Stockwatch: why I’m upgrading this share after post-summer dip

This week analyst Edmond Jackson looks at two similar shares to see if either of them is worth buying. At least one of them catches his eye.

10th October 2025 12:01

by Edmond Jackson from interactive investor

An interesting concept – at any stage of the business cycle – is a share that has de-rated from previous hopes to a moderate valuation yet retains scope to deliver better performance. You potentially can exploit a long-term re-rating if the price/earnings (PE) improves towards a classic “growth” multiple around 20x.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

A perspective of near a decade is needed to appreciate the de-rating of Hostelworld Group (LSE:HSW), an Ireland-based travel agent focused on hostelling. It provides software and data processing services that facilitate hostel, B&B and hotel accommodation, and also has hostels in some 180 countries.

While the business was obviously disrupted by Covid, and variable booking demand can affect near-term revenue/profit, you would think “discount accommodation” is a broadly attractive area. The majority of people seek an aspect of travel in their lives, albeit compromised nowadays by soaring costs not only to get around but especially hotels, food and drink.

For example, there has been quite some media reviewing of a new “Japanese capsule hotel” in Piccadilly Circus, operated by Zedwell Hotels which now operates five in the capital. You can stay here from £30 a night versus £25 in a dormitory at the YHA Central London.

It flags a growth segment, although it is exposed to classic risks of the travel industry that can mean modest PE multiples. Yet if management is on the ball, it should be possible to exact decent returns.

Precedent of stronger performance pre-pandemic

Hostelworld floated exactly a decade ago at 185p per share on the Irish and London Stock Exchange, raising €180 million (£157 million) for growth plans. The share price had soared to near 300p by April 2016, then came its first slump to 127p that June after bookings turned weaker following terrorist attacks in Paris and Brussels. Europe was a very significant contributor despite Asia-Pacific hostels expanding.

Another rally followed, this time to over 400p by March 2018 before an episode of flat bookings versus rising marketing costs hit profits. Introducing “free cancellation” meant deferring revenue until customers completed their stays.

| Hostelworld - financial summary | ||||||

| year-end 31 Dec (euros) | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Turnover (€m) | 80.7 | 15.4 | 16.9 | 69.7 | 93.3 | 92.0 |

| Operating margin (%) | 4.1 | -325 | -194 | -19.2 | 1.4 | 12.2 |

| Operating profit (€m) | 3.3 | -49.9 | -32.9 | -13.4 | 1.3 | 11.2 |

| Net profit (€m) | 8.4 | -48.9 | -36.0 | -17.3 | 5.1 | 7.4 |

| EPS - reported (€ cents) | 8.7 | -45.7 | -31.0 | -14.7 | 4.1 | 7.0 |

| EPS - normalised (€ cents) | 10.7 | -34.1 | -29.6 | -14.0 | 6.0 | 7.7 |

| Op cash flow/share (€ cents) | 11.7 | -10.3 | -11.8 | -0.6 | 13.8 | 16.7 |

| Capex/share (€ cents) | 3.2 | 3.6 | 3.8 | 4.1 | 3.2 | 4.3 |

| Free cash flow/share (€ cents) | 8.5 | -13.9 | -15.7 | -4.7 | 10.6 | 12.4 |

| Dividends/share (€ cents) | 4.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Covered by earnings (x) | 2.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Return on total capital (%) | 2.4 | -49.7 | -31.8 | -14.5 | 1.9 | 15.2 |

| Cash (€m) | 19.4 | 18.2 | 24.5 | 18.2 | 6.7 | 8.2 |

| Net debt (€m) | -15.1 | -12.7 | 3.8 | 13.4 | 4.0 | -7.9 |

| Net assets (€m) | 132 | 97.9 | 67.1 | 52.2 | 59.2 | 70.1 |

| Net assets/share (€ cents) | 136 | 84.1 | 57.7 | 44.5 | 47.9 | 56.1 |

Source: company accounts

This was all before Covid which swung Hostelworld from €8.4 million (£7.3 million) net profit to a near €50 million loss in 2020, with recovery only to €5 million profit by 2023. Consensus – likely with input from management if the company broker is involved - already expects strong progress to near €15 million net profit this year and €18 million in 2026, so it’s not as if there could be a major earnings surprise. Indeed, the price has risen 5p to 124p in response to yesterday’s “in-line” trading update, with revenue up 5% in the third quarter; nothing spectacular but no check to expectations mentioned.

This puts the share on a 12-month forward PE just shy of 10x but relative to an earnings recovery to growth, the PE-to-growth (PEG) ratio falls below 0.5. In principle this is very attractive for a short timeframe and obviously forecast-based.

- Is 4.7% the new magic number for sustainable pension withdrawals?

- Share Sleuth: the three firms I’ve been buying

Interestingly, there is a near-identical parallel in £340 million company On The Beach Group (LSE:OTB) which at 220p trades on a 10x forward PE with a PEG of 0.5. It has also only quite recently restored dividends, as has Hostelworld which restored its interim payout with €0.82 per share. Yields are quite immaterial on such travel shares, however, only 2.1% is expected for On The Beach and 2.7% for Hostelworld, despite projected earnings cover near 5x for both. Boards wisely do not want to establish then dash payout expectations, which is liable to impact market value.

Instead, both companies are also making “returns” via buybacks, which at least also affirm cash generation and have the advantage that not renewing such a programme is far less of a financial PR hit than cutting the dividend.

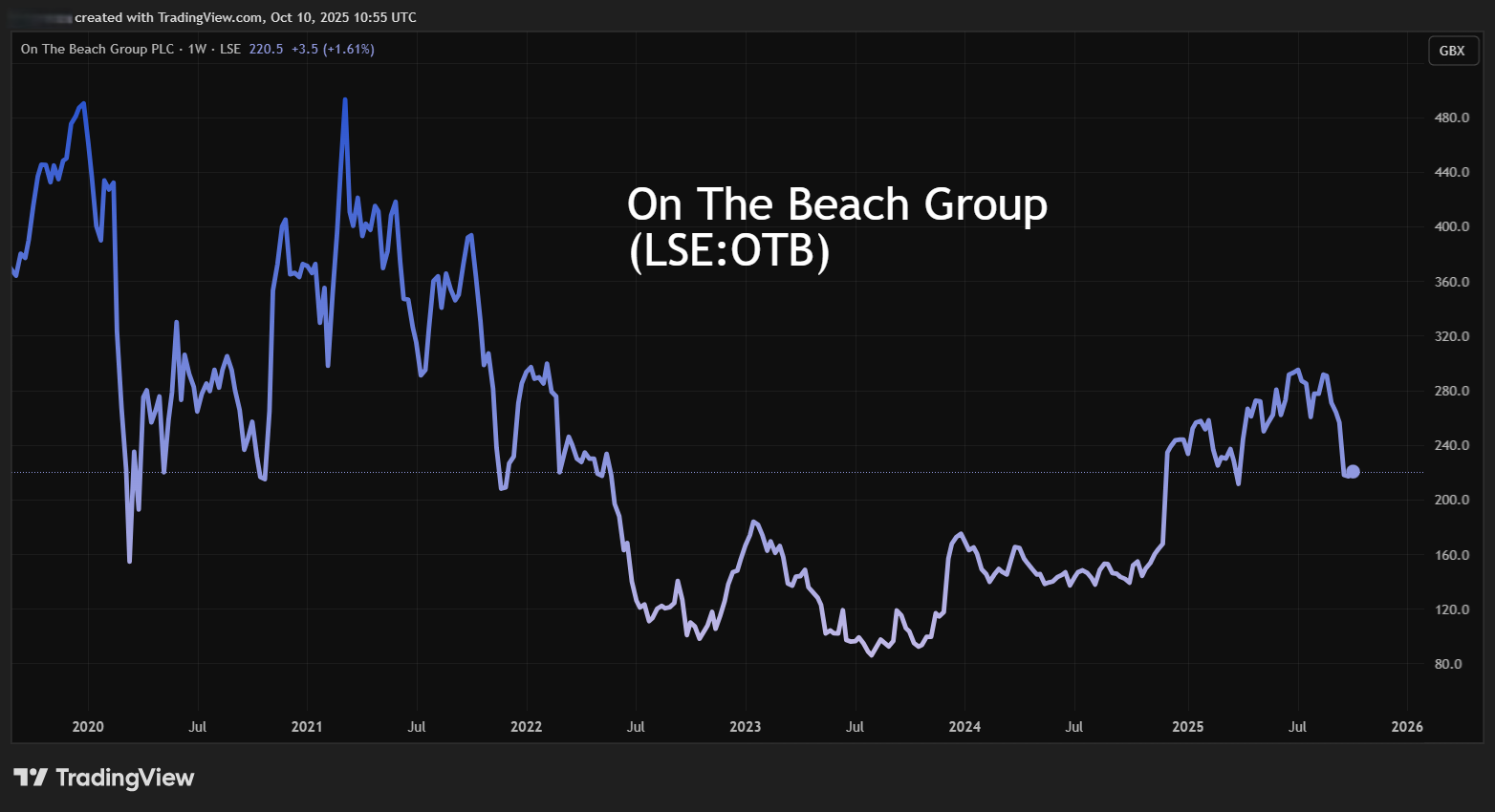

Charts affirm sense of volatile medium-term uptrend

On The Beach manifests quite a “bowl” chart pattern over the last four years, as if in a medium-term uptrend despite a 23% drop since August. Ironically, a 24 September pre-close update for its year to 30 September was robust, with no aspects of caution. Revenue rose 11% to £1.23 billion, helped by summer bookings up 12% and strong winter bookings, up 12%. Year-end cash was around £90 million.

Source: TradingView. Past performance is not a guide to future performance.

Possibly both shares have fallen since August amid a sense that the summer holiday theme would die thereafter, hence it being time to bag a trading profit. They both might also have been sensitive to growing fears that consumer confidence may be impacted by the 26 November Budget. More positively, both operate in value-conscious travel options, hence they might benefit from holidaymakers trading down even if others avoid bookings in the near term.

Hostelworld would appear also in a medium to long-term uptrend, but mind it is currently recovered to a level seen in September 2019, although still well down on 200-400p in 2017-18:

Source: TradingView. Past performance is not a guide to future performance.

Hostelworld is lagging On The Beach’s financial rebound since the pandemic, though it is expected to be of similar vigour going forward, at least for earnings.

I am wary at accepting consensus for Hostelworld, however, given the first nine months of its financial year shows revenue broadly flat, and with its operating margin only 4% pre-pandemic and now up from 1% in 2023 to over 12% in 2024. By comparison, On The Beach achieved 13% in 2019 – after 25% in 2017 and 2018 - and grew it from 11% in 2023 over 17% in 2024.

| On the Beach Group - financial summary | ||||||||

| year end 30 Sep | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Turnover (£ million) | 83.6 | 104 | 148 | 71.2 | 30.5 | 145 | 112 | 123 |

| Operating margin (%) | 25.3 | 25.2 | 13.0 | -64.5 | -117 | 1.8 | 10.7 | 17.2 |

| Operating profit (£m) | 21.1 | 26.2 | 19.2 | -45.9 | -35.8 | 2.6 | 12.0 | 21.2 |

| Net profit (£m) | 18.0 | 21.5 | 15.7 | -38.8 | -30.2 | 1.6 | 10.1 | 13.0 |

| EPS - reported (p) | 13.8 | 16.5 | 11.9 | -27.7 | -19.0 | 1.0 | 7.1 | 11.9 |

| EPS - normalised (p) | 15.6 | 16.8 | 17.5 | -8.2 | -14.9 | 2.2 | 8.7 | 11.6 |

| Return on total capital (%) | 20.5 | 20.3 | 14.2 | -28.9 | -23.5 | 1.6 | 7.0 | 11.5 |

| Operating cashflow/share (p) | 15.4 | 20.1 | 17.3 | -53.5 | 0.8 | 13.1 | 13.1 | 15.8 |

| Capital expenditure/share (p) | 2.4 | 4.6 | 6.4 | 3.7 | 3.2 | 7.4 | 7.2 | 6.1 |

| Free cashflow/share (p) | 13.0 | 15.5 | 10.9 | 57.2 | -2.4 | 5.7 | 5.9 | 9.8 |

| Dividend/share (p) | 2.8 | 3.3 | 3.3 | 0.0 | 0.0 | 0.0 | 0.0 | 3.0 |

| Cash (£m) | 33.0 | 47.3 | 54.8 | 36.5 | 56.0 | 64.5 | 75.8 | 96.2 |

| Net debt (£m) | -33.0 | -42.8 | -54.8 | -32.3 | -53.1 | -60.6 | -71.3 | -93.4 |

| Net assets (£m) | 96.6 | 118 | 129 | 152 | 150 | 157 | 168 | 183 |

| Net assets per share (p) | 74.0 | 89.7 | 98.7 | 96.8 | 90.6 | 94.3 | 101 | 109 |

Source: historic Company REFS and company accounts

This company also beats Hostelworld in terms of cash generation vigour versus modest capital expenditure, that has built a net cash position sooner and more substantially.

Investment calibre versus speculative growth?

From an investment perspective, the drop in On The Beach shares from August offers a firmer sense of a “buy” opportunity at 220p currently, given its more robust financials and track record, though the PE and PEG comparison with Hostelworld is otherwise similar.

Some would say that travel shares cannot rate investment grade given the fickle nature of bookings and, before long, yet another major disruptive event will happen.

But if you accept scope for volatility, both are interesting stocks, and I step up to a “buy” stance for On The Beach.

- The Income Investor: an alternative for those mulling shift to cash

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Hostelworld has more to prove but the market’s positive reaction to its update and the commercial space it is in, imply risk/reward is turning favourable. Budget accommodation should, if well-managed, offer sound prospects whether as operator or agent for. I still find it hard to say what, if any, “moat” could exist given Hostelworld effectively competes with general booking platforms, hostels with their own marketing via search engines, and novel players like capsule hotels.

So its shares get on my radar with a “hold” stance initially. The update cited the launch of “social network monetisation” in the fourth quarter – hopefully more substantive than money-off when a friend books – and “provision of budget accommodation initiatives” in the current fourth quarter. It sounds like what management should be doing anyway “towards delivery of our growth strategy”, but hints at scope for recovery-to-growth assuming recession is averted. Its pre-pandemic performance is off most tables and charts but worth bearing in mind.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.