Summer stock-market winners and a famous horse race

Find out why share prices are behaving like this and what might happen in the month ahead.

3rd September 2020 10:49

by Lee Wild from interactive investor

Find out why share prices are behaving like this and what might happen to financial markets in the month ahead.

August is typically one of the quietest months of the year for stock markets as influential investors and decision makers take a summer break. This can mean that share prices don’t move very much. However, this year Covid-19 continues to have a significant effect on stock-market performance.

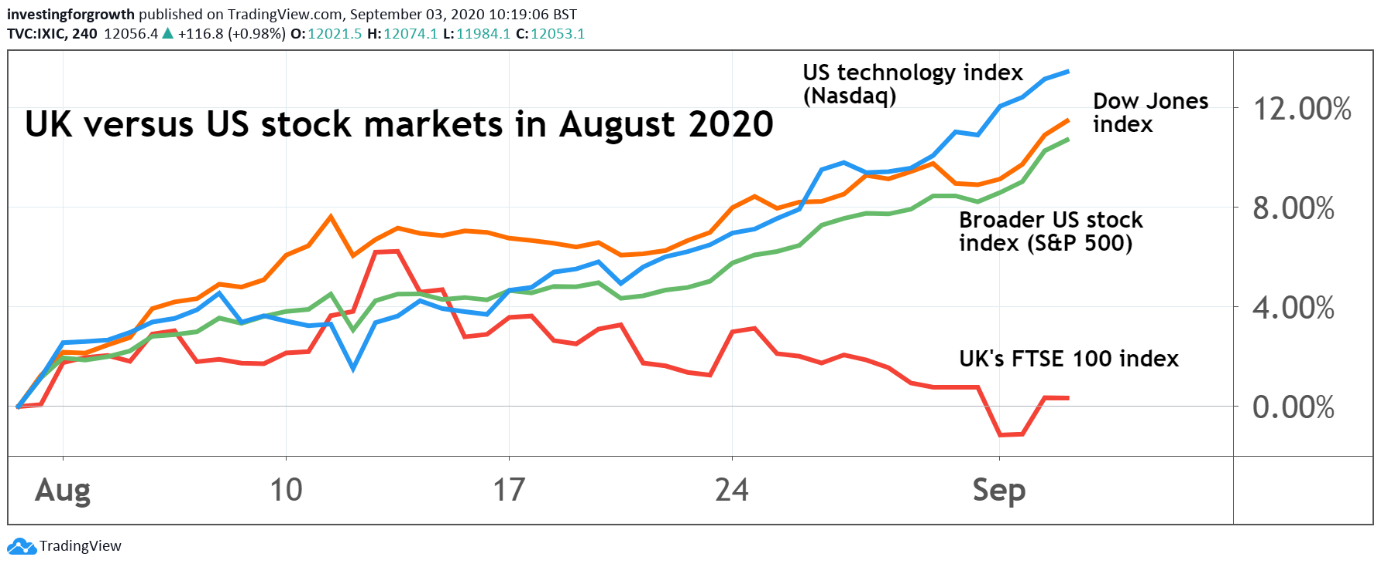

Investors who think shares are cheap and that a vaccine will get the global economy back to normal quite soon continue to buy. But many others worry about one of the worst recessions ever and massive job losses, so are selling whenever prices increase. This dynamic remained through August, with the FTSE 100 index of leading shares finishing the month roughly where it started – rising sharply during the first half of the month before falling during the second half.

A much stronger British pound has also worked against UK shares as it makes assets like stocks more expensive for overseas investors to buy.

Source: TradingView. Past performance is not a guide to future performance.

In America, technology shares like Apple (NASDAQ:AAPL), Amazon.com (NASDAQ:AMZN) and Tesla (NASDAQ:TSLA) remained hugely popular last month, sending the Nasdaq technology index up almost 10% to another record high. Investors love tech shares at the moment because shoppers have spent more online during the pandemic. Analysts think this trend will continue.

The price of gold also hit a record high in August. Investors typically buy gold as a safe haven in times of crisis, when the US dollar is weak, when interest rates are low, or if inflation is high.

So, what might happen in September?

Well, this month has, historically, been a poor month for stocks. It also has a reputation for being very volatile, and there is an old adage in City circles that might explain why.

“Sell in May and go away, don't come back 'till St Leger Day” is a relic from the days when the great and good of the Square Mile would spend the summer attending the big social events like Ascot, Wimbledon, Henley and Lords.

While the modern-day stock market remains open all year round, the number of active investors does shrink during the summer holiday season. As workers begin returning to their desks, the widely followed FTSE 100 index is up a modest 1.3% since the final working day of April.

Doncaster Racecourse has been the home of the St Leger horse race, the final Classic of the British Flat season, since 1778. This year, the race will be run on Saturday, 12 September.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.