Three funds that are on the march again

12th July 2021 14:31

by Douglas Chadwick from ii contributor

Saltydog analyst has re-purchased a multi-asset fund at a time when its portfolios are at record highs.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

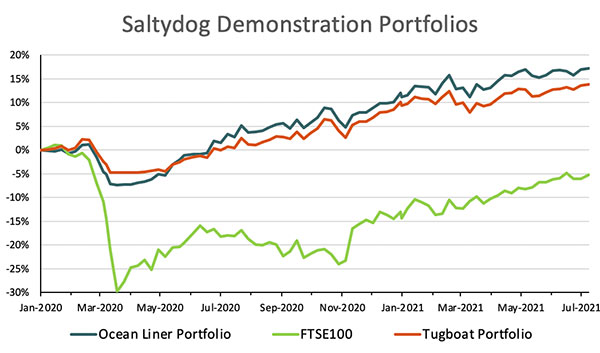

Last Thursday morning, both our demonstration portfolios were sitting at all-time highs.

Our most cautious portfolio, the Tugboat, only broke the record that it set the previous week. However, Ocean Liner has been struggling to get back above where it was in May.

The FTSE 100 has also made good progress since last November, but has levelled off in the last month. It is not really a fair comparison, because the FTSE 100 price chart does not include any reinvested income, but even when that is taken into account, it is still slightly down on where it was at the beginning of last year. The index actually peaked in May 2018 with its highest closing value standing at 7,877, and would need to go up by around 8% to get back to that level.

To control the overall volatility of our portfolios, we limit the amount that we invest in the most adventurous funds. These are the ones that may give the best returns when things are going well, but tend to fall the fastest when markets turn south.

- How Saltydog invests: a guide to its momentum approach

- Time to put tech funds back into our portfolios

- Open an ISA with interactive investor. Click here to find out how

In our Tugboat portfolio, we hold at least 70% in cash, or in funds from our ‘Safe Haven’ and ‘Slow Ahead’ Groups. In the Ocean Liner that figure falls to 30%.

The ‘Safe Haven’ Group is made up of funds from the Short Term Money Market and Standard Money Market Sectors.

The following sectors are in our ‘Slow Ahead’ Group:

- Sterling High Yield Bond

- Sterling Strategic Bond

- Sterling Corporate Bond

- Mixed Investment 0-35% Shares

- Mixed Investment 20-60% Shares

- Mixed Investment 40-85% Shares

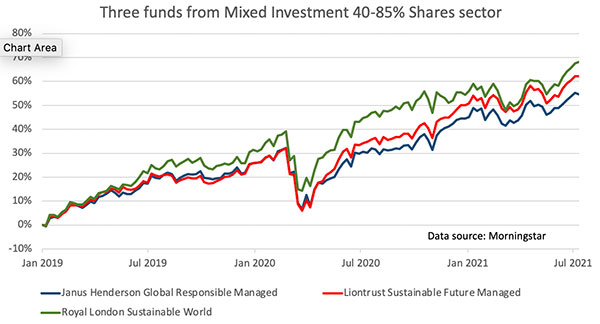

Although we review our portfolios every week, and make frequent adjustments, there are a handful of funds from the Mixed Investment 40-85% Shares sector that have regularly featured in both portfolios over the past couple of years. Last week, we went back into one of them, the Royal London Sustainable World trust.

The objective of this fund is to ‘achieve capital growth over the medium term (3-5 years) by investing mainly in the shares of companies globally listed on stock exchanges that are deemed to make a positive contribution to society. Investments in the fund will adhere to the manager’s ethical and sustainable investment policy.’

The other funds that we have previously invested in are Liontrust Sustainable Future Managed and Janus Henderson Global Responsible Managed.

We first went into the Royal London Sustainable World Trust fund in August 2018, but held it for just over a month, and then did a similar thing with the Liontrust fund. In February 2019, we went back into the Liontrust fund and at the same time invested in the Janus Henderson fund. That April, we added the Royal London fund and held all three until March 2020.

Stock markets all around the world were crashing, but soon started to recover. We began investing again in April and the first fund that we bought was the Royal London Sustainable World Trust. Soon we added the Liontrust Sustainable Future Managed and Janus Henderson Institutional Global Responsible Managed funds.

This time we kept all three until May 2021, when we sold the Royal London fund. We had already reduced the amount that we were holding in the other two funds.

Having levelled off for a while, these funds have recently taken off again and so last week we went back into the Royal London fund again. We now hold all three funds, which have an ethical or sustainable focus, in both portfolios.

Here is a graph showing how they have performed since the beginning of 2020.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.