Treatt is a great company, but is it a ‘buy’?

This flavour and fragrance manufacturer meets our companies analyst’s definition of a good company.

8th January 2020 13:32

by Richard Beddard from interactive investor

This flavour and fragrance manufacturer meets our companies analyst’s definition of a good company.

Happy New Year!

Treatt (LSE:TET) most recent financial year ending September 2019 may have tested investors’ resolve. The current financial year probably will too, but for different reasons. I think the long-term growth story is intact though.

The great orange oil bust

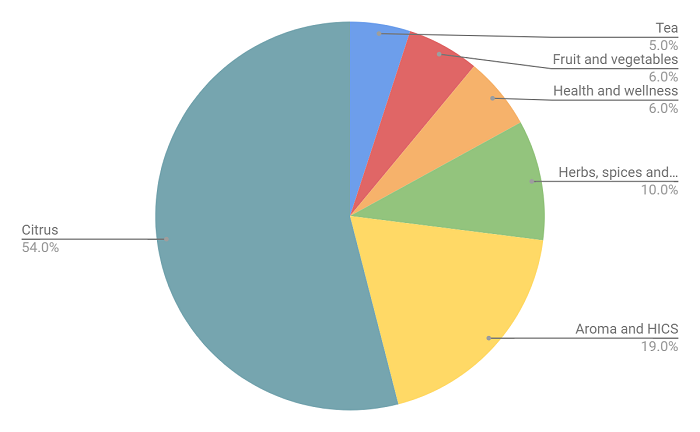

First off, 2019. The price of orange oil, a commodity responsible for a third of Treatt’s revenue, collapsed by 50% due to a bumper orange crop in Brazil. It was, the company says, one of the sharpest falls ever recorded, quite something when you consider Treatt has a 130-year history.

The impact on revenue and profit was muted in comparison to previous declines in citrus oil prices, though, because Treatt is less dependent on essential oils. It has developed new ingredients for tea flavoured and reduced sugar beverages, for example. These categories grew strongly in 2019.

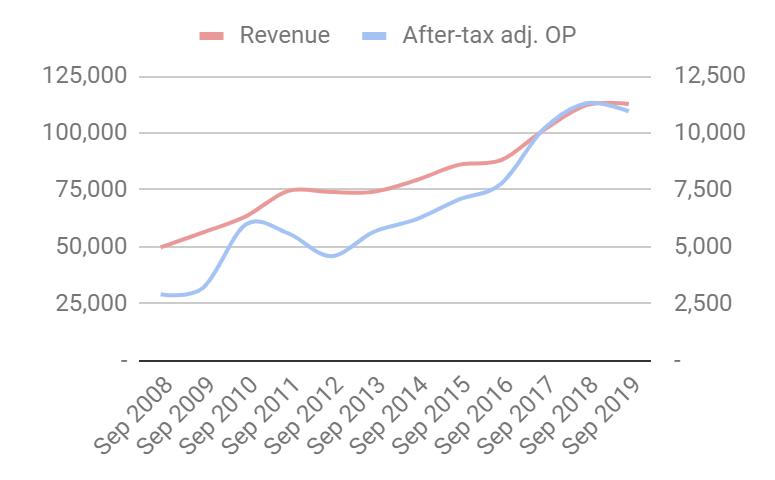

Overall, revenue was flat, and adjusted operating profit declined 3%. If that’s a bad year, Treatt passed the test convincingly, and though it didn’t grow, over the last eight years it has achieved a compound annual growth rate of 11% in adjusted profit and it has credible long-term prospects.

The growth story is not only important because that’s what investors want. It’s also the reason Treatt is about to make a huge investment. Having completed the $15 million expansion of its US facility in Florida, Treatt is building a new headquarters in Bury St Edmunds, which it plans to move into late in 2020. The current HQ is not just out of date, it also reflects Treatt’s heritage as a bulk processor of commodity citrus oils, although it has a laboratory tacked onto it.

The new facility, Treatt says, will be science-led allowing Treatt’s flavourists to collaborate with customers in the creation of more novel flavours commanding higher profit margins and further reducing Treatt’s sensitivitiy to citrus oil prices.

Investment risk

The total capital cost of the building project is expected to be £33 million, about three times adjusted after tax profit in 2019. The company will spend a further £5 million on expenses; design costs, running its existing facility in parallel with the new one while it is being commissioned, additional staffing and the procurement and installation of equipment.

Treatt’s cash flow is erratic because it buys stock strategically, so forecasting the company’s financial position once the move is complete is difficult, but the £21 million it raised from investors by selling new shares is unlikely to cover it, and the company will probably end 2020 with more debt than cash. How much will depend on how the company performs, and whether it overspends. It claims not to have overspent on the Florida facility.

- UK share tips: Six ‘value’ stocks for 2020

- Six portfolio failures and four lessons for long-term investors

- Like AIM and small-company shares? Check out ii’s Super 60 recommended funds

Perhaps unsurprisingly, Treatt is straining to conserve cash having increased the dividend by less than the amount prescribed by its dividend policy and taken the option of supplier financing offered by its customers. This arrangement means Treatt is paid more quickly, but at a cost. Treatt says the price is often less than the cost of borrowing, which is how it would finance its receivables otherwise, so it is probably good business. Quick payment also improves cash flow, which helps explain why Treatt earned record cash flow in 2019.

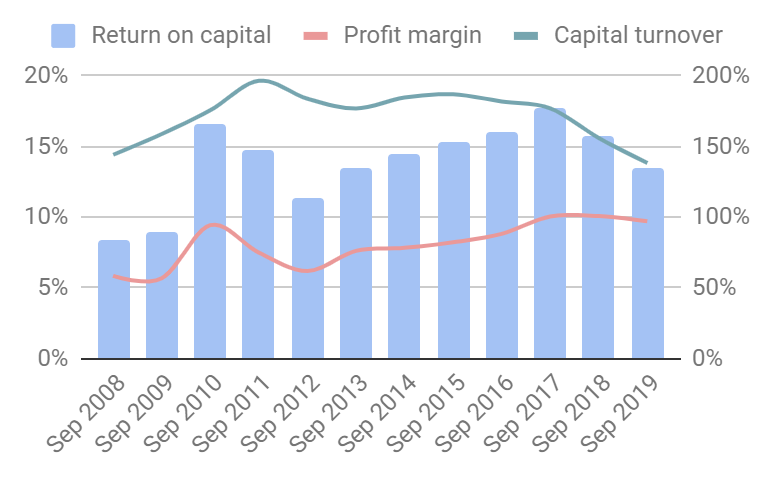

I think the debt will be manageable. A fall in return on capital is already evident (from 16% to 13%) due mostly to capital investment in the US plant and the first spending on the new UK HQ. Since the company will not have the benefit of the new HQ in the current financial year, but will bear much of the cost of building it, return on capital is likely to suffer in 2020 too.

Once the HQ has been up and running for three years, Treatt says efficiencies alone should enable a 10 to 15% improvement in profitability. It should improve further as the company sells more high-margin proprietary flavours.

Competition concern

But supplier financing raises the question of Treatt’s competitive position. Last year the company incurred additional costs because some of its larger suppliers increased their payment terms, so Treatt’s customers have clout. The most significant are much larger businesses. Traditionally, it has supplied multinational flavour houses, intermediaries between bulk suppliers like Treatt was and end customers, brands of drinks, perfumes and cleaning products. Increasingly, Treatt is targeting multinational brands directly, particularly beverage companies, some of which are goliaths like Coca Cola and Pepsi.

Developing novel ingredients is more profitable, but it is also required to maintain Treatt’s relevance. Thanks to the Internet, it is much easier for Treatt’s customers to source raw materials themselves than it used to be, and some of them have developed processing capabilities. Treatt needs to provide them with ingredients they can’t manufacture themselves.

People power

Treatt’s not so secret weapon in this competitive market, may well be its people. Chief executive Daemmon Reeve has fostered a collaborative culture, which he expects to flourish in the new headquarters. The list of initiatives to reward staff financially with free shares and incentives to buy shares, and in kind through health schemes and wellness initiatives is long. Reeve himself worked his way up through the business and Treatt says 70% of new vacancies are filled by internal candidates it has trained up.

- Stockwatch: An all-time price low and 9.6% dividend yield

- Which FTSE 100 stocks returned over 3,000% last decade?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The number one risk in the risk report is the poaching of key staff, and three of the company’s six strategic planks relate directly to staff empowerment; “investing in our culture”, “engaging with our communities”, and “reducing our environmental impact”. The others are investment in existing and new product categories, like coffee flavours in 2019, and investing in the infrastructure required for future growth.

We do need to keep an eye on the extent of executive pay, but I expect shareholders to benefit along with staff and customers.

Does Treatt make good money?

It does, helped by the development of specialist ingredients, but it hasn’t always been this profitable, and cash flows are volatile. It wasn’t able to fund its own expansion without raising money from investors.

Score: 1

What could prevent it from growing profitably?

Cost overruns in the short-run and competitors in the long run.

Score: 1

How will it overcome these challenges?

It will use its proprietary knowledge to develop a broader range of specialist flavours for customers.

Score: 2

Will we all benefit?

We should do. Treatt is demonstrating how an employee-first culture can serve customers better.

Score: 2

Are the shares cheap?

No. A share price of 450p values the enterprise at £470 million, about 24 times adjusted profit.

Score: -0.4

Treatt meets my definition of a good company (it scores six or more on the first four criteria all relating to the quality of the business), but a high valuation and short-term uncertainties detract somewhat from the investment appeal. Although the shares are probably a good long-term investment a total score of 5.6 ranks it 27th out of the 30 good companies in my Decision Engine.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.