Stockwatch: a US tech share with 130% upside potential?

This American tech firm’s AI solutions deal with a much larger software company has grabbed the attention of analyst Edmond Jackson. Here’s what he thinks of the business and one analyst’s price target.

16th April 2024 11:48

by Edmond Jackson from interactive investor

I stay alert to selective US technology opportunities given the UK stock market offers a relative dearth of them. Twenty to 30 years ago, there was microchip innovator ARM Holdings ADR (NASDAQ:ARM), but it was acquired and later has re-listed in the US. I believe this is chiefly due to higher share ratings in the US, which benefit flotations there and mean comparatively lower cost of equity finance for companies, given there is less dilution.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Another dilemma – applying to the lack of good flotations generally – is a vigorous private equity industry picking off the best growth companies. In 2001, ASOS (LSE:ASC) floated on AIM barely a year after it founded; this does not happen anymore. It went from a few pence to many thousands. Two decades later, Dr. Martens Ordinary Shares (LSE:DOCS) was floated by private equity, sealing gains, and its shares are down 85%.

That ARM has always been Cambridge-based shows the UK does not lack intellectual capability to innovate and become a global leader. But for sheer scale of technology investment opportunities, the US and Asia are well ahead.

The dilemma with US technology is that valuations are typically high to an extent that cannot be justified arithmetically. This is especially relevant in fast-moving technology because any kind of upset versus high expectations will hit the shares. More positively, that could be a chance to buy.

And what if the companies are loss-making? That was a regular jibe about Amazon.com Inc (NASDAQ:AMZN) over 20 years ago, although caution would have meant missed capital gains from 8 cents a share in 1997 to the current all-time high above $186.

Palantir and Oracle tie-up merits attention

So, it got on my radar, how despite a fundamentally high valuation Palantir Technologies Inc Ordinary Shares - Class A (NYSE:PLTR) on 4 April and Oracle Corp (NYSE:ORCL) declared a partnership to provide secure cloud and artificial intelligence (AI) solutions to businesses and governments around the world.

Might this be a game changer? Both companies have a substantial defence industry angle for assessing information, which plays into the global security and defence spending theme currently.

Oracle proclaimed in the announcement: “Oracle is the only hyper-scaler capable of delivering its entire AI and cloud suite to any business or government anywhere in the world. Combining the performance, scalability and flexibility of Oracle cloud infrastructure with Palantir’s leading data and AI platforms, we will help our customers win in any industry or environment.”

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- The UK stocks just as good as America’s Magnificent Seven

In response, several analysts turned bullish, one arguing for a $50 target on Palantir relative to less than $22 currently, implying almost 130% upside.

Palantir is a Software as a Service (SaaS) type business – specialising in big data analytics and leveraging a customer base off early work for the US intelligence community and Department of Defense. Its “security” angle derives from its 2003 founder having co-founded PayPal Holdings Inc (NASDAQ:PYPL) and been responsible for that company’s fraud recognition systems.

Activities spread, for example, to help the NHS during Covid, track and contain the contagion. This proceeded to a £330 million, seven-year contract for managing patient data (although it has attracted criticism). In finance, Palantir’s software on data integration and analytics has been applied to identify trends and anomalies – an aspect of predictive power, perhaps – hence it has been employed by several hedge funds.

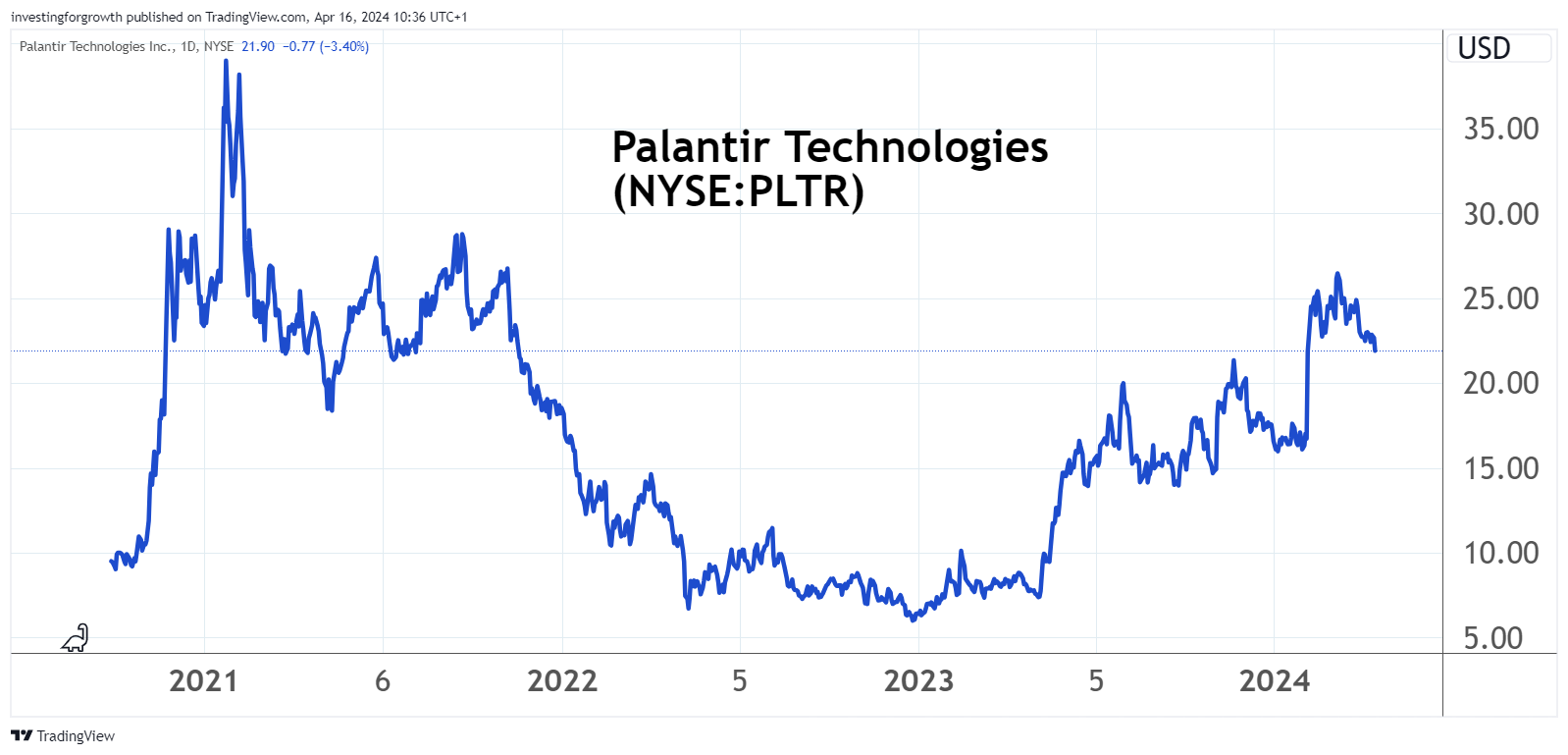

The share chart is quite a roller coaster, I would say significantly because the company has been loss-making until quite recently:

Source: TradingView. Past performance is not a guide to future performance.

Oracle, meanwhile, is a longstanding (1977) software business, the third-largest such globally, with a reputation for databases and enterprise resource planning.

It does take a partnering approach, for example in 2019 with Microsoft Corp (NASDAQ:MSFT) where the two were once rivals. With its shares at around $120, on a price/earnings (PE) ratio above 30 times, its chart has trended better than Palantir due to established earnings power, although has still been volatile.

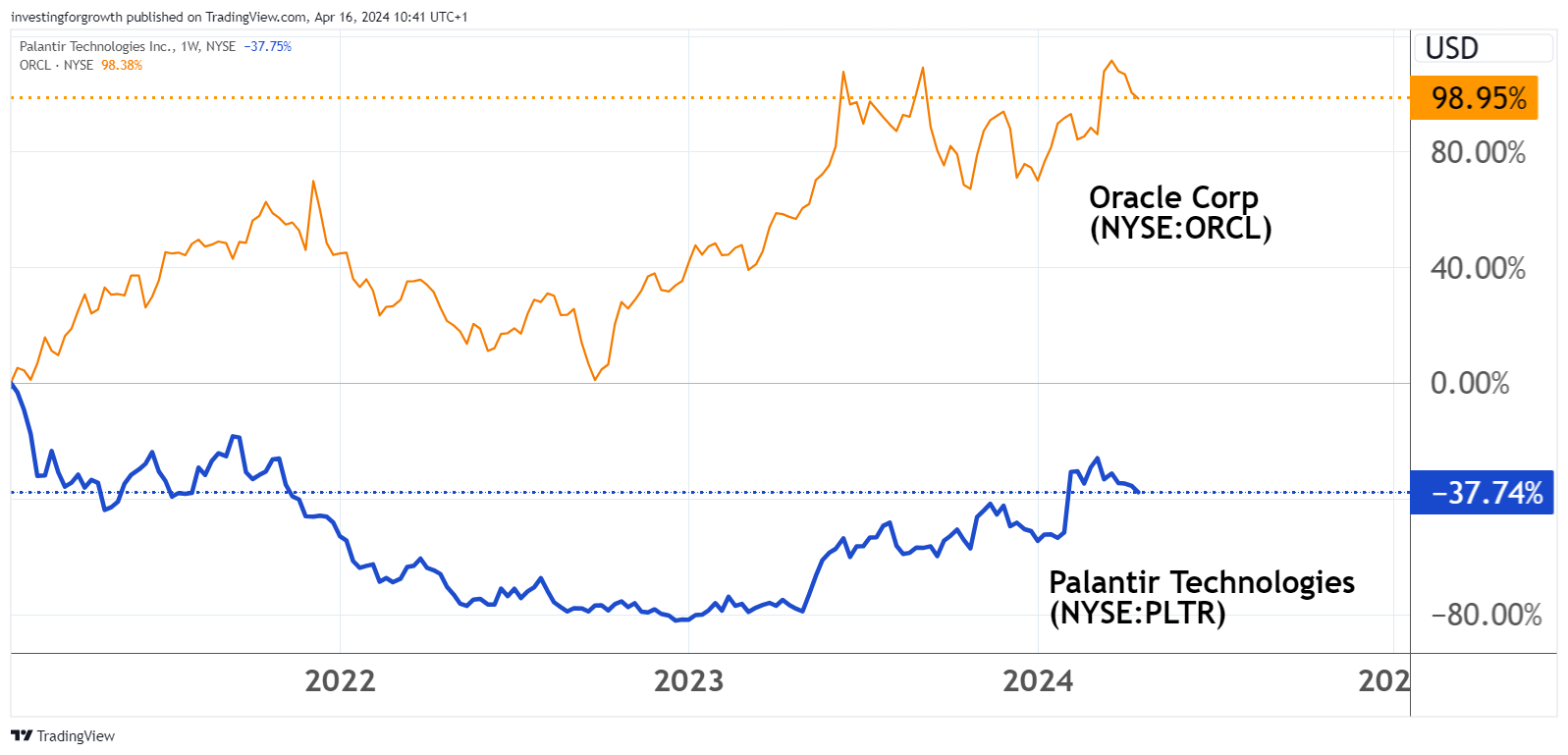

This chart tracks performance of both shares since Palantir peaked at $45 on 27 January 2021:

Source: TradingView. Past performance is not a guide to future performance.

The 4 April tie-up news did not help Oracle shares, which have trended down since mid-March, to a capitalisation of around $330 billion. It appeared more supportive for Palantir, which has traded sideways despite the wider market correction, capitalising it at around $50 billion.

A re-rating of sorts since February’s 2023 annual results

Palantir shares soared 163% last year and 31% last 5 February alone after declaring 2023 results, which showed fourth-quarter revenue up 20%. Within that quarter, 103 deals worth over $1 million each were struck, twice the like-for-like 2022 number, with 37 worth $5 million or more, and 21 at least $10 million. Certainly, it looks like momentum.

Expectations for 2024 revenue were guided higher albeit nothing spectacular - 19% growth after 17% was achieved in 2023.

Adjusted operating income was guided for an $842 million mid-range, ahead of $760 million consensus, implying a 33% jump from 2023 levels amid strong demand for its AI solutions.

- Merryn Somerset Webb: investing doesn’t have to be all about America

- Trading Strategies: pick these stocks for your ISA not cash

A current stock price of around $22 is still only a moderate leg-up on a rising chart since a year ago, although on fundamentals is high. It represents 22 times the $2.2 billion sales that Palantir achieved in 2023 and a PE multiple near 250 times given the company is only just breaking into profit after founding 21 years ago. For context, it took Amazon seven years to become profitable after founding.

Palantir Technnologies Inc.

Condensed consolidated statement of operations

$ million

| Three months ended | Years ended | |||

| 31-Dec | 31-Dec | |||

| 2022 | 2023 | 2022 | 2023 | |

| Revenue | 508 | 608 | 1,906 | 2,225 |

| Cost of revenue | 104 | 108 | 409 | 431 |

| Gross profit | 404 | 500 | 1,497 | 1,794 |

| Operating expenses: | ||||

| Sales & marketing | 190 | 197 | 703 | 745 |

| R&D | 82 | 109 | 360 | 404 |

| General admin | 150 | 127 | 596 | 524 |

| Total | 422 | 434 | 1,658 | 1,674 |

| Operating profit | -18 | 66 | -161 | 120 |

| Interest income | 13 | 45 | 20 | 133 |

| Interest expense | -2 | -0.1 | -4 | -3 |

| Other income | 45 | -4 | -216 | -12 |

| Pre-tax profit | 37 | 106 | -361 | 237 |

| Taxation | 4 | 9 | 10 | 20 |

| Net profit | 33 | 97 | -371 | 217 |

| Earnings per share | 0.01 | 0.04 | -0.2 | 0.1 |

| diluted $ |

Obviously, the future counts more, although the forward PE could still be as high as 70 times and the price/earnings to growth (PEG) ratio around 2.7 - when ideally you are looking for below 1.0 and certainly not over 1.5x.

Significantly, it reflects a dilemma with US valuations: many PEG ratios are above what the late Jim Slater argued was wise to engage, when he popularised the concept here in the 1990s.

As an interesting aside, with the US stock market on a cyclically adjusted “Shiller” PE multiple around 30 times, value-based investor Jeremy Grantham argues that US equities have never rallied sustainably from such a rating.

Buy and hope, or await some kind of setback?

If you are familiar with my analysis, you will know it is value-based – preferably with some kind of margin of safety – both of which principles are jettisoned if buying Palantir now.

So, I think it pertinent to note this development with Oracle as worthy of further investigation and following. With the possibility of further “risk-off” in global equities, I do not sense a need to rush.

- Nvidia is AI gold-rush winner, and two ‘weatherproof’ stocks

- Nvidia and Scottish Mortgage made me an ISA millionaire, but now I back these funds too

Asia-listed AI-related shares are sometimes cited as offering better risk/reward on comparably lower ratings than US peers. This would require specialist knowledge, however. A lesson I also learned in the late 1990s technology boom was not to be swayed by PhD technology analysts writing detailed notes; they could be wrong just like anyone. My instinct is, were the likes of NVIDIA Corp (NASDAQ:NVDA) to unveil any kind of disappointment, AI shares would sell off globally. In such a scenario, it could be best to simply buy US-listed leaders.

Palantir is due to release a first-quarter 2024 earnings report on 13 May, which potentially could excite interest, especially if recent momentum of sales is shown continuing, and also if the share is lower (with the market trending down). So, I will leave that for alert traders among you to consider. Overall: Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.