UK shares: Ways investors can exploit Brexit turmoil

27th December 2018 09:17

by Danielle Levy from interactive investor

They are looking cheap and there are ways investors in UK shares can play the turmoil to their advantage, says Danielle Levy.

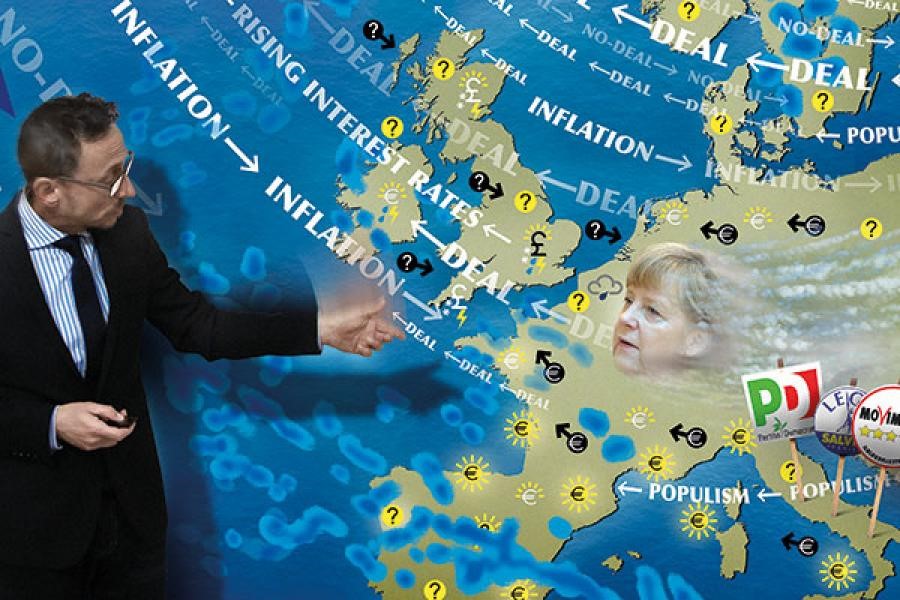

As the UK's deadline to leave the European Union approaches, investors in the UK stockmarket face great uncertainty. At the time of writing, the UK had a potential deal on the table with the EU. However, with plenty of hurdles still to clear, not least parliamentary approval, investors could be forgiven for preparing for the worst.

Faced with a continuous stream of negative headlines, investors have continued to shun the UK in favour of other developed markets. There were 16 consecutive months of outflows from UK equity funds between April 2017 and September 2018, according to figures from the Investment Association, with a total of £6.8 billion withdrawn over this period.

Political uncertainty

Brexit aside, there's also the prospect of political uncertainty to consider. Cabinet resignations, warring factions within the Conservative party and calls for a vote of no confidence all appear to threaten the prime minister's position.

However, while the headwinds are hard to ignore, the good news is there are still investment opportunities to be found in the UK market, which is home to a number of fantastic businesses.

Currency represents one of the biggest considerations for anyone who is trying to 'Brexit-proof' their portfolio. Sterling has dropped from $1.46 against the dollar prior to the EU referendum to $1.28 at the time of writing. Looking ahead, the direction of travel for the pound appears to be binary, depending on whether a deal with the EU is agreed.

"A no-deal exit or a poor deal would likely lead to a significant derating in the pound, but a reasonable or even good deal should lead to a large appreciation," explains Andrew Wilson, chief investment officer at Lockhart Capital Management.

In the event of a 'hard Brexit' or no deal, which would see the UK give up full access to the single market and Customs Union, sterling depreciation would provide a boost to companies which derive a significant portion of their earnings overseas. As close to 70% of revenues from FTSE 100 companies are earned outside the UK, these large-cap international earners have the potential to perform well in this scenario.

"If we get a hard Brexit, the currency will fall a lot. That means large caps will outperform and mid-caps will underperform. What could then happen is the central bank raises interest rates to defend the currency. This would be bad for fixed income, as they would not be raising rates because the economy is strong," says Nathan Sweeney, a senior investment manager at Architas Multi-Manager.

Simon Brazier is currently positioning the Investec UK Alpha to benefit from sterling weakness. Over the past two and a half years, he has increased the fund's large-cap exposure and favours international earners with dollar-denominated dividends (which benefit if sterling weakens), such as BP and HSBC. Close to 80% of his portfolio is currently invested in FTSE 100 names.

Elsewhere, he has cut the fund's allocation to companies with domestic revenues from 40% pre-Brexit to 30%. "We were wary of weaker sterling. Secondly, the Brexit vote itself and whatever deal comes out of it mean the UK economy is growing slower than we were predicting before Brexit, so we have reduced some of that cyclical domestic exposure which you find in mid-cap stocks," he explains.

Sterling weakness

David Coombs, head of multi-asset at Rathbones, points out that further sterling weakness would result in a "simultaneous pay cut for UK workers and a hike in the price of everything from food to consumer goods". "A recession would almost certainly be in the offing, which would be terrible for equities – in particular those with domestic UK earnings," he warns.

A 'soft Brexit', on the other hand, would spark a sharp appreciation for sterling. A deal that sees the UK retain close ties with the EU would spell good news for domestically focused businesses. In contrast, adds Wilson: "[Such a] strong sterling outcome would be disappointing for those whose portfolios have moved away from UK assets and currency."

Although Brexit continues to weigh on investor sentiment, more positive is that the UK looks cheap. Alex Wright, manager of the Fidelity Special Situations, points out that the UK market currently trades at an average price-to-earnings ratio of 12 times, and compares to 14 times for continental Europe and 17 times for the US.

While Wright isn't investing with a particular view on whether there will be a soft or hard Brexit, he says attractive valuations across the UK market have become hard to ignore. He is spotting opportunities in large and smaller companies, both international and domestic-facing. When it comes to the latter, he is happy to invest if he believes the balance sheet can withstand a period of economic weakness and the valuation provides a margin of safety.

"My process rests on identifying unloved companies with the potential for positive change. And the number of unloved companies available to choose from now makes me think 2019 could turn into a surprisingly positive year for investors brave enough to buy UK equities before the good news," he adds.

Peter Sleep, senior investment manager at Seven Investment Management, suggests that nervous investors may wish to hold UK companies that are able to generate steady earnings regardless of where we are in the economic cycle. "Historically, companies such as supermarkets have been relatively steady regardless of the economic cycle, because people still have to shop for essentials even in an economic downturn," he explains.

Defensive stocks

Although Andrew Wilson at Lockhart acknowledges that defensive stocks like Unilever hold up best during times of uncertainty, he suggests that investors who are sensitive to valuations may wish to look elsewhere. "These stocks are not necessarily cheap. The most value in the market is in domestically focused names that have the scope to rebound strongly on any vaguely sensible Brexit outcome. They certainly aren't 'safe' but probably offer the best risk/reward [trade-off] in the UK market at the moment, and you can always tilt towards larger cap stocks shunned by international investors, such as the banks," he says.

For investors who are looking to make the most of investment opportunities in the UK, is it best to invest via an active fund manager or a passive fund, which simply tracks the market?

Sweeney notes that passives have performed well in recent years because they were buoyed by strong markets, which in turn were driven by central bank intervention. However, he believes we are moving into a different environment which will see a greater divergence between good and bad companies. "In an environment like this, where an active manager can be more selective, you would expect actively managed funds to provide you with a better performance as they are in better companies," he explains.

Wilson agrees that an active fund manager should, in theory, be able to adapt to whatever the Brexit outcome turns out to be. "We would suggest looking at the most experienced managers in the market, be they long-only or absolute return. For 2019, you could consider the likes of Franklin UK Managers' Focus, Schroder Income or Sanditon UK Select," he says.

Nevertheless, there is no guarantee that an active manager will perform well in a down market. In addition, research shows that passive funds are able to perform better than the average active manager over the long term, after fees. They can also offer cheap and quick access to the market (see box).

For example, Rathbones' Coombs has been buying FTSE 100 ETFs in recent times, as he believes they offer a good hedged bet against the bifurcated Brexit situation. "If the decision is disappointing, sterling is likely to fall, which would make the FTSE 100 more valuable in sterling (given its overseas earnings). But, if the result is one that brings a measure of certainty, we think it should lead to foreign investors returning to the UK," he explains.

How to buy the UK

• For large cap exposure – iShares Core FTSE 100 ETFOngoing charges -figure (OCF): 0.07%; net assets: £5.6 billion Architas Multi-Manager's Nathan Sweeney explains: "If we were to see a 'hard Brexit', the currency would fall a lot and large companies would outperform. The FTSE 100 would bene¬ t, as a large portion of these companies generate their revenue from overseas – and when you convert that back to sterling, they would get a boost from the weaker currency."

• For income exposure – Vanguard FTSE UK Equity Income Index fundOCF: 0.22%; net assets: £360.8 million; historic yield: 4.8% Peter Sleep of 7IM explains: "This fund has a bias towards dividend-paying companies. Traditional FTSE 100 ETFs are quite biased towards a few very big companies in the oil and ¬financial sectors; this fund moderates that somewhat and produces a decent income."

• For value & income exposure – 7IM UK Equity Value index fundOCF: 0.35%; net assets: £192 million; distribution yield: 4.5% Sleep explains: "This is a smart beta fund with a bias towards high-quality cheap stocks. It has beaten the UK equity index by 4% over the last three years."

• For a Brexit sell-off – Vanguard UK Long Duration Gilt IndexOCF: 0.15%; net assets: £361 million; distribution yield: 1.8% Sweeney explains: "This gives you exposure to 30-year UK government bonds. It has a very long duration (high sensitivity to interest rates). When you get a big sell-off, it tends to provide strong performance. However, in an environment where interest rates are rising, you don't want to hold it."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.