US attack on Iran means opportunity at this oil giant

There’s an oil major worth buying that isn’t BP or Shell, argues our overseas investing expert.

8th January 2020 10:37

by Rodney Hobson from interactive investor

There’s an oil major worth buying that isn’t BP or Shell, argues our overseas investing expert.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

The season of goodwill was hardly over when US President Donald Trump unleashed his thunderbolt. Overnight, the killing of General Qasem Soleimani, widely described as the second most powerful man in Iran, transformed investment perspectives for the rest of the year – and in no sector is that more obviously true than in petroleum.

The Middle East remains the major source of crude production and any tension there will inevitably have an impact on oil prices. Each $1 rise in the price of a barrel flows through to the bottom line of oil producers substantially intact.

Before the assassination, investors had been working on the basis that a slowdown in the global economy – China has seen growth fall, Europe is flirting with recession and the US is bumping along – would reduce oil consumption and therefore oil prices.

Brent crude had peaked at $85 a barrel last April but has since been below $60 and seemed to be settling clearly below $70.

Now, attention has switched to supply. Gulf oil is shipped out through the frighteningly narrow Straits of Hormuz, where boats are susceptible to being seized or attacked by Iran, as has already been demonstrated. Oil refineries in Saudi Arabia were attacked by drones and put out of action for several days as recently as September.

It is hard to believe that Iran will not exact revenge in some form or another, with likely tit-for-tat retaliation from the US.

Oil from shale fracking in the US has helped to keep a lid on crude prices but this is an expensive method of producing oil and drilling in the US contracted in the fourth quarter of 2019. It will take time for fracking to make up even a fraction of any shortfall from the Middle East.

It's true that oil has got a bad name in these days of global warming campaigns and, over the next couple of decades, we will see petrol and diesel driven cars disappearing from our roads. However, oil is not going away yet. It will continue to be an important fuel across the globe, and it is far too early for investors to avoid the sector yet.

Woodside Petroleum (ASX:WPL) offers investors an alternative to BP (LSE:BP.) and Royal Dutch Shell (LSE:RDSB). Woodside is Australia’s largest independent oil and gas company and is the largest operator within Australia, producing onshore and offshore in Western Australia and Northern Territories. It is the pioneer of LNG in the country and it also operates numerous oil and gas fields and pipelines in the United States and Mauritania.

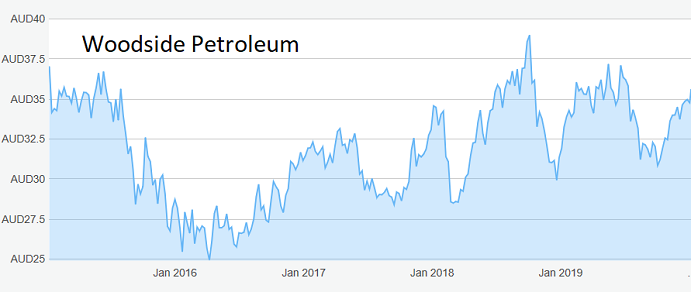

The shares naturally jumped more than 1% when markets opened after Trump’s lethal drone strike, and have risen further in the following two days but, at around A$36, they are still substantially lower than they were in the first half of this year, when they pushed above A$37 on several occasions. In September 2018, they peaked at A$39. There surely is further to recover in the current situation.

Source: interactive investor Past performance is not a guide to future performance

The yield is an attractive 5.2% and the price/earnings ratio (PE) not too demanding at 18. It is true that the yields on BP and Shell are currently above 6% but they are both on much higher PEs.

Production in the third quarter of 2019 was up 44% and sales revenue was 58% ahead, which is pretty impressive. Results for the fourth quarter are due on 16 January. There is obviously some risk in buying ahead of the figures but, then again, if the outlook is good the chance to buy at current levels will be missed.

Hobson’s Choice: Buy at up to A$37. This could again be a ceiling but there is a fair chance that the shares will go on to test A$39.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.