Is surging Boohoo still an AIM bargain?

Boohoo shares have hit a record, but is there more to come after this rising star beat forecasts today?

5th September 2019 14:10

by Graeme Evans from interactive investor

Boohoo shares have hit a record, but is there more to come after this rising star beat forecasts today?

Boohoo (LSE:BOO) shares have hit a record, but is there more to come after this rising star beat forecasts today?

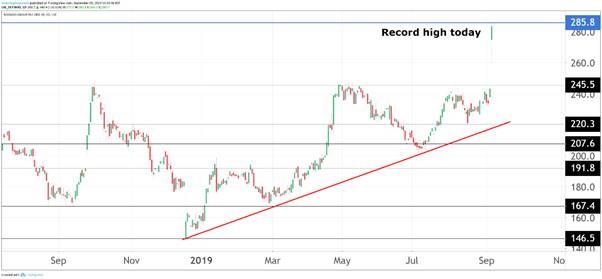

Boohoo shares have surged to a new record high after a surprise upgrade to forecasts helped the online retailer widen the market valuation gap to its AIM-listed rival ASOS (LSE:ASC).

The owner of brands including PrettyLittleThing and NastyGal continues to shrug off the turmoil being felt elsewhere in the retail sector, with sales for the current financial year to the end of February now running at between 33% and 38% higher.

This compares with previous guidance of between 25% and 30% as Boohoo continues its recent record of outperformance. Analysts at house broker Zeus said it was the tenth consecutive increase in management revenue guidance over the last three years.

Shares responded by surging 14% to a new all-time high of 277p, valuing the Manchester-based business at close to £3 billion. Big online rival ASOS also rose 3% on the back of today's update, although it is worth much less at nearer to £2 billion.

The latest rally for Boohoo reignites the valuation debate over a stock that was trading at less than 100p three years ago. Despite several upgrades, analysts at joint broker Jefferies said today it was an "inexpensive stock for such consistent, profitable growth".

They noted that Boohoo's enterprise valuation multiple had not kept pace with its performance, at just under 20x 2020 earnings. Shares have been in a narrow range in recent months due to margin worries and fears of increased competition, even though results in April went some way to addressing these worries.

Jefferies added:

"Boohoo has had a sustained period of outperformance and we like the virtuous circle Boohoo's multi-brand, multi-geography strategy has created."

Source: TradingView Past performance is not a guide to future performance

Further details on the company's performance will be revealed with Boohoo's half-year results on September 25. Margins are expected to remain at around 10% after investment behind the acquisition of new brands, including MissPap in March.

This was followed by the surprise move last month to buy the online businesses of renowned British fashion brands Karen Millen and Coast. The additions will further extend the group's reach and target market beyond its current young, value-orientated customers.

Zeus said Boohoo had multi-brand possibilities in athleisure and menswear, as well as the over 30s demographic where it can grow in line with its maturing existing customer base.

They add:

"We believe opportunities exist in both selective M&A as well as the potential for further in-house brand development, backed by a well invested supply chain and distribution infrastructure, highly experienced management team and significant cash resources."

The fear among investors will be that Boohoo experiences growing pains in the same way as ASOS has done in recent years. The older online business, whose revenues are still significantly higher than Boohoo's, has seen its share price fall sharply after a series of profit warnings linked to the roll-out of automated warehouses in Atlanta and Berlin.

ASOS is hopeful these short-term challenges will soon give way to optimism over longer-term efficiency benefits from the infrastructure to support global growth.

Substantial investments have also been made at Boohoo through new warehouse capacity and improvements at its Burnley warehouse. Founded in Manchester in 2006, Boohoo has around 13 million active customer accounts worldwide.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.