UK stockmarket outlook: Brexit, bargains and two income stars

21st December 2018 14:20

by Lee Wild from interactive investor

The next few months will again be dominated by Brexit, but the end is nigh! Lee Wild looks at the issues affecting UK stocks and the best approach to investing in 2019.

Investing is only ever based on best guesses. They might be very good guesses, using incredible analysis – fundamental or technical – but they are just that – a guess. No one can be 100% confident what will happen in the next few minutes, let alone the next few days, weeks or months. With that handy caveat out of the way, here's my 'best guess' at what 2019 has in store for investors in UK shares.

I paraphrase the well-known market saying, 'when Wall Street sneezes every other market catches a cold'. And it holds plenty of truth - America remains one of the growth engines of the global economy, and it follows that any hiccup there will impact demand for goods and services from elsewhere. But many economies elsewhere have already caught a bug, or are at the very least looking unwell and vulnerable.

We'll get onto Brexit shortly, but the Federal Reserve's meeting on 19 December holds some clues as to what 2019 might bring for investors everywhere.

Inflation is under control, so two further rate hikes, not three, is the prediction of US policymakers. A downgrade to economic growth forecasts is also telling – Fed officials trimmed their estimate for US GDP in 2019 from 2.5% to 2.3%.

And there are clearly risks to that number, too. The Fed has been hiking rates since December 2015 from almost nothing to 2.25-2.5% currently. Those hikes, though gradual, will feed through to the economy, as will the strong dollar – the dollar index remains near an 18-month high. Withdrawal of economic stimulus and the threat of economic weakness in China and elsewhere remains very real.

OECD economists recently downgraded expectations for a number of countries including China and, while they do not expect a 'hard landing' for the global economy, they do admit there are a “lot of risks”. In Europe, too, growth is estimated to slow from 2% this year to 1.6% in 2020.

What's the starting point?

As I write, the FTSE 100 is down 13.4% in 2018 at 6,661, within a few points of its lowest levels since August 2016. From its record high in May at 7,903, the index is down 15.7%. This is by far the worst year for FTSE 100 returns since 2008 and ranks among the most miserable performances since the index was created in 1984.

The absence of a Santa rally is telling. Our own statistics showed that December always gets some kind of pick up, even if it's not on day one. The final few days of the calendar year are historically a positive event, but not even this is certain in 2018. Already, the FTSE 100 is down 4.3% in December, statistically the best month of the year for UK stocks – Stock Market Almanac data shows blue-chips fell in only six of the last 34 years. It'll be seven and 35 in 10 days' time.

Source: TradingView (*) Past performance is not a guide to future performance

To add some perspective, however, the S&P (down 10.6%), Dow Jones (-10.5%), Nasdaq (-10.2%), Nikkei (-9.8%), Cac (-7.3%), Dax (-6.3%) and even the high-flying Brazilian Bovespa (up 11.6% in 2018, but down 4.7% in December), have all done worse than us this month!

True, all but the Dax have done better than the UK over the 12 months, so had further to fall to remove some of the froth. But it does look like more of the bad news is written into domestic stocks than overseas markets who are now playing catch up.

On an individual stocks basis, it's been an appalling year for some of the best-known blue-chip names. We wrote about this recently, but it's worth pointing out a 50% decline for British American Tobacco, Standard Life Aberdeen down 42%, Vodafone down 33%, Barclays 28%, Prudential 27% and ITV 24%.

What to expect in 2019

If you were to look at the FTSE 100 as you would a stock, it would almost certainly pique your interest and warrant further analysis. Currently, the index trades on a price/earnings (PE) ratio of 11.2 – a big discount to its historic average - and dividend yield of 4.5% covered twice by earnings. Those numbers are attractive both on their own and versus history.

But Stockmarkets are forward-looking, and these figures reflect future risk and poor perception of prospects. Our technical analyst Alistair Strang's unique charting software says the FTSE 100 only escapes a path to the 5,800's if it manages to rise above 7,125. Grim stuff.

- FTSE 100's 10 biggest winners and losers of 2018

- New poll: Here's where you think the FTSE 100 will end 2019

So, what are prospects for UK shares?

In addition to the global events mentioned above, we should add the potential US government shutdown (this often happens and always gets resolved, so risk is small) and US/China trade war. The latter will rumble on for some weeks, but it is in neither superpower's interest to prolong this. A US increase in tariffs on $200 billion of Chinese goods is already delayed while talks take place in January. A compromise deal would give world financial markets a much-needed boost.

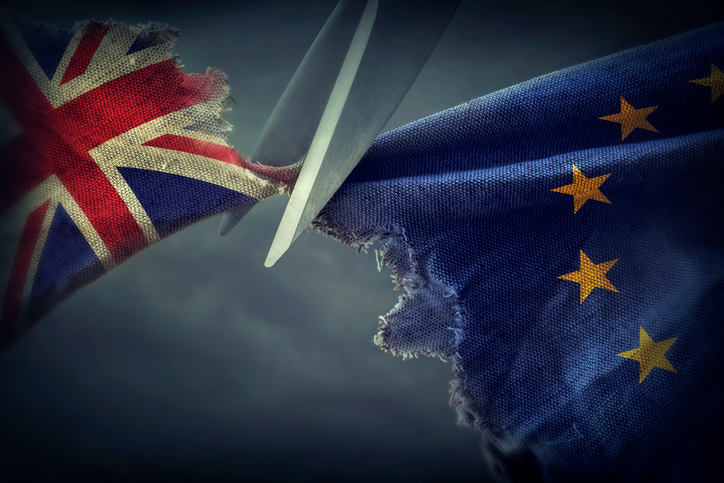

The biggie for UK companies is Brexit.

Trying to second guess what happens next is a fool's errand. MPs must approve a deal by 21 January, but most of us – whatever our political persuasion - are exhausted with the entire process and want clarity. Markets do too, so there is an argument to be made that a deal either way at least gives us that.

However, if we do leave EU on 29 March 2019 without a deal, the scale of the unknowns make it difficult for stocks to go any way but down. Even with a deal in place, few will welcome it and there's a 21-month transition period during which time negotiators will try and untie 43 years of treaties and agreements. It's a massively complicated process and, judging by how the referendum process has been handled, could trigger further ructions on UK markets.

For investors, few would advise positioning for a particular outcome to negotiations. There are so many possibilities that picking the right one would be an unnecessary gamble. As usual, the sensible advice is to diversify across both asset classes and geographies.

Some kind of Brexit deal would probably be good for sterling. However, an inverse relationship with the FTSE 100 and its legion of overseas earners has broken down this year – the pound is down around 7% versus the dollar in 2018. Will it re-establish itself in 2019?

Most likely, the deal scenario gets the pound back above $1.30 and UK-focused FTSE 250 stocks outperform blue-chips. According to analysts at UBS, a no-deal scenario triggers a collapse in business investment, a confidence crisis and dumps sterling to $1.15.

- Brexit poll: Investors tell us what they're doing now

- 14 shares for the future

- Will 2019 take the BISCUIT?

But investors cannot and should not ignore UK equities. With a long-term view, and with potential for rapid gains if confidence returns in a post-Brexit world, the 5% yield offered by solid multinationals making up nearly half the FTSE 100 index is attractive. There are plenty of well-covered dividends on offer from companies trading on modest PE multiples.

Look at Royal Dutch Shell (Dividend yield: 6.4%, PE: 9.3). Record low oil prices a few years back weighed on the oil major, but it's selling off $30 billion of non-core assets and bought BG Group at a good price. Oil prices are significantly higher now and Shell's balance sheet is in much better shape. Crucially, it has not cut its dividend since the Second Word War.

Imperial Brands (Dividend yield: 9.6%, PE: 7.9) has a great track record of dividend growth and is expected to keep increasing the payout in future. Ethical investors will steer clear, but income seekers will like Imperial's steady earnings and free cash flow.

For UK assets, everything hinges on Brexit, and at least we'll get a result in Q1. But even if markets do fall sharply, there will be more great opportunities for those with a longer-term investment horizon to drip money in and do well further down the line. Generous income stocks will reward you for your patience.

For some great ideas on value stocks and income plays, keep reading the weekly notes from our companies analysts Richard Beddard and Edmond Jackson, and for accurate charts commentary our technical analysts Alistair Strang and John Burford.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.