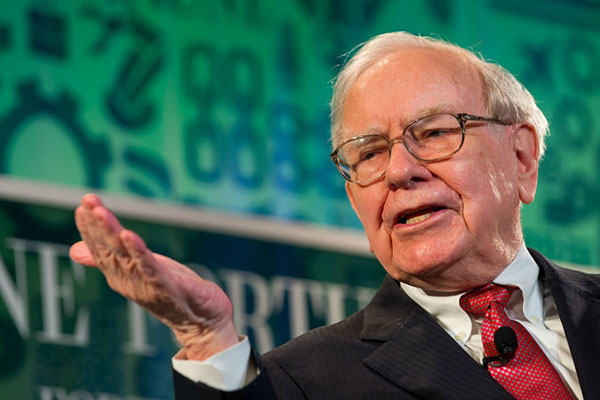

Time to buy one of Warren Buffett’s favourite stocks now?

5th October 2022 09:49

by Rodney Hobson from interactive investor

A reliable dividend and excitement ahead of third-quarter results season, analyst Rodney Hobson analyses an iconic company owned by star investor Buffett for more than 30 years.

It is always a bit of a risk buying stocks ahead of a quarterly trading update as you never know if a nasty shock lies in store. The other side of the coin, though, is that if all is well, then the shares could surge as soon as the good news is out. One stock worth looking at ahead of the third-quarter results season in the US is Coca-Cola Co (NYSE:KO).

There is no denying that the fizzy drinks maker’s second-quarter figures, issued in July, were disappointing. While revenue soared 28% to $4.83 billion, net income slumped by a similar percentage to $1.9 billion and earnings per share similarly fell to 44 cents, as operating margins were squeezed sharply from 29.8% a year earlier to 20.7%.

- Discover more: Buy international shares | Interactive investor Offers | Most-traded US stocks

The company admitted that some of the sales growth had come at the expense of profit margins, with higher operating costs and supply chain issues not being passed on in the form of higher prices. Spending on marketing had been stepped up, and the strength of the US currency meant profits made overseas translated into 9% fewer dollars.

More revenue is generated internationally than in the US, with countries such as Mexico, Brazil and Japan being key markets, so foreign exchange movements are important.

However, in July Coca-Cola actually upgraded its revenue and profit forecasts for the full year, suggesting that organic revenue growth would come in at 12-13% compared with previous guidance of 7-8%, and earnings per share would hit 14-15% rather than 8-10%.

- Is the US a land of opportunity for trust investors?

- 10 UK shares that Warren Buffett might buy

- Is this heroic US share a buy?

Despite the strengths of its brands, which include not just the eponymous cola but also the equally famous Sprite, Costa Coffee and Fanta names, Coca-Cola is not immune to the macroeconomic picture. For a start, the strength of the dollar has continued into the third quarter.

Source: interactive investor Past performance is not a guide to future performance

Coca-Cola is the largest beverages supplier in the world. It concentrates on making the ingredients and leaving bottling and distribution to local companies that know their markets. It has plenty of plans to protect and develop its leading position.

It says it has a 14% market share in developed countries but only about 6% in emerging markets, which already account for 80% of sales. There is clearly much scope for higher sales and ultimately higher profits.

Twice this year the shares stalled at $65 and that could well remain a ceiling during these turbulent times. They currently stand at $57, still well above the pandemic low of $38 in March 2020. The price/earnings ratio of 25.5, although higher than for most consumer goods stocks at the moment, is not too demanding for a company of this quality.

- Threat to America as top central banker promises to get the job done

- Best chance to buy this software giant’s shares?

The yield of 3.1%, better than most American companies, is sufficiently attractive, especially as the dividend has been raised for 60 consecutive years, even when sales were under pressure during the pandemic or in times of financial crisis. The company also intends to buy back $500 million worth of shares during this year.

Fabled investor Warren Buffett owns 400 million shares through his Berkshire Hathaway (NYSE:BRK.B) investment company. That is nearly 10% of the whole company. He has built the stake up since 1988 and clearly sees the long-term value of this iconic company.

Hobson’s choice: I suggested buying the shares around $48 in May 2019 and it has proved a roller-coaster ride for investors who followed that advice at the time. I could not have foreseen the pandemic, although the dividends have been a comfort during stock market turbulence. I repeated the buy advice at just below $40 in March 2020 and, despite a subsequent low of $38, the shares are now clearly, if not spectacularly, ahead of both tip prices and are still worth buying.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.