Three lower risk funds generating double-digit returns

These typically less risky funds have made the Saltydog analyst a tidy profit in the past four months.

24th June 2019 10:57

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

These typically less risky funds have made the Saltydog analyst a tidy profit in the past four months.

Steady progress in the mixed investment sectors

As part of our regular weekly analysis we look at the relative performance of the Investment Association sectors.

To help with our investment decisions we combine the sectors into our own proprietary 'Saltydog' groups based on their historic volatility.

The groups are:

• Safe Haven – very low risk, but also very low returns.

• Slow Ahead – normally a low risk level and often with adequate returns.

• Steady as She Goes – generally medium risk, with potentially higher returns.

• Full Steam Ahead – higher risk, with potentially the best returns. There are quite a few sectors that fall into this risk category and so we split them into Emerging Markets and Developed markets.

The Specialist sector contains a range of funds which don't naturally sit within the other sectors, and so we look at that separately but treat the funds as if they have the same risk profile as funds in the 'Full Steam Ahead' group.

We can then use these groups to control the overall volatility of our portfolios. As you would expect, the larger the amount invested in funds from the lower volatility groups the less volatile we would expect the overall portfolio to be.

We also have a rule that we only invest in funds from the more volatile sectors when they are giving better returns. Why would you accept a higher level of volatility, when you're not seeing any significant benefit?

Most of our commentary tends to focus on the more exciting sectors in the 'Full Steam Ahead' groups. This is where the largest gains are usually made, but it is also where it's easier to come unstuck. The sectors in the lower volatility groups often get over-looked, even though they make up the majority of our investments.

The Investment Association splits the sectors into funds principally targeting income, and funds principally targeting growth. Of the sectors focusing on growth four are classified as 'Mixed Investment' sectors. This is where the funds hold a mixture of cash, gilts, bonds, and equities. The fund manager can determine the relative proportions (within set limits) depending on what’s happening in the markets.

The four sectors are:

• Mixed Investment 0–35% Shares

• Mixed Investment 20-60% Shares

• Mixed Investment 40-85% Shares

• Flexible Investment

Back in February, we invested in some funds from the 40-85% Shares sector and they have been making steady progress ever since. We have already added to our holdings. These funds are in our 'Slow Ahead' group.

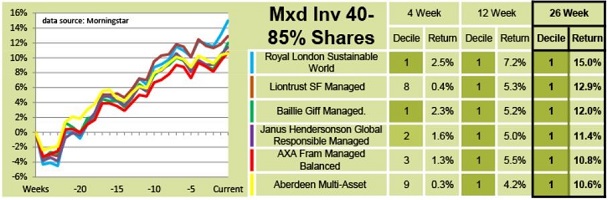

This table shows the performance of the leading funds in this sector over the last 26 weeks.

Our portfolios are currently invested in the Royal London Sustainable World fund, the Liontrust Sustainable Future Managed fund and the Janus Henderson Global Responsible Managed fund.

The graph shows that they were all going down at the end of last year but have more than made up for it since then.

They haven't gone up in a dead straight line, and there have been a few wobbles along the way, but, overall, they have made relatively steady progress, and few of us would complain with returns of between 10% and 15% over the last six months.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.