Top sector of 2019 and how these four funds performed

Saltydog analyst updates on his autumn fund purchases and reveals how sectors did last year.

13th January 2020 13:28

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst updates on his autumn fund purchases and reveals how sectors did last year.

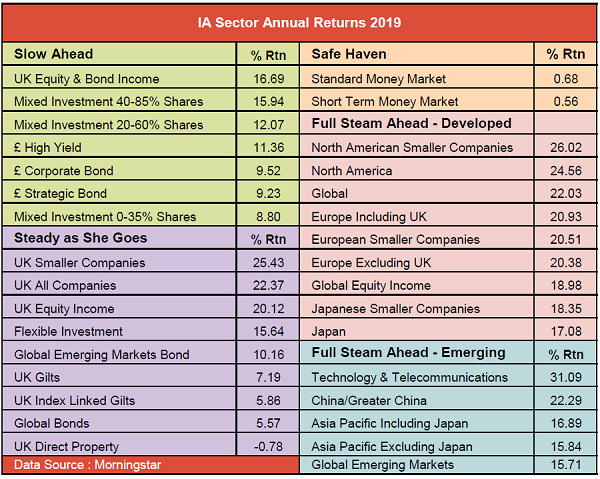

After a disappointing 2018, when the majority of the Investment Association sectors recorded losses, last year was much kinder to UK investors.

In 2018, the only sectors that went up were the Money Markets, UK Direct Property, Global Bonds, and Technology & Telecommunications. The sector showing the largest loss, European Smaller Companies, fell by more than 15%.

Last year, the only sector that went down was UK Direct Property, which dropped 0.8%, and the best performing sector, Technology and Telecommunications, gained just over 31%.

Each week at Saltydog Investor we review the performance of thousands of Unit Trusts, OEICs, ETFs and Investment Trusts.

We split them into their Investment Association sectors, so that we can track the individual sector performance, and then combine them to form our own proprietary Saltydog groups.

The four Saltydog groups are:

Safe Haven

These are the least volatile funds and can be found in the two money market sectors. Last year the sector returns were 0.7% for the Standard Money Market and 0.6% for the Short Term Money Market.

Slow Ahead

This group is made up of sectors that either invest in bonds, or a combination of bonds and equities. They can go down, as well as up, but tend to be less volatile than the funds which focus just on equities.

All of the sectors went down in 2018. The worst - UK Equity & Bond Income - lost over 7%.

In 2019, the situation was reversed. All sectors went up and the UK Equity & Bond Income sector gained over 16%.

Steady as She Goes

The sectors in this group have been more volatile in the past, but not as volatile as funds in the ‘Full Steam Ahead’ groups.

In 2018, the best performing sector - UK Direct Property - went up by 2.9%, but the worst - UK Smaller Companies - lost nearly 12%.

Last year, most sectors made gains. The only exception was UK Direct Property. All of the other sectors in this group went up by at least 5%, and the best - UK Smaller Companies - went up by more than 25%.

Full Steam Ahead

These are the most volatile sectors which we split into two groups - Developed Markets and Emerging Markets.

In 2018, most of the sectors made losses. Half of them went down by 10%, or more, and one lost 15%.

Last year, all of the sectors in this group went up. The worst - Global Emerging Markets - went up by nearly 16%, and the best - Technology and Telecommunications - made more than 31%.

When we put together our portfolios we like to have a balance between the more volatile funds, which could be more rewarding when everything is going up, and the less volatile funds, which may give adequate returns but should suffer less in a downturn.

At the beginning of last year, it was the Global, North American and Technology sectors that were doing the best. However, in the final quarter of 2019, the UK Equity Income, UK All Companies, and UK Smaller Companies sectors started to overtake them. This is reflected in our demonstration portfolios.

During September and October, we invested in the Franklin UK Mid Cap, Franklin UK Smaller Companies, Allianz UK Opportunities and Artemis UK Smaller Companies. They are currently showing gains varying between 7% and 11%, although they have dropped back a bit in the last couple of weeks.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.