These are the US stocks hit hardest by coronavirus

Some high-quality American shares are down 18% because of coronavirus. Here are the big-name fallers.

28th January 2020 14:59

by Graeme Evans from interactive investor

Some high-quality American shares are down 18% because of coronavirus. Here are the big-name fallers.

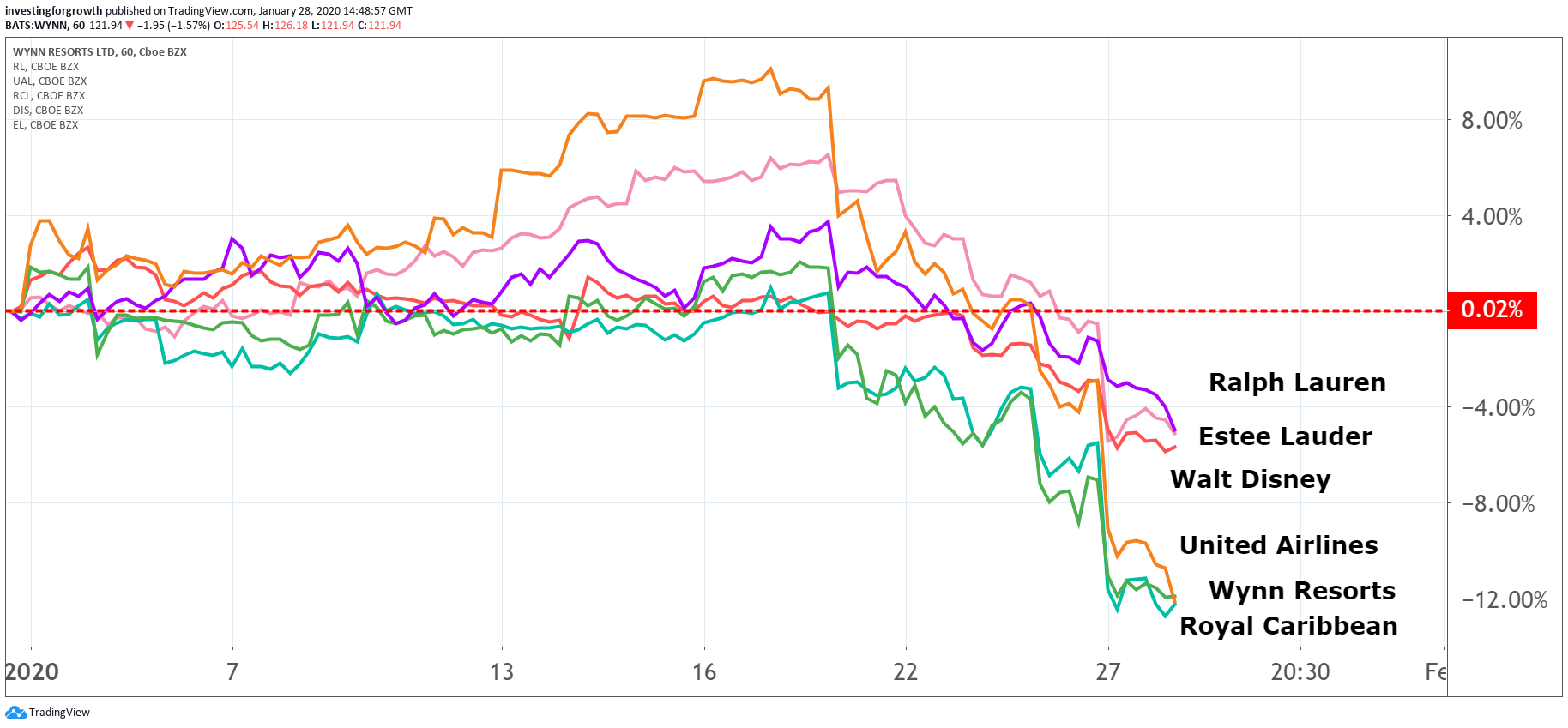

The buoyant mood of Wall Street markets less than two weeks ago has been replaced by fear and volatility after the spread of the Sars-like coronavirus caused shares to slide across the luxury goods, airline and holiday sectors.

Since the Dow Jones Industrial Average and other markets hit a record high on January 17, stocks including Nevada-based hotels and casino business Wynn Resorts (NASDAQ:WYNN) have slumped by as much as 18%. United Airlines Holdings (NASDAQ:UAL) and Royal Caribbean Cruises (NYSE:RCL) are both down 13.5% in the S&P 500, while The Walt Disney (NYSE:DIS) has declined 6% in the Dow Jones.

The slump, which has become more marked in recent days, reflects anxiety over the potential global impact of the coronavirus outbreak on Asian travel, particularly in the fast-growing Chinese tourism market.

Wider fears that the virus marks a repeat of the Sars outbreak, which severely damaged China's economy and triggered a sharp fall for global markets in 2003, have caused the wider Dow Jones Industrial Average to fall 2.5% from its mid-January record high.

Source: TradingView Past performance is not a guide to future performance

There was some respite today, with the Dow opening in positive territory and the FTSE 100 index also higher as investors eyed buying opportunities. However, the likes of cruise ship operator Carnival and American Airlines are still down by more than 8% since Thursday.

The sell-off reflects a new “black swan” for markets, with the CBOE Volatility Index at its highest reading since October. The coronavirus has now spread to at least 16 countries, with more than 100 people known to have died in China.

The big difference compared with the Sars outbreak in 2003 is that the pandemic risks are heightened by the rapid recent growth in Chinese travel. The country's outbound tourists spent some 258 billion US dollars in 2017, which at the time represented 20% of the world’s total spending on tourism.

This growth has been fuelled by the emergence of China's newly rich middle class, as well as more direct flight connections and a softening of travel restrictions by Chinese authorities.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Get exposure to the world’s biggest companies via these ii Super 60 recommended funds

The tourism cash has been particularly beneficial for luxury goods companies such as London-listed Burberry (LSE:BRBY), whose shares have now fallen 15% since 17th January. On Wall Street, Estee Lauder (NYSE:EL) is down more than 10%, while Ralph Lauren (NYSE:RL) is off 7.5% over the same period.

Analysts at UBS recently noted that Chinese consumers accounted for a third of the global luxury market, adding that during the Sars outbreak share prices of luxury goods stocks fell by 20%.

Jefferies has also used the Sars episode as a baseline for how coronavirus might affect industrial stocks. The US broker noted that the initial reaction to the virus was sharply negative for metals and mining shares, followed by a sharp rebound.

It added: “There would likely be a negative knee-jerk reaction if the coronavirus escalates in a similar fashion to Sars. However, as we saw in the performance data relating to Sars, the sell-offs offered great buying opportunities.”

Jefferies said that downside scenarios tend to be scoped and significantly discounted within two to three months, with a recovery trade once the new case rate decelerates.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.