These fund portfolios have never been better

Saltydog investor’s names the slow and steady funds that continue to deliver and those he’s buying now.

21st September 2020 10:35

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog investor’s names the slow and steady funds that continue to deliver and those he’s buying now.

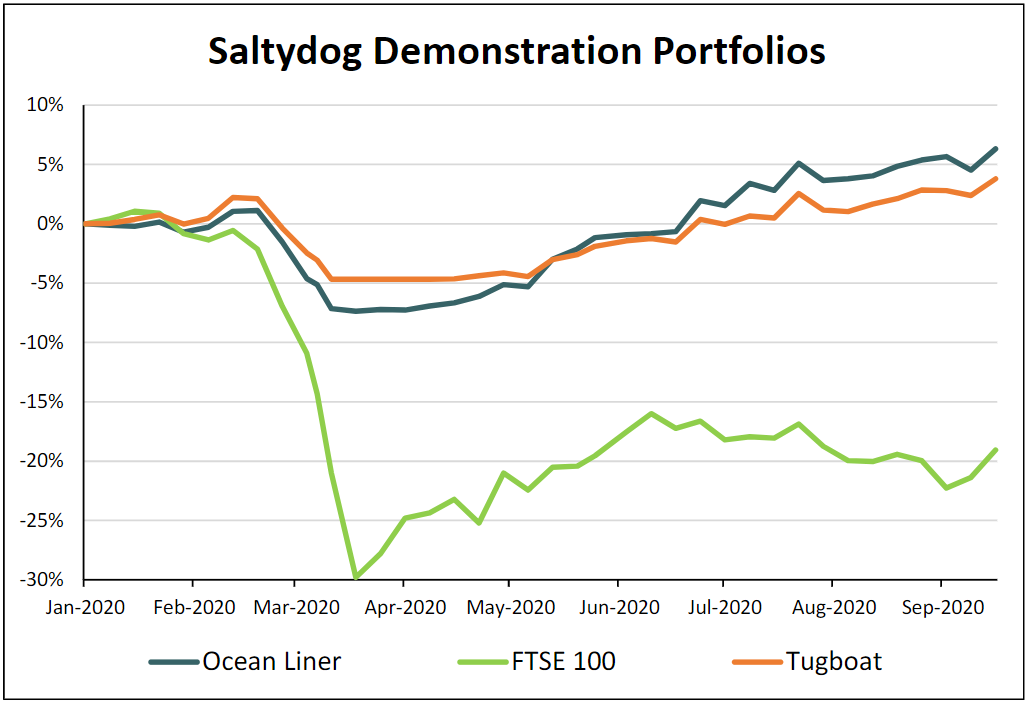

In the last six months ,the two Saltydog demonstration portfolios have seen a dramatic turnaround. The most cautious, the Tugboat, has gone up by 8.9% and the slightly more adventurous Ocean Liner has gained 14.8%. Last week, they both recorded new all-time highs.

Past performance is not a guide to future performance.

We have held some real star performers. The Ninety One Global Gold is showing a six-month return of 73% and Baillie Gifford American has done even better, up more than 100%. However, funds like this only ever make up a relatively small proportion of our portfolios.

We launched the demonstration portfolios as a way of explaining how the data that we provide every week can be used to build a portfolio, and how the Saltydog Groups can be used to control the overall volatility. They also show how the split between the groups varies as market conditions change.

We thought it prudent to start by focusing on the more cautious end of the spectrum while our members gain in confidence and competence. Having grasped the principles of building a portfolio, then moving from a cautious portfolio to something more adventurous should be relatively straightforward.

One of our key principles is to only invest in the more volatile funds when they are giving better returns than funds that have historically been more stable. To control the overall volatility of the portfolios we also limit the total amount that we will ever invest in the most volatile funds.

To help with this process we combine the Investment Association sectors into our own proprietary Saltydog Groups which are:

- Safe Haven

- Slow Ahead

- Steady as She Goes

- Full Steam Ahead – Developed Markets

- Full Steam Ahead – Emerging Markets

The nautical names of these groups give an easily recognisable indication of the volatility of the sectors and funds which are allocated to the groups. Using the performance data it is easy to see whether the increased risk associated with the more volatile funds is then being rewarded.

Due to the cautious nature of our portfolios, their largest holdings are in funds from the 'Slow Ahead’ Group. Although they may not make spectacular returns like the Ninety One Global Gold and the Baillie Gifford American funds have done, we also would not expect them to fall as dramatically when things go wrong.

Although these funds are less likely to grab the headlines, they have a greater impact on the overall performance of the portfolios, and so it is important that our chosen funds perform well.

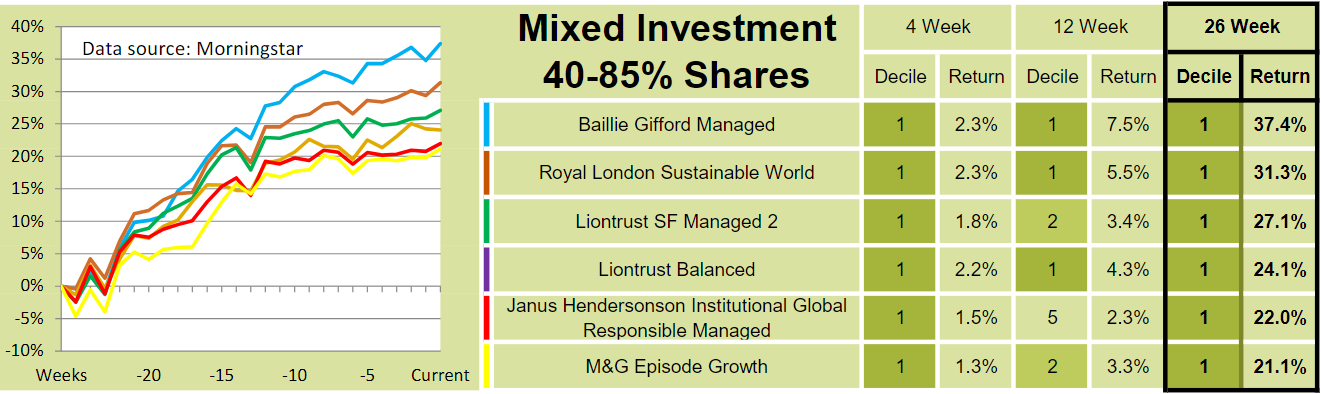

For the last 18 months, a handful of funds from the ‘Mixed Investment 40-85% Shares’ sector have been fulfilling this role for us.

We went into the Liontrust Sustainable Future Managed fund at the beginning of February 2019 and a couple of weeks later we invested in the Janus Henderson Institutional Global Responsible Managed fund. In April 2019 we added the Royal London Sustainable World.

These were the last funds that we sold earlier this year as markets headed into the coronavirus crash, and they were the first funds that we went back into when we saw signs of a recovery at the beginning of April.

In July, we added another fund from the same sector, Baillie Gifford Managed.

These funds have regularly appeared in our data tables highlighting the best-performing funds, and last week was no exception.

Past performance is not a guide to future performance.

All funds were in decile one over four weeks and 26 weeks, with 26-week returns ranging from 22% to 37.4%.

Both portfolios have recently added to their holdings in the Baillie Gifford Managed and the Royal London Sustainable World funds.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.