Is today’s massive jump in some share prices a sucker’s rally?

Pub chain Marston’s is up as much as 45%, M&S over 15%, and other stocks over 60%. Here’s why.

18th March 2020 12:57

by Graeme Evans from interactive investor

Pub chain Marston’s is up as much as 45%, M&S over 15%, and other stocks over 60%. Here’s why.

Emergency aid for the coronavirus-hit hospitality, leisure or retail industries was today welcomed by some of the listed companies facing a near wipe-out in trade.

Among the most significant of £350 billion worth of measures unveiled last night by Chancellor Rishi Sunak was a business rates holiday covering the 2020/21 financial year.

Pub chain Marston's (LSE:MARS) said this was good progress towards the “very significant commitment” needed from the Government as the hospitality sector braces itself for several months of reduced social activity.

Rival Mitchells & Butlers (LSE:MAB) is also encouraged by access to a credit guarantee facility worth up to £330 billion — equivalent to 15% of GDP — in loans to businesses. The owner of Harvester, All Bar One and Nicholson's said this should underpin its future performance and liquidity.

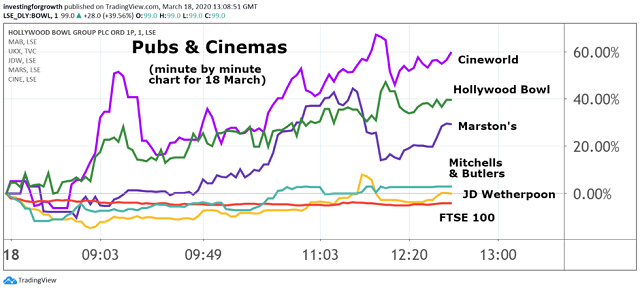

Source: TradingView Past performance is not a guide to future performance

Revolution Bars, which has 74 premium bars, also welcomed the Government support but said more was needed in the coming days to provide assistance with payroll entitlements to “gain surety for our employees”.

In the retail sector, Superdry (LSE:SDRY) backed the approach but added it was futile to give guidance on 2020 trading. In the case of supermarket Sainsbury's (LSE:SBRY), the business rates holiday will result in a saving of about £567 million, based on figures for the 2018/2019 financial year.

Business rates are a significant overhead for the majority of hospitality businesses in the UK, and usually amount to around half their rental bill if they have a fully leased estate.

Analysts at Morgan Stanley point out that Mitchells & Butlers' rates bill will be around £100 million, which is about half of 2019 profits. For Premier Inn owner Whitbread (LSE:WTB), the bank estimates a £120 million bill the equivalent to 35% of February 2020 profits.

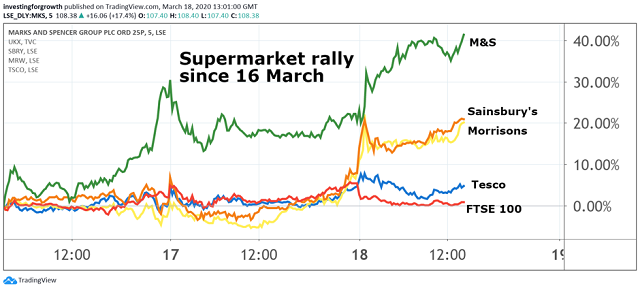

The Chancellor's measures helped shore up several UK-focused stocks despite another session of heavy losses for the FTSE 100 index and FTSE 250 index. Significant risers included B&Q owner Kingfisher (LSE:KGF), with a gain of 5%, while Sainsbury's and Morrisons added more than 12%.

The supermarket sector has been one of the most resilient during the stock market carnage, with Morrison's (LSE:MRW) shares now higher than when the sell-off started on 20 February. In the FTSE All-Share, McColl's Retail (LSE:MCLS) lifted 27% and bashed-up M&S (LSE:MKS) is now up more than 17% at lunchtime Wednesday!

Source: TradingView Past performance is not a guide to future performance

Shares in restaurants and bars, meanwhile, are as much as 80% lower since the stock slide started in mid-February. Restaurant Group (LSE:RTN), which has over 650 outlets trading as Frankie & Benny's, Wagamama or Chiquito, has been one of the worst-affected stocks.

Based on its assumption for a 10-week shutdown, the group today forecast a 45% slump in like-for-like sales in the six months to June 28, with a 5% fall over the rest of the financial year. It is taking a series of measures to mitigate the trading slump, and said it would be looking for its 2020 rent roll to reflect the “unique and unforeseeable situation”, with a 50% cut in fixed rent.

In its update, Mitchells & Butlers declined to provide detailed guidance based on the likelihood that social curbs will mean a significant downturn in sales. It is protecting cash flows by suspending capital spending and reducing costs across the business.

The chain remains confident that it will pass its next debt covenant test at the April half-year stage, even if it suffers a significant loss over the next four weeks. It has debt service commitments of around £200 million a year and agreed pension contributions of £48 million.

Mitchells was one of the sector's best performing stocks last year, fuelled by takeover speculation. Its shares recovered from a weak start this morning to climb 3% to 144p, compared with 456p at the start of 2020.

Marston's shares also displayed significant volatility, with the pub operator and brewer of ales including Pedigree, Wainwright and Hobgoblin subsequently up 29% at 28.67p. The sudden mid-morning acceleration came despite the company saying it was unlikely to pay an interim dividend in order to retain £20 million within the business.

The chain benefits from having a 93% freehold estate, alongside sufficient liquidity to maintain operations at a materially reduced level of business. It is also in talks with lenders about the provision of covenant waivers should these be required.

The company said in a statement: “We are taking an extremely prudent approach and being cautious in our management of the business during this period of unprecedented uncertainty.”

JD Wetherspoon (LSE:JDW) is due to provide an update on its position alongside interim results on Friday. However, chairman Tim Martin has already criticised the UK approach on social curbs. He said yesterday that the Dutch position of admitting that most people will get the virus, while protecting the elderly and sick, was the best path for the UK.

Martin added: "The difference in keeping the hospitality industry open, even with reduced sales, is colossal. The industry contributes £120 billion a year of tax and six million jobs. Wetherspoon alone contributes £2 million a day of tax.

"Lockdown delays the inevitable and destroys the tax base at the same time, which will cripple the NHS and the economy.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.