Share Sleuth: the three firms I’ve been buying

Richard Beddard has taken action to reduce Share Sleuth’s cash pile, while also making moves to simplify his investment process after the portfolio fell short of its benchmark for the first time.

9th October 2025 08:42

by Richard Beddard from interactive investor

I entered September determined to reduce Share Sleuth’s cash pile, which requires me to re-score shares that predate the changes I made to the system in spring.

- Invest with ii: Open a Stocks & Shares ISA | What is a Stocks & Shares ISA? | ISA Offers & Cashback

Adding more Renew

In September I re-scored Renew, an engineering company that maintains and improves infrastructure such as railways, roads, water mains, and nuclear facilities. Before the re-evaluation, it was the highest-ranking Decision Engine share that was also under-represented in the portfolio. Afterwards, its score was unchanged.

Although the company was about to end its financial year and probably issue a full-year trading update in October, I decided to add more Renew Holdings (LSE:RNWH) shares to the portfolio on Friday 19 September. Not one to gamble on whether companies do better or worse than expected, I was happy to go with my assessment of the company’s long-term prospects.

In the short term, I was lucky, the company said it has a record order book, and my trade looks prescient.

Past performance is not a guide to future performance.

To recap, each share has an ideal holding size determined by its score. Renew’s score of 7.9 meant its ideal holding size was 5.8% of the total value of the portfolio. The actual holding size was 2.8%, a difference of 3% of the portfolio’s total value.

I added 621 shares in Renew at a fraction under 788p per share, the share price to buy quoted by a broker. The total cost including £10 in lieu of portfolio fees was £4,902.55, equivalent then to about 2.5% of the total value of Share Sleuth, which is my minimum trade size.

Jet2

While I was re-evaluating Renew, package holiday company and leisure airline Jet2 Ordinary Shares (LSE:JET2)’s share price continued its summer slump.

A falling share price reduces the value of the portfolio’s holding and improves the share’s score because, other things being equal, the shares are cheaper. Since the ideal holding size increases with the score, the gap between the smaller actual size and the larger ideal size widened beyond 2.5% of the portfolio’s total value, and Jet2 became available to trade.

There was no need to re-evaluate Jet2, I had scored it a few weeks earlier. I decided to add shares even though the leisure airline, along with other package holiday providers, has warned that cash-strapped holidaymakers are booking later. In addition, a greater but still small proportion of customers are buying flights on their own, rather than package holidays, which is less profitable.

- Insider: something fishy about this director deal

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Once again, I hope the long-term advantages of Jet2 will make the share a worthwhile holding through short-term turbulence.

I added 366 shares at £13.53 a share. The total cost including £10 in lieu of fees was £4,961.14, also about 2.5% of the total value of the portfolio.

Jet2 has been one of Share Sleuth’s outstanding investments, but I haven’t added to the holding since it joined the portfolio weeks after I started it in 2009. I have twice taken profits, also a long time ago.

Past performance is not a guide to future performance.

Hollywood Bowl

Unlike Jet2, Hollywood Bowl Group (LSE:BOWL) and I have had an on-off relationship. I added the shares to the portfolio at the start of the pandemic in 2020, held them through it, and then ejected them in 2023. Now, having reaffirmed the share’s score, I’ve added it again at much the same price as the earlier transactions.

Past performance is not a guide to future performance.

Some of the things that worried me about Hollywood Bowl in 2023, have been acknowledged in the score I give it now. I have, however, looked past presentational issues in the 2023 annual report that irked me then.

On Thursday 25 September, I added 1,972 shares in Hollywood Bowl. The price was 250p and the total cost including £10 in lieu of broker fees and just under £25 in lieu of stamp duty was £4,970.

Quartix

Quartix was the bottom share in the Decision Engine table, when I re-scored it in September.

Long story short, I like the company’s low-cost vehicle tracking system and the business appears to be back on track now its founder and major shareholder has returned. But a high share price and not knowing how the company will be managed if Andy Walters decides to retire again, blunts the investment case.

Also on Thursday 25 September, I reduced the portfolio’s holding from 3,285 shares to 1,667 shares, enough to take it down to my minimum holding size of 2.5% of the portfolio’s total value. The share price was 304p, which after deducting £10 in lieu of fees netted the portfolio £5,059.

Past performance is not a guide to future performance.

After the trade, Quartix published a trading update confirming the numbers are still moving in the right direction. It also said the prospect of a large and costly tracking device replacement programme in the UK has diminished significantly because of a new five-year agreement with the company’s 2G network provider.

The month ahead...

Additions are still the priority because my aim is to keep the portfolio close to fully invested. I can move forward with less urgency now the portfolio’s cash balance is (fractionally) below 10% of its total value.

The ih%-% column in the table below shows how closely the portfolio holdings match the ideal holding sizes as suggested by the Decision Engine. If the absolute value is 2.5% or greater, the Decision Engine is nudging me to trade. If the difference is positive, it wants me to add shares. If it is negative, it wants me to reduce or liquidate a holding.

company | score | qual | price | ih% | ss% | ih%-% | |

1 | FW Thorpe | 8.5 | 0.2 | 7.4% | 6.5% | 0.9% | |

2 | Howden Joinery | 8.0 | 0.6 | 7.1% | 6.1% | 1.0% | |

3 | James Latham | 7.5 | 1.0 | 7.0% | 6.0% | 1.0% | |

4 | Oxford Instruments | 7.0 | 1.0 | 6.0% | 5.0% | 1.0% | |

5 | Jet2 | 7.0 | 1.0 | 5.9% | 5.8% | 0.1% | |

6 | Macfarlane | 7.0 | 0.9 | 5.9% | 3.4% | 2.4% | |

7 | Solid State | 7.0 | 0.9 | 5.8% | 4.3% | 1.5% | |

8 | Hollywood Bowl | 7.5 | 0.3 | 5.6% | 2.5% | 3.1% | |

9 | Bunzl | 7.5 | 0.2 | 5.5% | 5.1% | 0.4% | |

10 | YouGov | 7.5 | 0.2 | 5.5% | 5.5% | ||

11 | Porvair | 8.0 | -0.3 | 5.4% | 3.3% | 2.1% | |

12 | Softcat | 8.0 | -0.4 | 5.1% | 2.5% | 2.6% | |

13 | Churchill China | 6.5 | 1.0 | 5.0% | 2.9% | 2.1% | |

14 | Renew | 7.5 | -0.2 | 4.7% | 5.9% | -1.3% | |

15 | Bloomsbury Publishing | 7.5 | -0.2 | 4.6% | 2.1% | 2.5% | |

16 | Auto Trader | 8.0 | -0.9 | 4.2% | 4.2% | ||

17 | 4Imprint | 8.0 | -1.0 | 4.1% | 1.9% | 2.2% | |

18 | Renishaw | 7.5 | -0.5 | 4.1% | 4.3% | -0.2% | |

19 | Advanced Medical Solutions | 6.5 | 0.5 | 4.1% | 2.1% | 1.9% | |

20 | Games Workshop | 8.5 | -1.5 | 4.0% | 4.7% | -0.6% | |

21 | Focusrite | 6.0 | 1.0 | 4.0% | 2.0% | 2.0% | |

22 | Judges Scientific | 7.5 | -0.6 | 3.9% | 3.9% | ||

23 | Anpario | 7.0 | -0.2 | 3.6% | 2.8% | 0.8% | |

24 | Dunelm | 8.0 | -1.3 | 3.5% | 3.5% | ||

25 | Volution | 8.0 | -1.4 | 3.1% | 3.1% | ||

26 | Keystone Law | 7.5 | -1.2 | 2.7% | 2.7% | ||

27 | Cohort | 8.0 | -1.8 | 2.5% | 2.2% | 0.3% | |

28 | Quartix | 7.5 | -1.9 | 2.5% | 2.3% | 0.2% | |

29 | Goodwin | 8.0 | -2.5 | 2.5% | 5.9% | -3.4% | |

30 | Tristel | 7.5 | -2.0 | 2.5% | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio, ss% is the actual size of Share Sleuth’s holding, and ih%-% is the difference between ideal and actual sizes.

YouGov (LSE:YOU), Softcat (LSE:SCT), Bloomsbury Publishing (LSE:BMY) and Auto Trader Group (LSE:AUTO) are the most likely additions because they are high-scoring shares, and the difference between their ideal holding sizes and their actual holding sizes are greater than 2.5% of the portfolio’s total value, its minimum trade size.

YouGov and Softcat need to be re-scored, though, and since they have already passed their financial year-ends, I’ll probably wait until November when they should have published annual reports.

- Stockwatch: prepare for volatility and range of outcomes

- Stockwatch: three shares trading at big discounts

YouGov’s score is more likely to change, because I’m putting more emphasis on risk and there have been lots of changes in the business and its management.

Other shares I’m likely to score soon include Renishaw (LSE:RSW), which has published its annual report, Thorpe (F W) (LSE:TFW) and Volution Group (LSE:FAN). I’m expecting annual reports from them soon.

The gift that is Goodwin keeps on giving. It’s over-represented in the portfolio, but I’m unlikely to reduce the holding. I reduced it only last month.

Share Sleuth performance

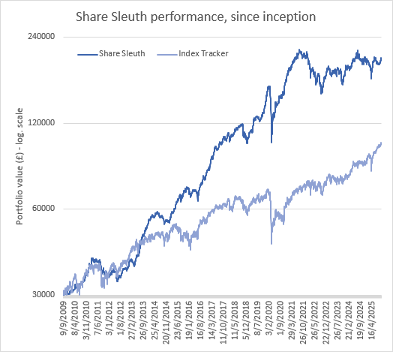

Last month was the 16th anniversary of the Share Sleuth portfolio. It has done well, but its reputation is increasingly dependent on past glories.

For the first time, Share Sleuth failed to beat its benchmark: which is to do better than accumulation units in an index-tracking fund handsomely over five years. In fact, it failed handsomely.

Between 9 September 2020 and 9 September 2025, Share Sleuth was up just 34% compared to 83% for the tracker fund.

I think this is explained by mistakes, which is why I’ve been simplifying my investment process over the last six months, and by the fact that the shares in the portfolio are currently undervalued.

From this, I conclude that I can do better, and now is not the time to throw in the towel.

At the close on 5 October 2025, Share Sleuth was worth £203,449, 578% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index-tracking fund would be worth £182,211, an increase of 242%.

Past performance is not a guide to future performance.

After dividends paid during the month from 4imprint Group (LSE:FOUR), Cohort (LSE:CHRT), Games Workshop Group (LSE:GAW), Goodwin (LSE:GDWN), Quartix and Solid State (LSE:SOLI), Share Sleuth’s cash pile is £21,335.

The minimum trade size, 2.5% of the portfolio’s value, is £5,086.

Share Sleuth, 05 Oct 2025 | Cost (£) | Value (£) | Return (%) | ||

Cash (10% of portfolio) | 21,335 | ||||

Current holdings (23 shares) | 182,114 | ||||

Total, and performance since 9 September 2009 | 30,000 | 203,449 | 578 | ||

Benchmark: FTSE All-Share index tracker (acc) | 30,000 | 102,587 | 242 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,343 | -4 |

ANP | Anpario | 1,124 | 4,057 | 5,620 | 39 |

BMY | Bloomsbury | 845 | 3,203 | 4,250 | 33 |

BNZL | Bunzl | 417 | 9,798 | 10,383 | 6 |

BOWL | Hollywood Bowl | 1,972 | 4,971 | 4,999 | 1 |

CHH | Churchill China | 1,495 | 17,228 | 5,905 | -66 |

CHRT | Cohort | 326 | 1,118 | 4,544 | 306 |

FOUR | 4Imprint | 116 | 2,251 | 3,874 | 72 |

GAW | Games Workshop | 66 | 4,116 | 9,471 | 130 |

GDWN | Goodwin | 81 | 1,959 | 11,948 | 510 |

HWDN | Howden Joinery | 1,476 | 10,371 | 12,376 | 19 |

JET2 | Jet2 | 822 | 5,211 | 11,820 | 127 |

LTHM | James Latham | 1,150 | 14,437 | 12,190 | -16 |

MACF | Macfarlane | 7,689 | 10,011 | 6,997 | -30 |

OXIG | Oxford Instruments | 505 | 10,044 | 10,151 | 1 |

PRV | Porvair | 906 | 4,999 | 6,686 | 34 |

QTX | Quartix | 1,618 | 3,988 | 4,611 | 16 |

RNWH | Renew Holdings | 1,310 | 9,804 | 12,052 | 23 |

RSW | Renishaw | 234 | 6,227 | 8,705 | 40 |

SCT | Softcat | 326 | 4,992 | 5,086 | 2 |

SOLI | Solid State | 5,009 | 6,033 | 8,766 | 45 |

TFW | Thorpe (F W) | 4,362 | 9,711 | 13,195 | 36 |

TUNE | Focusrite | 2,020 | 14,128 | 4,141 | -71 |

Notes

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

Objective: To beat the index-tracking fund handsomely over five-year periods

Source: ShareScope.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all the shares in the Share Sleuth portfolio.

For more on the Share Sleuth portfolio, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.