Three funds sold, one new holding added

6th March 2023 14:26

by Douglas Chadwick from ii contributor

Saltydog has been making changes to its two demonstration portfolios. Here’s why.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

It may be unfortunate, but there is no way of denying that the recovery we saw at the beginning of the year seems to have stalled. At least for the time being.

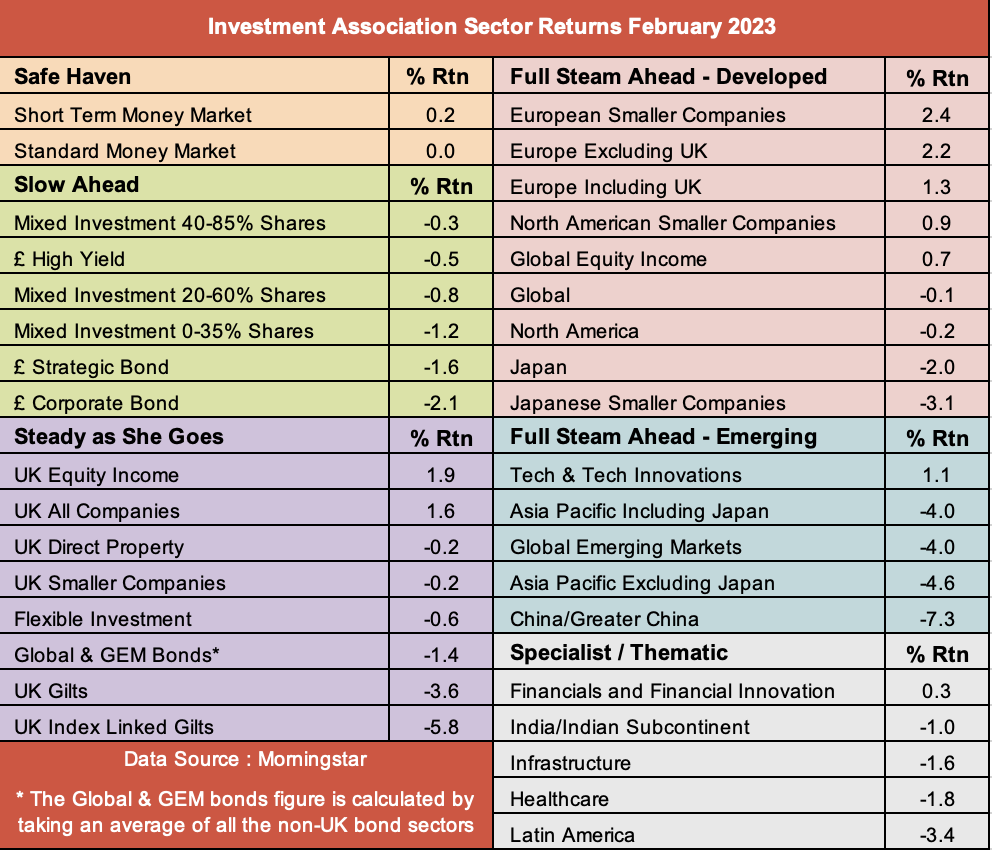

During January more than 95% of the funds we track went up, and that was reflected in our sector analysis where nearly all sectors were showing one-month gains. The only exceptions were the Healthcare and India/Indian Subcontinent sectors.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

In February, fewer than 50% of the funds made gains, and last week the number dropped below 5% (although we tend not to put too much emphasis on the one-week figures).

Not surprisingly, our latest analysis of the Investment Association (IA) sectors monthly performance shows most of them going down last month.

Although it is disappointing, we do not think that it is time to panic. There are still some sectors showing gains for last month, and most are still up over the last three months. Unfortunately markets seldom move up, or down, in straight lines. Therefore, we should expect some bumps on the way. Having said that, perhaps now it is not such a bad time to have a few less chips on the table.

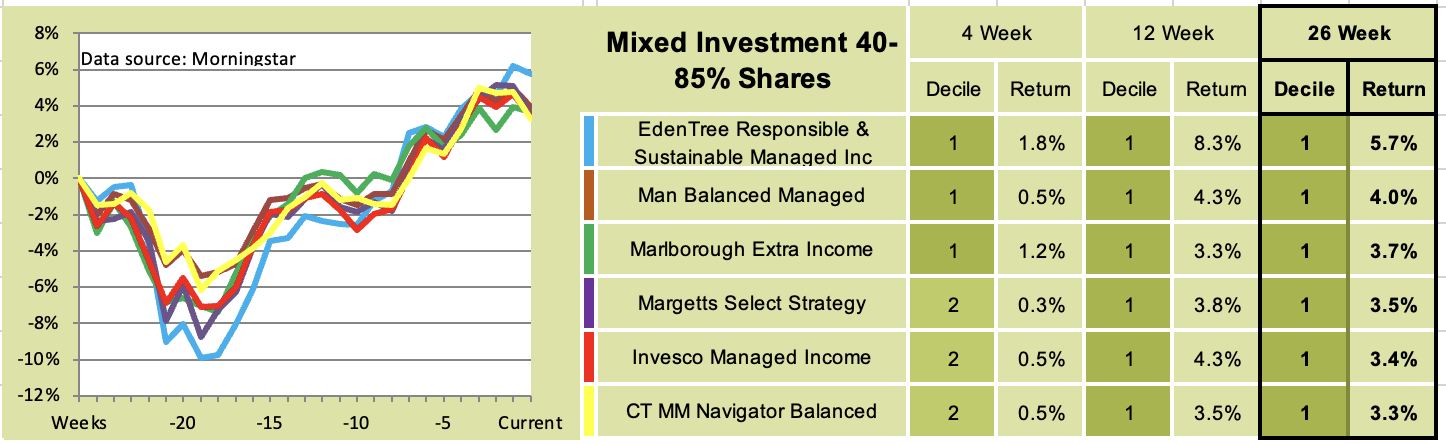

In our 'Slow Ahead' Group, the best-performing sector in February was Mixed Investment 40-85% Shares. The sector as a whole had made a small loss, but when we reviewed our analysis last week the leading funds over the past 26 weeks had been trending up for the previous 18/19 weeks. Even though the last couple of weeks had been a bit shaky they were still up over the last four.

In our demonstration portfolios, where we show our members what we are actually doing with our own money, we currently hold four funds from this sector. They include the EdenTree and Invesco funds which feature in this table.

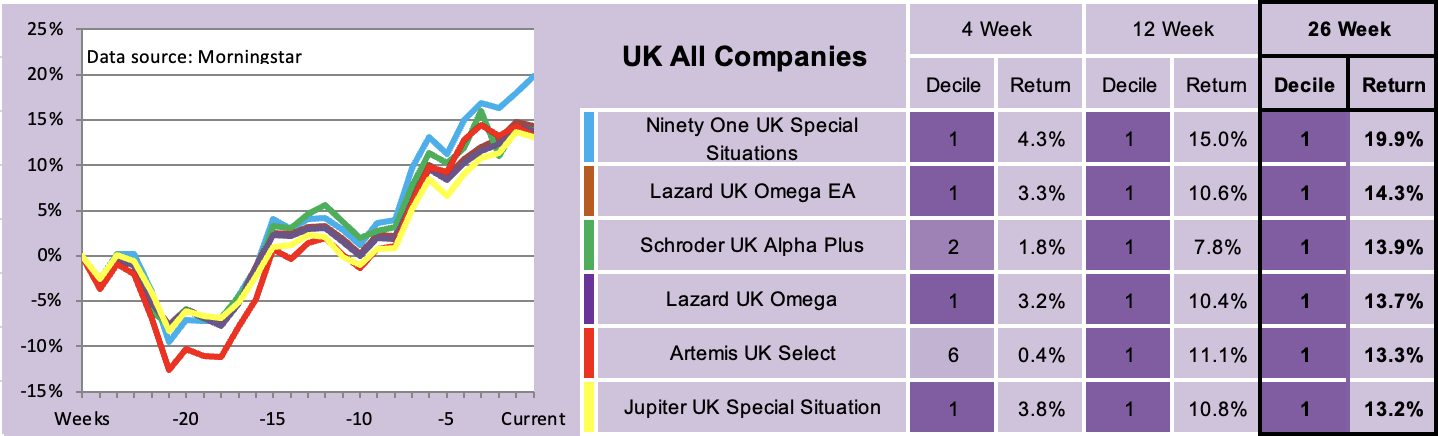

In the 'Steady as She Goes' Group, the UK Equity Income and UK All Companies sectors are the only ones showing gains in February. We also hold several funds from these sectors, most of which we are happy to keep, but last week one of them broke our ‘three weeks in decile six or worse’ rule and has been sold. It was the Baillie Gifford UK Equity Alpha fund that we first bought in November of last year and since then has gone up by more than 5%.

Our Ocean Liner portfolio is investing in a new fund from the UK All Companies sector, Ninety One UK Special Situations, which featured in last week’s four and 26-week data tables, and was in decile one over four, 12 and 26 weeks.

Last November, the Ocean Liner also bought the Janus Henderson UK Smaller Companies fund. Since then, it has gone up by 6.8% but its performance has dropped off in recent weeks. The UK Smaller Companies sector went down in February and this fund also broke our ‘three weeks in decile six or worse’ rule. It has now been sold.

The three European sectors all went up in February and are at the top of the Full Steam Ahead Developed Group. We are not making any changes to the three funds that we hold from these sectors.

- Why investors should be returning to the UK equity market

- ISA fund ideas for different ages and stages

There is another fund that we let go of last week, Invesco China Equity. Having been one of the best sectors in January, China/Greater China was the worst-performing sector in February. Time to sell up and move on. We only had a relatively small holding, and we did not have it for very long. We went into it in January and it did briefly show a small profit, but then started falling and at one point was down by more than 8%.

By the time we sold it, it had recovered a bit, but was still showing a loss of 4.8%. We have to accept that not all the funds that we invest in will make gains, that is just part of investing.

Some people have difficulty selling at a loss and would rather wait and hope that the fund recovers. As momentum investors we have a different approach, we believe in ‘cutting the losers and letting the winners run’.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.