Which FTSE 100 stocks returned over 3,000% last decade?

The main index is much changed, but plenty of stocks generated massive returns for patient investors.

2nd January 2020 10:57

by Graeme Evans from interactive investor

The main index is much changed, but plenty of stocks generated massive returns for patient investors.

A lot has changed over the past 10 years, especially in terms of share prices and the make-up of the blue-chip index. It means picking winners since 2009 excludes lots of big-name stocks you’ll all remember.

Cast your mind back to early 2010 when Cadbury was taken over by Kraft Foods, and chip designer ARM Holdings replaced the chocolatier in the FTSE 100. Six years later ARM was taken over by Japan’s SoftBank.

Invensys lost its place in the FTSE 100 before being taken over by France's Schneider Electric in 2013, while Autonomy had been bought by Hewlett Packard two years earlier.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

After being booted out of the FTSE 100 index after the financial crisis, housebuilders like Barratt Developments (LSE:BDEV) and Persimmon (LSE:PSN) regained their places at the top table and have flourished, despite the EU referendum slump.

While the current crop of FTSE 100 constituents may not have called the main index home for all of the past decade, an analysis of their performance gives a great insight into how companies can turn from acorn to oak and deliver patient shareholders spectacular returns.

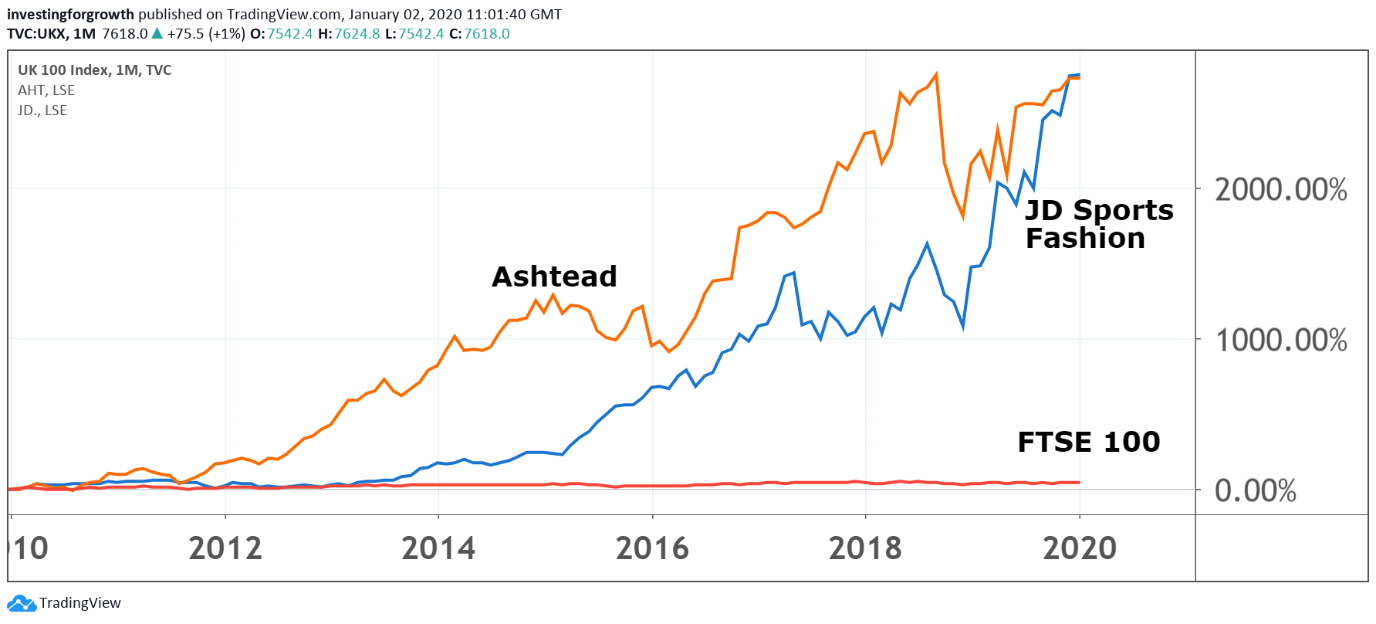

Source: TradingView Past performance is not a guide to future performance

Best of the best

JD Sports Fashion (LSE:JD.) and Ashtead (LSE:AHT) represent the stock market buys of the decade after returns of 3,220% and 2,870% eclipsed the performance of a clutch of high-yielding housebuilding stocks.

The pair's remarkable rise since 2010 highlights some of the riches available to longer-term investors who were prepared to “buy and hold” after the financial crisis. Their patience has been rewarded with a decade-long bull market in which ultra-low interest rates and other stimulus measures have boosted corporate coffers and led to record shareholder returns.

Nowhere are these forces more noticeable than in the housebuilding sector after the UK government supported home ownership through schemes such as Help to Buy.

- 10-year market round-up: When equities were king

- You can also invest in UK equities via ii’s Super 60 recommended funds. Click here to find out more

The initiative for first-time buyers, which was launched in 2013, buoyed house prices and helped to transform company profit margins over the decade, with the resulting build-up of surplus capital benefiting shareholders in the form of annual and special dividends.

This has led to some eye-watering dividend yields, with Taylor Wimpey (LSE:TW.) starting 2019 with a forecast yield of 13% based on its promise for a one-off dividend of £350 million. Low interest rates and few problems surrounding mortgage availability are among other factors why this cyclical sector has dominated the decade for FTSE 100 index stocks.

Barratt Developments and Berkeley Group (LSE:BKG) lead the way with total returns of more than 600% when including dividend reinvestment. Persimmon is up by a similar level, having made a long-term commitment in 2012 to deliver £1.9 billion or £6.20 per share of surplus capital to shareholders over 10 years to 2021, which was similar to the market capitalisation at the time.

The total value of the plan has subsequently risen to £13 per share, despite the company also having to address well-publicised operational difficulties. Other beneficiaries of the Help to Buy boom include property portal Rightmove (LSE:RMV), whose shares have rocketed by more than 1,100% over the past decade.

That performance is small change compared with retailer JD Sports Fashion and plant hire business Ashtead, whose total returns for the decade amount to 3,270% and 3,080% respectively.

Source: TradingView Past performance is not a guide to future performance

JD's shares have accelerated in spectacular fashion since 2015, with this year's 140% rise aided by the recent transformational deal to acquire Finish Line in the United States for £400 million.

With around 20% of sales now coming from the US, investors are clearly excited by the potential rewards from the other side of the Atlantic, even though this is a notoriously difficult market for UK retailers to crack. In the meantime, JD continues to show it has the formula for success in its domestic market after reporting further strong like-for-like sales growth.

- These indices can rally in 2020, but will FTSE 100 top 8,000?

- Like AIM and small-company shares? Check out ii’s Super 60 recommended funds

JD's underlying profits have risen over the decade from £67.4 million to £355.2 million for 2019. Revenues of £4.7 billion from 2,420 stores worldwide achieved this year compare with £769.8 million from 523 stores 10 years ago.

JD's strong record of cash generation means it should be well placed to fund further expansion opportunities, even if this tends to be at the expense of dividend growth.

Like JD, Ashtead is a mainstay of the interactive investor Aggressive Winter Portfolio after achieving average returns between the months of November and April of 30% and more over the past decade. Ashtead's progress owes much to its Sunbelt division in the United States, which accounts for around 87% of its revenues.

As well as benefiting from an industry shift from ownership towards the rental model, Ashtead has capitalised on opportunities presented by a highly fragmented US market and the impetus from President Trump's infrastructure spending plan.

Our head of markets Richard Hunter thinks Ashtead should remain a market favourite in 2020, with the general view of the shares as a ‘strong buy’ likely to hold firm based on a price/earnings (PE) multiple still below 15 times.

Tech conglomerate Halma (LSE:HLMA) is another popular stock for retail investors, with its record of growing its dividend by 5% or more for 40 years in a row the very definition of stock market consistency. Its shares are up 771% over the decade, or 822% including dividends.

Economic conditions have certainly been helpful for Halma, whose portfolio of subsidiaries makes products that sit inside the systems of world leading equipment manufacturers.

This structure enables Halma to easily integrate new acquisitions as well as to merge or sell businesses should the longer-term market potential change adversely, ensuring that it can grow rapidly without becoming too complex. The shares are not cheap with a forward PE of 38 times, but similar valuation worries in the past haven't stopped progress.

Halma entered the FTSE 100 in 2018, joining other recent new entrants such as Spirax-Sarco Engineering (LSE:SPX), Melrose Industries (LSE:MRO) and Croda International (LSE:CRDA) at the top of the past decade's risers board.

London Stock Exchange is one of the more established names near the top of the list, with shares up 91% this year and 1,070% over the past decade amid further progress in its ambition to become a global financial markets infrastructure leader.

The ultra-low interest rate environment has offered a supportive backdrop by pushing investors away from cash and into other assets. The explosion of data across all sectors of society and including financial services also appears favourable.

Other familiar names on the list of FTSE 100 risers for the past decade include catering company Compass (LSE:CPG), whose shares are up 284%, or 353% when including the reinvestment of dividends, and financial services firm Legal & General (LSE:LGEN) after a rise of 276%, or a total return of 408%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.