

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns 4imprint and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.