Trifast: Continuous improvement adds up

13th July 2018 13:17

by Richard Beddard from interactive investor

Since Trifast's board was pushed out by shareholders in 2009, the company has changed, writes analyst Richard Beddard, and for the better.

Trifast manufactures fasteners and other category 'C' components, small, inexpensive, easily overlooked bits of car dashboards, washing machines, and telecommunications equipment that are nevertheless important in terms of weight, reliability and ease of assembly. We're talking nuts, bolts, rivets, screws, washers and miscellaneous plastic bits 'n pieces.

Heavily dependent on telecommunications equipment, Trifast suffered a big reversal when manufacturers and distributors destocked during the dot.com crash almost 20 years ago. During thefinancial crisis almost 10 years ago, profits plunged again. Shareholders who believe history repeats itself will probably be getting nervous about Trifast's next crisis.

I can't tell you when that will be, but I have an opinion on whether Trifast is a more resilient businesses now, and whether its worth considering as a long-term investment.

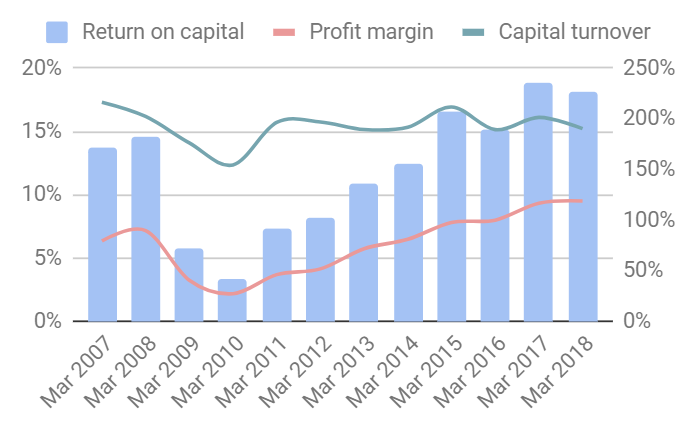

First up, a familiar chart:

Source: interactive investor

Return on capital slumped to very low levels in the financial crisis and took some years to recover. For the last four years though, Trifast has not only been highly profitable, it has been more profitable than it was immediately before the financial crisis. The increase in profit margins to 10% (after tax) is particularly welcome as it implies Trifast could endure a bigger fall in revenue than in the past, and still profit.

Reading the annual reports, it seems Trifast's improved performance can be attributed to three factors: nearly a decade of growth in manufacturing, Trifast's changing shape and a flourishing self-reliant culture.

Manufacturing, particularly large capital items like vehicles and home appliances, is tied to the economic cycle, and so some reduction in profitability during recessions is inevitable. But Trifast did not lose money during the financial crisis and perhaps next time round it will perform better.

Changing shape

Trifast is changing shape, partly through acquisition. In three consecutive years from 2013 it acquired PSEP, VIC and Kuhlmann, and after a brief hiatus it bought PTS earlier this year. PSEP, a Malaysian company, supplies automotive, home appliance and air conditioning equipment manufacturers. VIC, an Italian business, supplies many European appliance manufacturers, including Indesit, Whirlpool, Electrolux, and Bosch and Siemens. Kuhlmann is a German distributor, and PTS, Trifast's newest acquisition, distributes stainless steel fastenings in the UK.

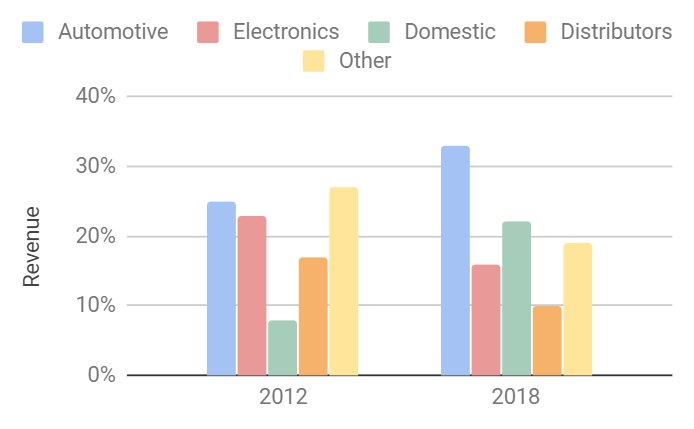

Comparing 2012 to 2018, Trifast has become more dependent on motor manufacturers and less dependent on electronics. Meanwhile, the acquisition of VIC particularly has grown its home appliance business. Since all of these markets can be capricious, the shift in emphasis has not necessarily made Trifast more stable.

Source: interactive investor

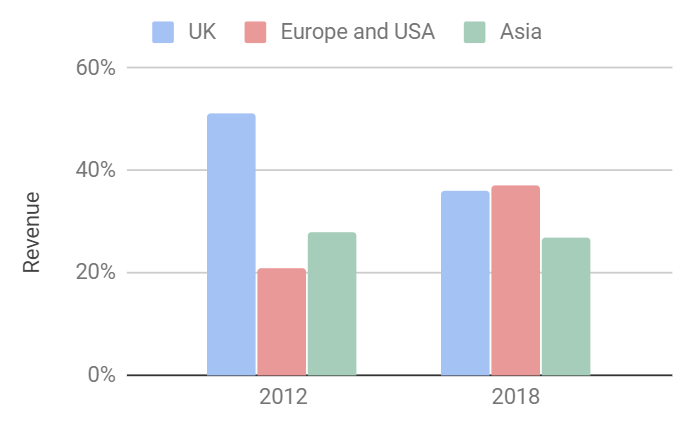

A more even geographical balance may have strengthened the business though. After the financial crisis, Trifast still earned the majority of revenue in the UK, but now revenue is quite evenly split between the UK, Europe and Asia (revenue from the USA is modest):

Source: interactive investor

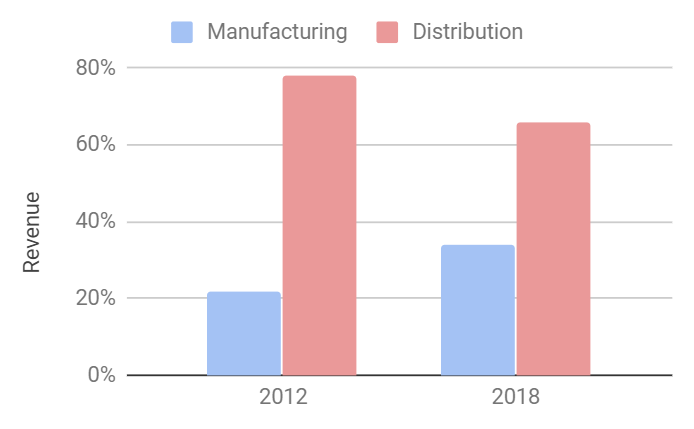

A bigger proportion of revenue from manufacturing could also go some way to explaining Trifast's improved performance. The company tends to manufacture more complex fasteners, which ought to earn it the biggest profit margins. Trifast says 75% of revenues come from bespoke, branded, or licensed products.

Source: interactive investor

Changing Culture

Underlying and perhaps powering these changes are countless operational tweaks, a process of "continuous improvement" adopted by the company after the financial crisis. The latest initiative is more than a tweak. It is an IT system costing a year’s profit and promising to make the most efficient use of each person and machine in the company’s factories, warehouses, and sales offices dispersed around the world.

Nearly every section in the annual report starts with a homage to Trifast’s staff. Trifast’s first strategic pillar is "Investing in our People". The four-page section explaining its training programmes profiles two employees promoted in the year: Maddy Webb, director of quality, she joined Trifast in 2000, and Ping Siong Tong, general manager of PSEP. He joined PSEP from college in 1988.

The board is ancient. Chairman Malcolm Diamond, who has 43 years service and 18 as chief executive, was re-appointed in 2009 to turn the company around. He promoted Mark Belton (an employee since 1999) as finance director and Glenda Roberts, an employee since 1990, to sales director. Belton is now chief executive. Remarkably, more than 50% of Trifast's 1,300 employees have been with the company for a decade or more. I conclude Trifast looks after its staff, so they look after its customers.

Though it is tempting to believe staff might be a little too comfortable and the company set in its ways, I'm slowly beginning to believe the opposite. That the institutional memory of past crises is motivating continuous improvement, and the changes will ameliorate future crises.

Changing times

There's another reason to believe Trifast might perform better in future than it did during past crises. It was close to the epicentre of the dot.com bust because of its heavy dependence on electronics. The company diversified, subsequently, but that didn't protect it much during the global financial crisis because the UK was hit particularly hard, management had lost its way, and the EU had introduced dramatic anti-dumping duties on components from China. Trifast, along with its competitors ramped up imports prior to the duty coming into force, only to find their customers didn't want the fasteners.

The next crisis will not replicate the last one, but Trifast seems better positioned now. It is better managed, less dependent on the UK, and although we face the palpable reality of increased tariffs and trade barriers due to Brexit, Trifast already has manufacturing and distribution businesses based in other EU member states.

Scoring Trifast

As usual, I'm scoring Trifast to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 1

Over the last 12 years, Trifast has earned an average return on capital of 12%. Cash flow has been strong too, averaging about 80% of adjusted profit over the same period. However between 2009 and 2011 return on capital was below 8%, a level that if sustained for longer, would lead me to question the viability of the business.

Adaptable: How will it make more money?

Score: 2

Trifast has adapted to two crises and come out stronger.

Resilient: What could go wrong?

Score: 2

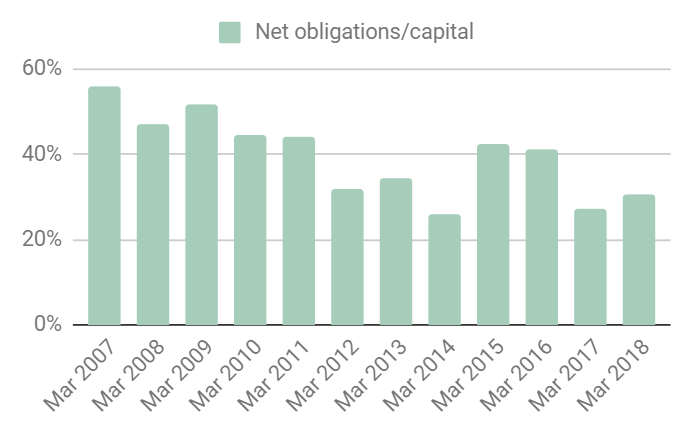

Plenty could go wrong. Trifast still serves cyclical end markets and profitability will be impacted by recession in future. I think changes to its shape and changes to its culture will moderate the impact though. It's also less dependent on external finance:

Source: interactive investor

Equitable: Will we all benefit?

Score: 2

Yes. The company values its staff, and they reward it with loyalty and a willingness to embrace change..

Cheap: Is the firm’s valuation modest?

Score: 0

At 18 times adjusted profit in 2018 the shares are probably fairly valued.

Verdict: Good business, fair price

'Nuff said

Here are Richard's most recent articles:

- Vp: An acquisition too far

- Air Partner: Talks a good business

- Sprue Aegis: Do this and they'll be 'dirt cheap'

- 16 conviction shares to consider

- Walker Greenbank: Cheap but fearful

- Hollywood Bowl close to joining exclusive club

- Anpario: Gearing up for growth

- Are Next shares a buy for the long term?

- 16 shares for the future

- Is Portmeirion in the 'buy' zone?

- XP Power shares: They're electrifying!

Contact Richard Beddard by email: richard@beddard.net or on Twitter:

@RichardBeddard

Richard owns shares in Trifast

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.