UK outlook: it’s time to turn the frown upside down

One Kepler analyst argues that extreme negativity towards the UK is being indiscriminately applied to UK-located assets, whether they are dependent on UK plc or not. Investors who realise this could do well.

1st September 2023 14:57

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Britain is a country where the serious press will straight line recent economic growth in Poland for the next 20 years, compare it to straight-lined UK growth and decide Poland will be richer than the UK imminently. Commentators will then do colour pieces based on their walks around Bydgoszcz in their leather jackets reporting how you can just feel how Poland is richer, even though the numbers they are discussing are a projection of the state of affairs 20 years’ hence and current numbers show the UK is still much richer (over twice as rich, in fact). Somehow this is all related to the inability of a journalist to buy a five-bedroom house in zone 1. On the right, Britain’s commentators like to claim the poorest states of the US such as Mississippi are richer than the UK, which is an interesting take. Arguably, Britain needs a psychiatrist, not an economist.

- Invest with ii: Buy Investment Trusts | Top UK Shares | Open a Trading Account

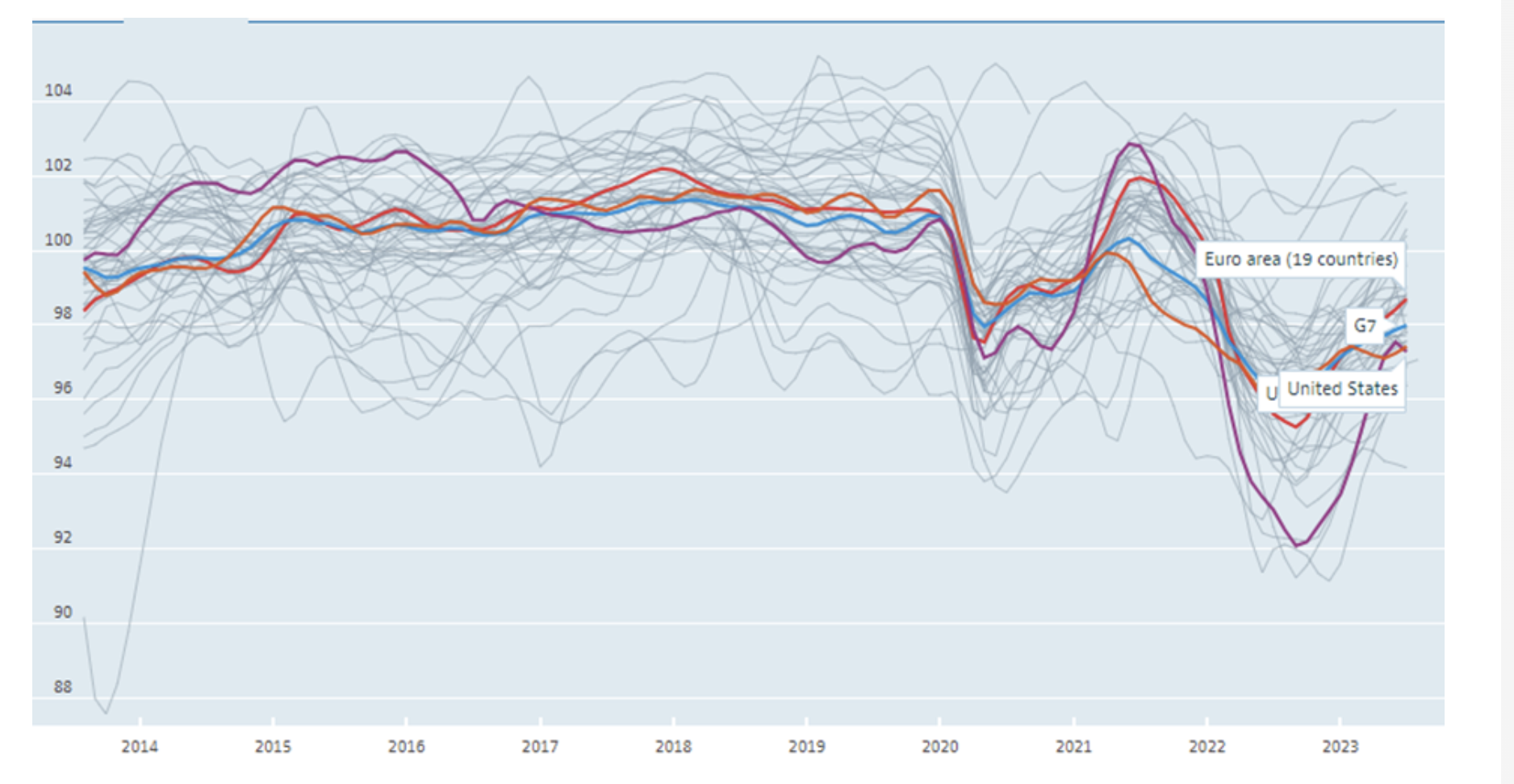

I think this addiction to doom, whether it be rooted in our national character, a symptom of political polarisation post-B**** or something else, explains in part the consensus view that the UK economy is cream-crackered. I expect it has contributed to the extreme gyrations in the consumer confidence index for the UK (the purple line) visible in the chart below.

Now, you can make a case that Britain is more exposed to global prices than the US, so as global inflation moves it could be perceived as more of a threat to the UK, and you can point out the UK had a full national lockdown during the pandemic unlike the US, which may have led UK consumer confidence to move more dynamically. But similar points could be made about a number of countries that didn’t report such an alarming decline in consumer confidence. The pace and magnitude of both the drop and the rebound in the UK numbers are striking. Those countries which saw consumer confidence hit lower lows than the UK? Latvia and Estonia, both of which faced the possibility of literal military invasion, and Turkey, which borders not one but two warzones and has seen its currency collapse amid political instability.

CONSUMER CONFIDENCE: UK AND PEERS

Source: OECD (2023), Consumer confidence index (CCI) (indicator). doi: 10.1787/46434d78-en (Accessed on 21 August 2023)

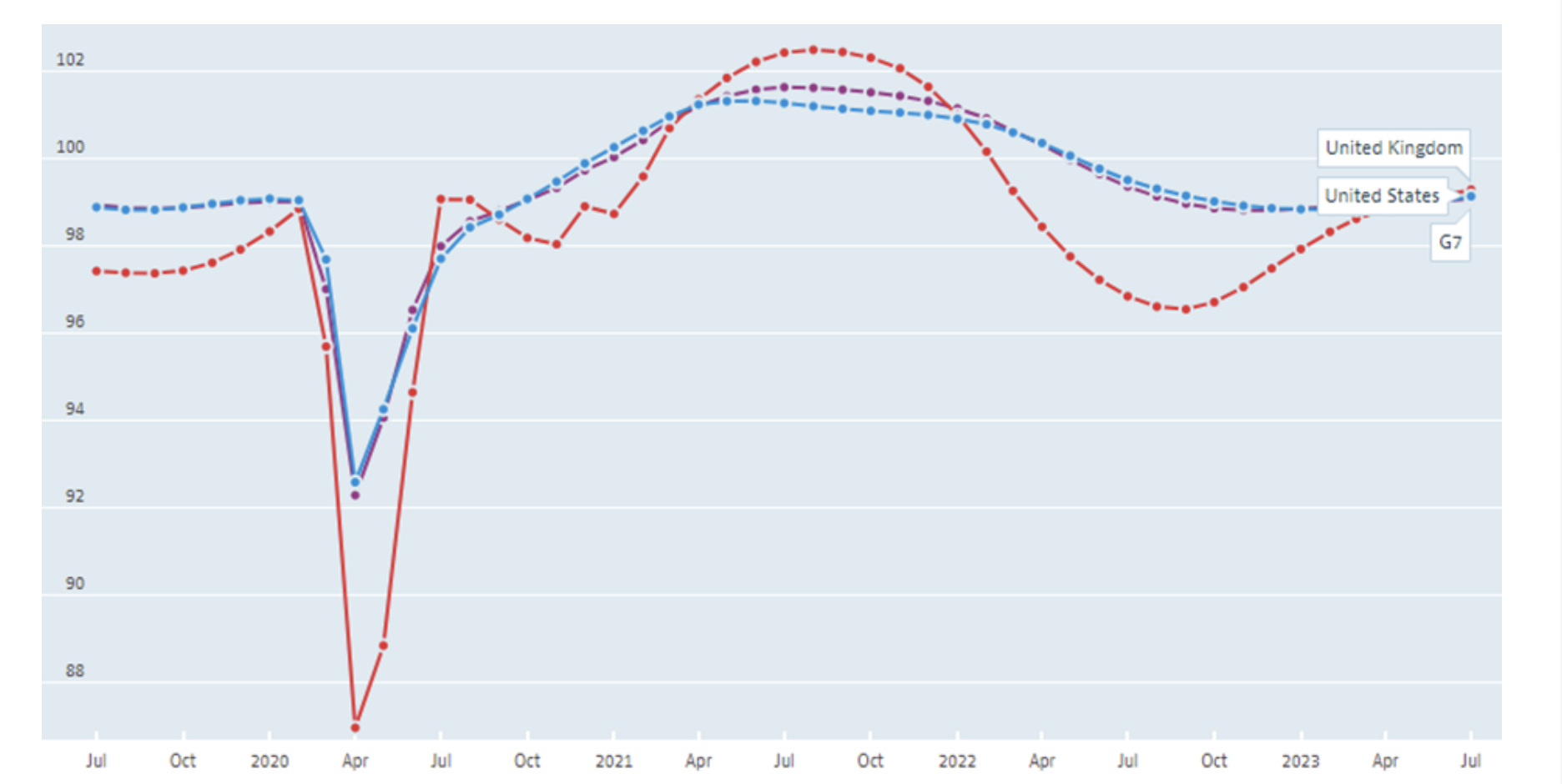

The extremity of the moves can be questioned, but the direction of travel is rational. I think it is now starting to be acknowledged widely that the outlook for the UK has improved, and this is indeed visible in the OECD’s leading indicator series below. To be clear, all these numbers are below 100, so they represent expectations of a marginal slowing of economic activity. But nothing like what was expected six months ago, and it is worth noting that the dramatic drop in activity previously anticipated did not emerge.

LEADING ECONOMIC INDICATORS

Source: OECD (2023), Composite leading indicator (CLI) (indicator). doi: 10.1787/4a174487-en (Accessed on 21 August 2023)

Quietly the news seems to be dribbling out that the UK is actually doing OK. We have not experienced the “mortgage timebomb” we were “facing”, unemployment remains at extreme lows, and lower than France, Germany or the US, while the UK economy has grown in 2023, unlike that of Germany or the Netherlands, which are in recession. Indeed, neither the polemicists of left nor right see it in their interests to reflect on the fact that a key reason inflation has remained a little higher in the UK than on the Continent is precisely because our economy is a little stronger and domestic demand is a little higher. Another key factor, of course, is exactly how and to what extent energy prices have been subsidised – i.e. a technical factor that makes the hand-wringing about differences in month-on-month readings between countries asinine – but great copy if your business model is making money out of whipping up anxiety.

None of this is meant to imply a new golden age is beginning. Britain’s economy is facing headwinds, as are those of our peers. While we are not in recession, growth remains extremely weak and higher interest rates are likely to continue to have delayed effects as time goes on. The consumer’s willingness to spend and borrow will likely decline, more and more businesses will have to regear, and house prices will likely be weak, repressing all the economic activity associated with moving home. The slowdown in China will also impact UK firms – although it will also reduce pricing pressure on commodities, which will dampen inflation. However, I think investors have a distorted view of how serious these issues are and how major their impacts will be.

This is not just a UK-wide issue. In the US too, investors seem to have assumed rising interest rates would have more of an impact than they have. One indicator comes from US data showing that the net interest payments of non-financial corporations have actually fallen over the past year. Why would this be the case? Presumably, this reflects the maturing of older, more expensive debt in preference for debt issued before the recent hiking cycle, as well as de-gearing efforts by companies anticipating a hiking cycle. Some of this balance sheet management may reflect action taken during the pandemic to build resilience. In any case, the US economy has proven much more resilient to rate hikes than expected, and this seems a key piece of explanatory data.

The Bank of England (BoE) doesn’t enjoy access to information anywhere near as good as this on the UK economy. Last week, it published widely quoted research which warned of the potential for defaults as rates remained high. But digging into the report it is clear they had to use balance sheet data from 2021 for most companies, as this was the most recent data available. They then calculated the notional impact of the rate hikes experienced since and those still expected on those out-of-date numbers. Is it possible that UK companies have also substantially improved their resilience over the last two years, as American companies have, and so the impact of rate hikes will be lower than expected? It's hard to believe they haven’t. (As an aside, it’s worth remembering how tough the BoE’s job is. They are slated whatever they do, and no doubt they don’t always get it right, but what hope do they have of anticipating how their actions will affect the economy with data this out of date?) Companies having more resilience to higher rates than expected would be a potential explanation for why the BoE has expected inflation to be lower than it has been and has had to raise rates much higher than it initially thought.

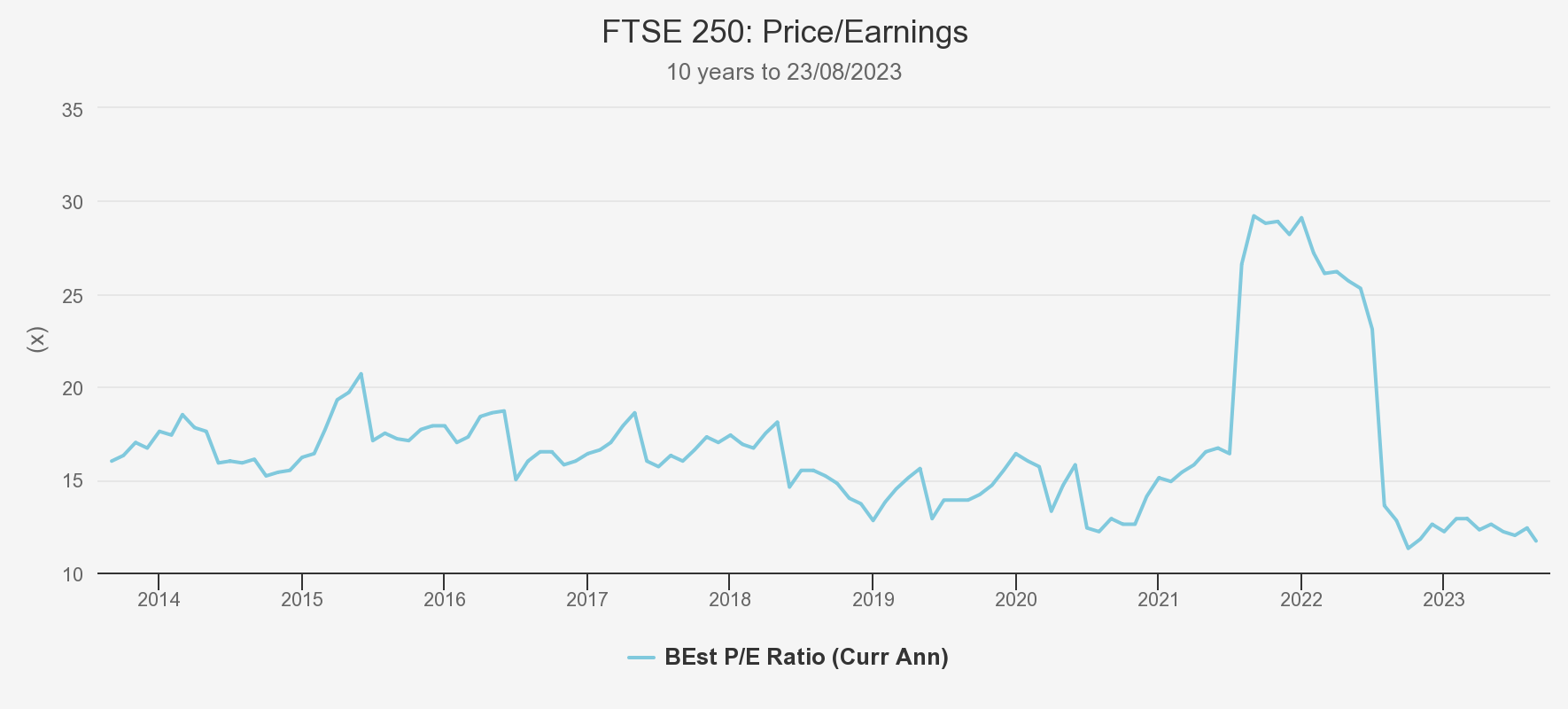

For investors, the question is what is priced in? Is it the moderate slowdown that data is suggesting in the price, or is it the dramatic catastrophe implied by the headlines and the consumer sentiment readings of a few months ago? At the index level, valuations look pretty extreme. The P/E ratio of the FTSE 250 is well below its 10-year average, according to Bloomberg. In fact, the only time it has been lower since the financial crisis was during the nadir of the pandemic when the economy was facing enforced closure for an indeterminate amount of time. In other words, market pricing implies the outlook is as poor as it was during lockdown or during the aftermath of the collapse of Lehman Brothers. This seems unwarranted.

INDEX VALUATIONS

Source: Bloomberg, Kepler calculations

In the investment trust space, investors are getting a discount even on these extreme levels of valuation. Focusing on the mid caps, high-quality trusts Mercantile Ord (LSE:MRC),JPMorgan Mid Cap Ord (LSE:JMF)and Schroder UK Mid Cap (LSE:SCP) are all available on a discount of circa 13-14%. All three have excellent track records of adding value with different strategies. An additional factor to consider is that while the FTSE 250 is considered a proxy for the UK domestic economy, revenues are fairly equally split between the UK and overseas. This idea that the FTSE 250 is domestic and the FTSE 100 is foreign is widely held, but it is a distortion of a much more balanced picture. And this is at the index level, on the stock-specific level many companies are simply not reliant on the health of the UK economy to grow. In my view, the extreme negativity towards the UK is being indiscriminately applied to UK-located assets, whether they are dependent on UK plc or not, and over time investors will pick up on this.

There is some evidence that extreme value is already beginning to be recognised. I think it is fair to say US real estate investors are at the ruthless end of the spectrum and are unlikely to be investing in the UK out of a sentimental wish for dear old Blighty to do well. I think the purchase of Industrials REIT by Blackstone, and the advanced talks between Realty Income Corporation and the board of Ediston Property Income are straws in the wind. Managers we talk to expect takeovers of undervalued UK companies to pick up across a variety of sectors. In my view, it’s easy to get caught up on the risks of investing over the next few months, but looking at valuations and sentiment they seem to be at long-term bottoms. It’s worth considering that when sentiment is poorest the reason for a potential re-rating is never clear – otherwise sentiment would be better. But investing at these times tends to be when the best gains are made, and waiting for the way out to become clear often leads to missing out.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.