Two American giants with powerful attractions

Our expert on overseas stocks likes the reliable and growing income generated by these two utilities.

22nd May 2019 10:24

by Rodney Hobson from interactive investor

Our expert on overseas stocks likes the reliable and growing income generated by these two utilities.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

The two biggest power utilities in the United States are surprisingly little known to investors over here. They should be, as they have increased their dividends year after year for more than a decade.

Regulated electricity companies face considerable demands, with heavy and continuous investment needed in the construction of power plants, transmission systems and distribution networks. At the same time, politicians are keen to hold down prices to keep the voters happy, while the cost of generating power can swing heavily between the twin pulls of supply and demand for oil and gas.

- Invest with ii: Top US Stocks | Sustainable Investing Ideas| Open a Trading Account

While that makes life challenging for existing players, it does put up barriers to new entrants. Another plus is that consumers and industry need electricity even in a recession. Income from regulated electricity and gas tends to be safe and secure with guaranteed cash flow.

Duke Energy (NYSE:DUK) was founded more than 100 years ago and has grown into the largest electricity utility in the US, with 7.6 million electricity customers across the southeast and Midwest. Regulated electricity still accounts for nearly nine-tenths of Duke's revenue, but its gas business is growing rapidly and now has 1.6 million customers. There is also a small renewable energy portfolio.

Duke did have an international energy business accounting for about 5% of earnings, but this was sold three years ago to concentrate on domestic operations, a wise move that has made earnings less volatile and left management to concentrate on the markets it knows best.

- How Ford shares could really motor

- It's not just UK stocks that pay big dividends. Check out these ii Super 60 recommended income funds

The group has a consistent record of paying quarterly dividends and it has raised the payout in each of the past 13 years, mostly by about 2%. However, last July it upped the rate of increase to 4%, more in line with earnings growth, and there is a fair chance that this level of increase will continue for the foreseeable future.

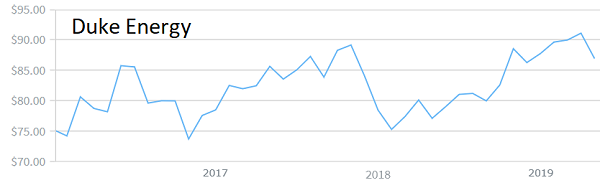

The shares have pushed above $90 several times since the beginning of December but have slipped back this month and now stand at about $87, where the price earnings (PE) ratio is 21.3 and the yield 4.25%, pretty good for such a solid investment.

Source: interactive investor Past performance is not guide to future performance

Southern Company (NYSE:SO) is another large producer of electricity that has been around for more than 100 years. The Atlanta-based company's 9 million customers make it a close second to Duke, although they are split fairly equally between electricity and gas, with electricity utilities in the southeast and natural gas distribution in seven states. About 90% of earnings come from regulated subsidiaries.

It has raised its dividend every year for 17 years.

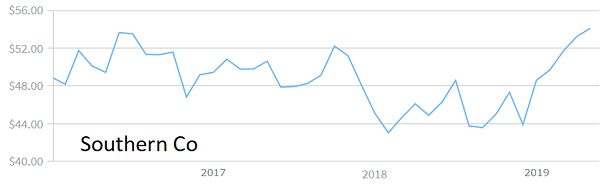

The shares have had a great run since Christmas, rising steadily from $43 to around $54 now so the best chance to buy has admittedly gone. Even so, they are still only at the level they reached three years ago – but with a higher yield at 4.5%, while the PE is an undemanding 16.7.

Source: interactive investor Past performance is not guide to future performance

Both figures are better than for Duke Energy so I can't see the shares slipping back far, although there are good reasons for the lower rating.

Southern has had some difficulty with large projects, including having to take over the running of a nuclear project from Westinghouse that is behind schedule and over budget.

The two nuclear units it is building are due to come on stream in November 2021 and November 2022, but it is possible that they will start up a few months earlier, which would obviously be a great boost for the company. Patient investors with a three-year horizon could find the shares rising strongly by then.

Hobson's choice: Buy Duke Energy below $90. The downside looks limited to the last support point at $83. Buy Southern Co below $56.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.