Time to buy the world's biggest housebuilders?

It began the financial crisis, but our commentator, author and columnist sees potential in this sector.

13th March 2019 11:08

by Rodney Hobson from interactive investor

It began the financial crisis, but our commentator, author and columnist sees potential in this sector.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Investors hardly need reminding that the global financial crisis of 2008 began in the American housing market, where lenders doled out mortgages to homebuyers who never had any hope of repaying. The outcome was not only a disaster for the banks, it left the US housebuilders devastated as homes were repossessed and new buyers dried up.

There have been, however, solid signs over the past five years of the US housing market getting back to normal, and the evidence can be seen this side of the Atlantic through a company quoted on the London Stock Exchange.

Plant hire group Ashtead (LSE:AHT) this month reported continued strong growth for its Sunbelt US arm, with higher revenue and operating profits over the past nine months. Ashtead continues to seek bolt-on acquisitions there.

It is worth looking at successful companies in any sector listed over here in case the success is replicated elsewhere, and several companies listed on the New York Stock Exchange offer a more direct route into the US housing market. Prefer companies with operations in a wide spread of states, as the sector can vary enormously in different parts of such a large country.

There are, admittedly, new clouds over the US housing market, where prices kept falling for four years until they hit the bottom. Since 2012 they have risen by more than 50%. The US was first among Western countries to adopt quantitative easing (QE) and the first to recover economically.

With annual GDP growth little short of 3% it is still the healthiest economy among developed nations. Fracking has added to its oil and gas production and President Trump's financial stimulus package has provided an additional, though possibly short term, boost. Some of the worst affected parts of the country, where house repossessions and mortgage arrears were most acute, are benefitting from Trump's tariff walls.

Last year, however, concerns started to grow as the Federal Reserve Bank lifted interest rates four times, pushing the cost of new mortgages higher and deterring new buyers from taking the plunge.

At the same time, minds began to focus on the need one day to unwind the mountain of cash tied up in the QE programme. House prices had recovered to the point that homes were becoming less affordable, putting off young buyers.

Rising interest rates have not yet hit the US housing market hard and mortgage holders will get some respite from the central bank's indication that the ramping up of rates will proceed more cautiously than previously expected. Rather more worrying is that the number of US homes sold fell to a three-year low in December, according to data from the National Association of Realtors.

A major factor is whether higher construction costs will prevent builders from cutting prices to lure buyers at the bottom end of the market, but experts suggest that the more cautious approach to rate rises will attract back homebuyers in the crucial spring selling season that is just beginning.

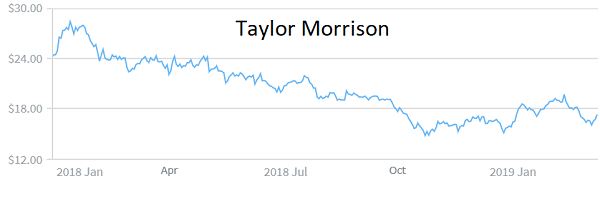

Shares in the sector slipped throughout 2018 but have picked up a little on hopes that the experts are right.

Taylor Morrison Home Corporation (NYSE:TMHC) is based in Arizona and operates under two well-known brands, Taylor Morrison and Darling Homes. It has a good mix of developments from first-time homes to luxury.

At $17.50, the shares are only $2.50 off the recent low, but $11 below the start of last year.

KB Home (NYSE:KBH) and Lennar (NYSE:LEN) have recovered further from last year's dips but at least they pay a dividend, albeit with tiny yields.

Dallas-based D.R. Horton (NYSE:DHI) has bounced back furthest but it still offers the best yield and the price/earnings (PE) multiple is an undemanding 10 times.

Hobson's Choice: Horton looks the best in the sector but don't go much above $42 at this stage. Consider Taylor Morrison below $18. KB Home and Lennar are worth looking at if they slip back from current levels of $24 and $48.50 respectively.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.