Three top green funds delivering spectacular returns

Saltydog analyst was rewarded for his belief in these ‘sustainable’ funds. He’s keeping the faith.

10th February 2020 12:44

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst was rewarded for his belief in these ‘sustainable’ funds. He’s keeping the faith.

Holding our nerve as portfolios hit new highs

As well as providing weekly performance data on the 30-plus Investment Association sectors, and the leading Unit Trusts, OEICs, Investment Trusts and EFTs, we also run a couple of demonstration portfolios. These are a way of explaining how the Saltydog groups can be used to control the volatility within a portfolio, and also how the split between the groups would vary under different market conditions.

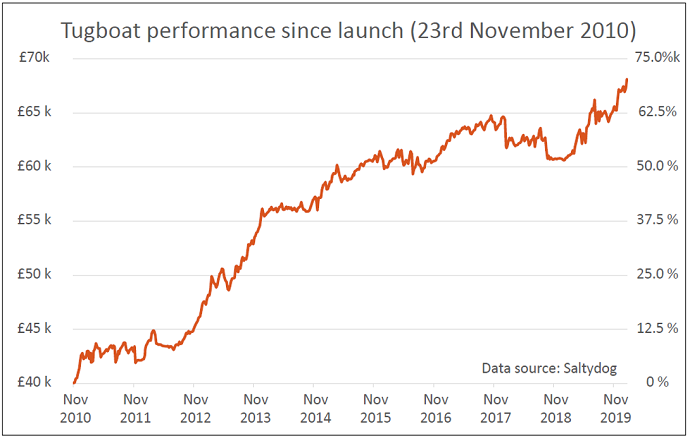

We thought it prudent to focus on the less risky end of the spectrum and so, at the end of November 2010, we launched ‘The Tugboat’ and have been reporting on it ever since. It is run using our own money through a standard fund supermarket. It’s a very cautious portfolio where avoiding falls is as important as making gains.

Three years later we launched the slightly more adventurous Ocean Liner portfolio. Once our subscribers understand the concepts involved in controlling the volatility within their own portfolios, they can then go on to develop an investment strategy suitable for their personal appetite for risk.

One of our key principles is to only invest in the more volatile funds when they are giving better returns than funds that have historically been more stable. And we also limit the overall amount that we will ever invest in the most volatile funds.

To help with this process we combine the Investment Association sectors into our own proprietary Saltydog groups which are:

- Safe Haven

- Slow Ahead

- Steady as She Goes

- Full Steam Ahead – Developed Markets

- Full Steam Ahead – Emerging Markets

The nautical names of these groups give an easily recognisable indication of the volatility of the sectors and funds which are allocated to the groups. Using the performance data, it is easy to see whether the increased risk associated with the more volatile funds is then being rewarded.

When nothing is doing particularly well, or in times of uncertainty, we will increase the cash levels within the portfolio. The last time we did this was in preparation for the General Election in December. Our main concern was what would happen to the strength of the pound. If the Labour Party won with an overall majority, we thought that sterling would weaken. A Conservative victory could see it continue to strengthen (which it did initially but it has subsequently dropped back).

To protect our portfolios, we reduced our overall exposure to the markets and increased our cash holdings. At one point, cash accounted for 60% of the Tugboat’s overall value. (It was 50% in the Ocean Liner).

Since then we’ve been reinvesting and have bought the cash down below 20% and anticipate it going lower. We have resisted the urge to make any drastic changes because of the coronavirus outbreak and, at the moment, hope to weather this particular storm.

Both portfolios did drop a couple of weeks ago but have recovered and finished last week at all-time highs. When we started the ‘Tugboat’ we invested £40,000. Since then it has gone up by 70% and is now worth over £68,000.

In the last 12 months it has risen by 11.9%.

To control the overall volatility of the portfolio, we only ever invest a maximum of 10% in funds from the most adventurous Saltydog ‘Full Steam Ahead’ groups, and 20% from the ‘Steady as She Goes’ group.

This means that the portfolio performance is heavily dependent on the funds from our ‘Slow Ahead’ group. There are three that have served us particularly well over the last year and they are all from the Mixed Investment 40-85% Shares sector.

We first went into the Liontrust Sustainable Future Managed fund on the 7th February 2019. A couple of weeks later we invested in the Janus Henderson Institutional Global Responsible Managed fund, and then on the 11th April we added the Royal London Sustainable World trust.

The graph below shows their performance since February 2019.

We reduced our holdings in these funds at the beginning of December, as part of our overall move out of the markets, but then added to them later in the month. We increased our holdings again in January and the three of them together now account for more than 40% of the portfolio.

If they perform as well over the next year as they have over the last 12 months, then we’ll be very happy.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.