Air Partner: Talks a good business

29th June 2018 15:57

by Richard Beddard from interactive investor

I've just about lost patience with Air Partner, a charter broker that's trying to turn itself into a broader provider of air services. It's accounts are difficult to get your head around, and it is not just easily muddled me that's been bamboozled by them.

Earlier this year the company 'fessed up to fraudulent accounting that caused it to report higher net assets and profits every year since 2010. The fact the problem went undetected for so long shows Air Partner didn't fully understand its own accounts.

Unnervingly, the air charter broker suspended its shares and went silent while it investigated the problem, so it could publish an annual report for the year to January 2018.

Now that it has, we learn the auditor's opinion is qualified: It is satisfied the accounting misstatement amounts to a cumulative £4 million, but Air Partner cannot recreate its accounts, so it has adopted a kludge and written off the £4 million equally over the years.

All this means Air Partner's historical balance sheets and income statements for any particular year since 2010 are wrong, but the cumulative effect is not hugely significant: between 2010 and 2018, the company reported £36 million in operating profit so £4 million brings it down by about 11%.

As for blame, the culprits had already left the business when their actions were discovered, and their motivation was unclear. No cash went missing.

Devilishly difficult accounting

Even after the restatement, Air Partner is very profitable. Return on capital used to operate the business in 2018 leapt to 38% from 23% and profit margins were steady at 10%, although like many of the company’s statistics, profitability requires some explanation.

The still dominant charter business does very well when it is called upon to deliver people and freight around the world to deal with natural and man-made disasters. In the year to January 2018, gross profit from large commercial jet charters increased 23%, and freight charters more than doubled as the US mopped up after hurricanes Irma and Maria in September 2017.

Air Partner doesn't employ much capital - it doesn't own planes, it arranges charters with airlines and operators on behalf of governments, politicians, tour operators, football teams (it expects to do well out of the World Cup), companies and very rich people. Its biggest expense is pay, which is an operating, not a capital cost.

Capital is the denominator of the return on capital calculation, and because it is relatively small it too can move around a lot. In a good year like 2018, when the numerator of the return on capital calculation increases (adjusted profit increased 13%), and the denominator, capital employed, moves in the opposite direction, the company is very profitable but the effect can be transitory.

The return on capital calculation only tells us about the returns Air Partner earns on its operations, which until 2015 was pretty much all that mattered. That year it went on the acquisition trail though, buying Baines Simmons. Then it bought Clockwork in the year to January 2017 and SafeSkys in its most recent financial year. All of these companies provide consultancy and training to airlines, and also airports, regulators, and the defence industry.

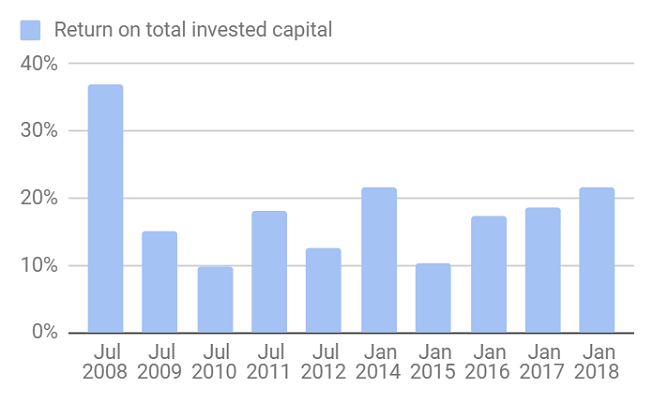

Factor in the cost of acquisitions and we get a less impressive but still very good return on total invested capital of 22% for the year to January 2018, and an average return on capital of 18%. The year 2008, when profitability was much higher, was the tail end of a bonanza: Air Partner was profiting from a more militaristic UK foreign policy then, by arranging the transport of personnel and equipment. Weaning itself off this source of income (which peaked at about 60% of pre-tax profit, compared to 3% today), has been a major achievement.

Source: interactive investor Past performance is not a guide to future performance

The surge in chartering in the year to January 2018 hides a bad year for Air Partner's fledgling consultancies, and its new diversification strategy. Gross profit fell 23%.

Maybe Air Partner needs time to bed in acquisitions, but I’m disappointed it didn't offer explanations in its annual report for the poor performance. Especially since one of the casualties of its accounting crisis was an acquisition, in its late stages, that would have grown the consulting and training division considerably.

Scoring Air Partner

As usual, I'm scoring Air Partner to determine whether the business is profitable, adaptable, resilient, equitable, and the shares are cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the fifth. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 1

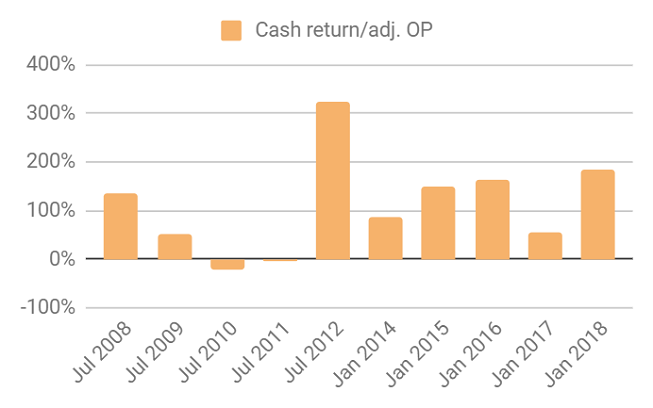

It is difficult to interpret Air Partner's financial record. Not only has it restated the accounts, in recent years it has also changed its year end and the basis for how it reports revenue. Strong cash flows give me confidence the reported profit is reasonable, although you have to look beyond inconsistent performance from year to year, to long-term average cash flow, which is higher than adjusted profit.

Source: interactive investor Past performance is not a guide to future performance

Adaptable: How will it make more money?

Score: 1

Air Partner wants to generate more consistent returns by striking an even balance between broking charters and providing aviation services. Since aviation services are also people businesses, Air Partner believes it can inject the customer centric culture developed in the broking division into its acquisitions. These businesses may have little else in common, though. Aviation services use different suppliers and often have different customers and the company is not building from a position of strength in the consultancy market.

Resilient: What could go wrong?

Score: 1

Apart from the possible failure of diversification, aspects of Air Partner's business face obsolescence. Other companies are building online charter platforms that could gradually eat into its more routine business, small private jets flying point to point journeys for example, although for complex charters and very privileged customers there will probably always be a place for personal service. Air Partner will use technology to help its brokers and consultants, but says "In our experience, technology cannot replace people". I fear it will replace some.

Equitable: Will we all benefit?

Score: 2

The executives are paid handsomely, but then the brokers and consultants probably are too. Air Partner says all of the right things about developing long-term relationships with customers and empowering staff, and that leads me to believe the business will ultimately benefit shareholders - if the strategy works out. I’m reassured by its choice of key performance indicators, which in addition to financial metrics, include measures of employee and customer satisfaction.

Cheap: Is the firm’s valuation modest?

Score: 0

Judge Air Partner by its performance in 2018, and the enterprise looks cheap at a valuation of 11 times adjusted profit. Mercifully, though, disasters cannot be counted on to grow in frequency or intensity year after. So as with most things Air Partner, I’m not very confident in the valuation.

Verdict: A can of worms

A score of 5/10 means I can't recommend the share.

The company decries short-termism, and is plotting a course through a capricious market while bucking the automation trend, so despite many misgivings I am going to follow it, at least for another year.

While I don’t know whether it will prosper, I'd rather like it too.

Here are Richard's most recent articles:

• Sprue Aegis: Do this and they'll be 'dirt cheap'

• 16 conviction shares to consider

• Walker Greenbank: Cheap but fearful

• Hollywood Bowl close to joining exclusive club

• Anpario: Gearing up for growth

• Are Next shares a buy for the long term?

• Is Portmeirion in the 'buy' zone?

• XP Power shares: They're electrifying!

Contact Richard Beddard by email: richard@beddard.net or on Twitter:@RichardBeddard

Richard owns shares in Air Partner

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.