Three oil giants: what to do with the shares now

4th May 2022 07:54

by Rodney Hobson from interactive investor

These are some of the world's biggest companies and profits have grown further as the price of oil surges. Our overseas columnist tells us what he thinks about them.

The soaring price of crude has come to the rescue of major oil companies but several clouds hang over the sector, blotting out the favourable factors. Investors should be cautious of being overexposed to what is a potentially volatile sector.

It is a well documented fact that most of each extra dollar on the price of crude drops straight through to the bottom line of oil explorers and, with the price of crude persisting above $100 to the barrel, it is no surprise that Exxon Mobil Corp (NYSE:XOM) and Chevron Corp (NYSE:CVX) both reported higher profits in the first quarter.

Exxon doubled its income to nearly $5.5 billion compared, with the first quarter of 2021 as revenue rose by half to $90.5 billion. Earnings per share doubled to $1.28. Chevron did even better. Net profit of $6.3 billion was more than four times the $1.40 achieved 12 months earlier to give earnings per share of $3.23, up from only 72 cents, while revenue rose 70% to $54.4 billion.

A slight worry is that higher oil prices rather than higher output accounts for the improved revenue and profit figures. Exxon’s production was down 3.7% compared with the fourth quarter of 2021. Although unplanned downtime, caused by adverse weather, on top of planned maintenance accounted for some of the shortfall, output was still down an underlying 2%. Chevron’s output was also 2% lower.

- Q1 US earnings season preview

- US earnings season calendar here

- Want to buy and sell international shares? It’s easy to do. Here’s how

The price of crude has soared because the world economy has held up better than expected during and after the height of the pandemic, with consumers in many wealthier countries finding they have built up a cash pile during lockdowns that can now be splurged.

However, energy prices are already causing rampant inflation across the world and higher prices, plus rising interest rates, threaten to choke off the consumer demand that has fuelled demand for oil.

Unless production can be stepped up, any fall in the unusually high price of crude will hit the bottom line as the year progresses. On the other hand, ramping up production helps to drive down crude prices.

Another big imponderable is how long the Russian invasion of Ukraine will last and what action if any the West will pursue if Russia retains control of territory in eastern Ukraine.

Oil companies are in the forefront of the move to reduce or eliminate operations in Russia, but since that country is a major producer of oil and gas any withdrawal is likely to be cumbersome and expensive.

Exxon has set aside $3.4 billion to cover the cost of exiting its Sakhalin-1 project in the far east of Russia.

- Top 10 things you need to know about investing in the US

- Find out what is now being tipped to be the best investment of 2022

- How high could US interest rates really go?

Despite all the possible setbacks, the second quarter is set to show a further improvement, and possibly a dramatic one at that. The average price of oil and natural gas was under $80 in the US and around $90 worldwide in the January-March quarter, while it looks certain to be well clear of $100 in the three months to the end of June. That means profits will be yet higher even if production levels slip again.

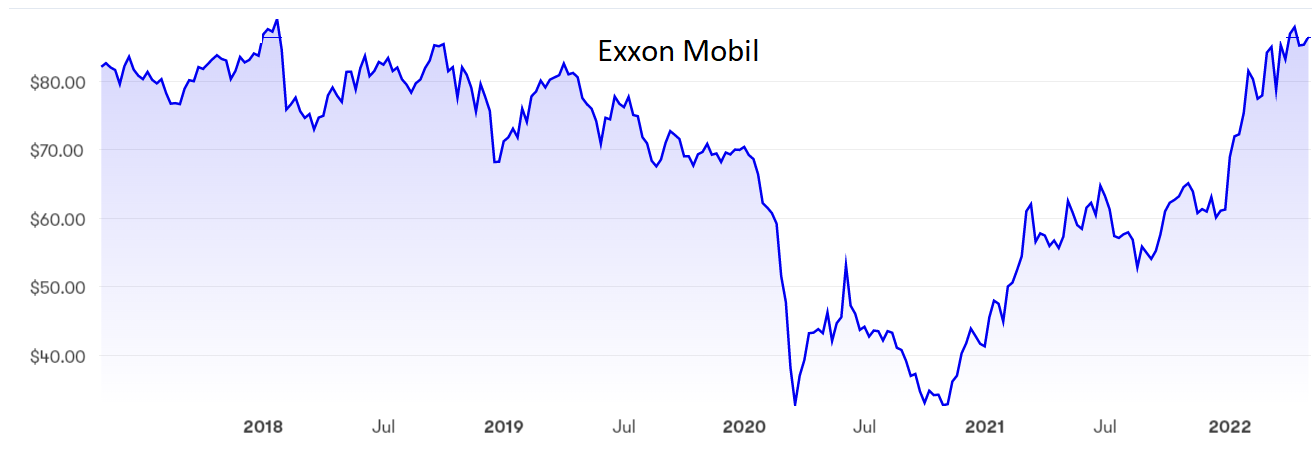

At $88, Exxon shares are back to the levels they enjoyed in early 2018, having more than doubled from the lows they hit in the pandemic-affected year of 2020.

Source: interactive investor. Past performance is not a guide to future performance.

Chevron shares have performed even more strongly, having quadrupled since March 2020 to around $160, which is well above the previous peak of $130.

Source: interactive investor. Past performance is not a guide to future performance.

Famed investor Warren Buffett has just revealed that he has been adding heavily to his stake in Chevron. Buffett has also been buying shares in Occidental Petroleum Corp (NYSE:OXY), which announces its latest figures on 10 May.

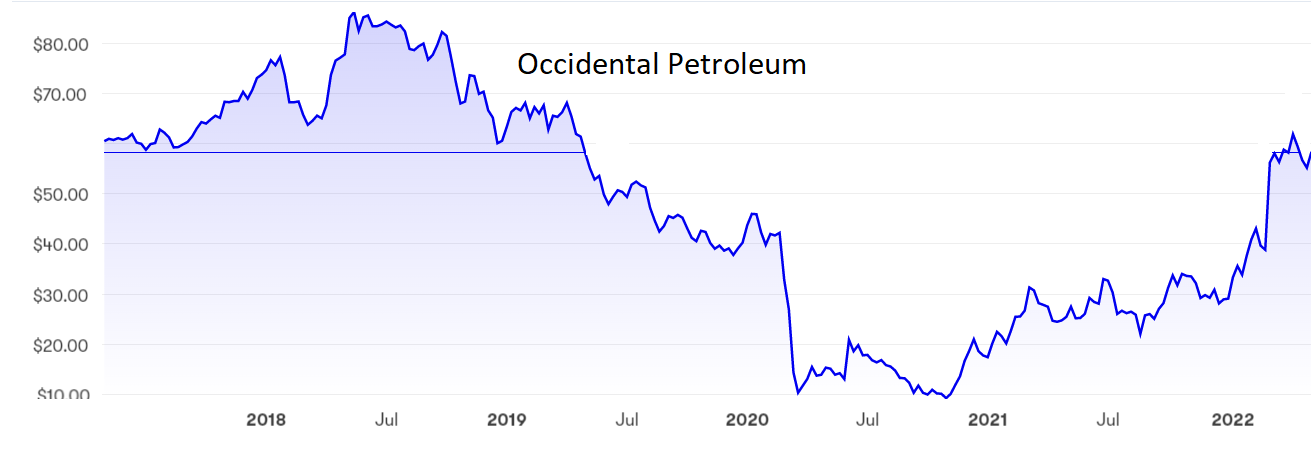

Occidental shares have proved to be rather more erratic, having soared from $10 to nearly $60 but failing to come near to the previous peak of $88.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s Choice: It’s hard to argue with the judgement of long-term investor Buffett but some caution is required. While oil shares look to be a buy now, investors who step in should be prepared to bail out if oil market dynamics turn for the worse later this year. Chevron may already be near a peak after the boost from Buffett.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.