Is Tesco in your shares shopping basket?

In our FTSE Sector Watch column, Richard Hunter examines two stars of the consumer staples sector.

17th January 2020 10:30

by Richard Hunter from interactive investor

In our FTSE Sector Watch column, Richard Hunter examines two stars of the consumer staples sector.

The awkwardly titled personal care, drug and grocery stores sector is where the supermarkets live, as well as some of the famous products on sale within them.

As defined by the London Stock Exchange (we are limiting the scope of this article to the FTSE 100), the sector comprises the following companies: William Morrison Supermarkets operates a supermarket chain under the Morrisons (LSE:MRW) brand. The company operates around 500 total stores, from over 10 manufacturing sites across Britain.

Ocado (LSE:OCDO) is the world’s largest dedicated online grocery retailer, with over 580,000 active customers. It has developed an end-to-end solution for online grocery sales, based on proprietary technology, and uses this to operate its own business and those of its commercial partners.

Reckitt Benckiser (LSE:RB.) is a consumer health and hygiene company. It manufactures and sells branded products in the health, hygiene and home categories, including Calgon, Dettol, Gaviscon, Cillit Bang and Finish.

Sainsbury's (LSE:SBRY) operates Sainsbury supermarkets in the UK. It also operates convenience stores, an internet-based home delivery service, and Sainsbury’s Bank.

Tesco (LSE:TSCO) is an operator of retail stores. Its products include groceries, clothing, and general merchandise and digital entertainment.

Unilever (LSE:ULVR) is engaged in the household products industry. The company is a supplier of fast-moving consumer goods. Its areas of operations are personal care, home care, foods and refreshment, with brands including PG Tips, Marmite, Radox, Domestos and Lynx.

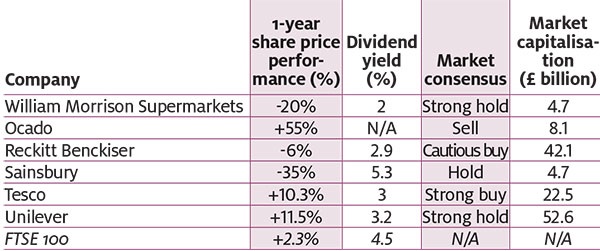

Tale of the tape

Mixed fortunes

The supermarkets themselves have seen mixed fortunes over the year. The stellar performance of Ocado shares – arguably less of a supermarket and more of a technology play these days – followed a transformational deal with Kroger in the US and a tie-up with Marks & Spencer (LSE:MKS). The latter deal provided an injection of cash for future investment, as well as new opportunities in a competitive market. Meanwhile, the failure of the proposed merger with Asda hit Sainsbury shares hard in 2019, while Tesco continued its recent revival in fortunes (see Three Stocks to Watch).

Of course, shopping habits are changing, not just in supermarkets but for retailers generally. There is also something of a blurring of boundaries as clothing and general merchandise (and, in the case of Sainsbury, even Argos) are added to groceries in the supermarkets.

Hypermarket race ends

There has been a clear move towards online and convenience shopping for the supermarkets, and away from the “space race” of a few years back, when the building of new hypermarkets was seen as the preferred option.

This has now slowed, with both online and the rise of the discounters (such as Aldi and Lidl) likely to dominate in the coming years.

Analysis of shopping habits has always been a skill of the supermarkets, and the advent of online shopping has meant that data analytics are becoming sharper. Meanwhile, new entrants such as Amazon (NASDAQ:AMZN) will further tighten the screw in terms of competitiveness on price – and, if their previous experience is anything to go by, the other supermarkets may yet need to up their game with ever-shorter delivery times.

Somewhat counter-intuitively, the discounters are looking to expand their physical presence in the UK. It has been reported that Aldi plans to open 1,200 new stores by 2025, while the current rate of expansion of stores at Lidl is between 50 and 60 per year. Even in physical stores, expect to see further pressure on supermarkets to perform, as they aim to make the experience fulfilling, to the extent of tempting the shopper to return.

Recent research in June 2019 from the food and grocery research organisation IGD predicted that by 2024, although supermarkets and hypermarkets will still account for 50% of the market, the fastest areas of growth by far will be online, dis- count and convenience.

Away from the supermarkets in the sector are two mature and well-established businesses whose brands are perhaps far more recognisable than the stocks themselves – Reckitt Benckiser and Unilever. As mature companies, their growth tends to be steady and reliable rather than racy and, given the nature of the products they produce, they are both seen as defensive stocks.

Defensive stocks are usually defined as those whose earnings are likely to remain in place regardless of the state of the overall market (or indeed the economy), since they provide products or services which we still require. Falling within this category are the likes of the utility stocks, consumer staples such as RB and Unilever – and, to some extent, the super- markets – and healthcare stocks.

Defensive stocks tend to perform better than the broader market during recessions (and conversely underperform during strong economic expansions).

Three stocks to watch

Tesco: Tesco is a company whose turnaround has been impressive to watch. The latest numbers built further on this progress, with revenues rising above expectations and pre-tax profits forging ahead, underpinned by impressive operating profit and free cash flow numbers.

Strategically, it is becoming increasingly apparent that the Booker acquisition was a masterstroke, while the tie-up with Carrefour and the launch of Jack’s provide tantalising opportunities. The company is also planning to tighten the screw further on its rivals through initiatives such as new store openings and an increase in its online offering. Progress in Asia also looks promising and Thailand is being targeted for further growth.

The market consensus regards Tesco as comfortably the preferred play in the sector.

Reckitt Benckiser: the sale of its remaining food business back in mid- 2017 marked the foundation of the company as it is today. A portfolio of health and hygiene products gives the company a defensive tag, with its goods potentially proving relatively recession-proof.

However, a recently reported sales miss and lowering of key full-year metrics in the wake of disappointing half-year results raised the question as to whether challenges at the company are more than temporary.

From an investment prospective, a forward dividend yield of 3% (not guaranteed) covered twice by earnings offers attraction in the current ultra-low interest rate environment, while a forward price/earnings (PE) ratio below both the three- and 10-year averages could now point to the emergence of value. But with challenges at Reckitt now resurfacing, investor caution is clearly warranted.

Unilever: recent years have not been all plain sailing for Unilever. Wage-squeezed consumers have often been turning to cheaper non- branded goods, such as those offered exclusively by the likes of discount retailer Aldi.

For investors, the company is considered to be defensive in nature. The types of product it sells are regularly on the shopping lists of consumers glob- ally. Its brands have also increasingly been marketed and sold in the emerging markets, although slowing growth in both India and China has been flagged.

A prospective dividend yield of around 3% is not unattractive in the current ultra-low interest rate environment either, although a forward p/e ratio of around 20, which is broadly in line with both the three- and 10-year averages, generates little excitement.

Richard Hunter is head of markets at interactive investor, Money Observer’s parent company.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.