Valuation for this global giant is ‘insultingly low’

In a slow and steady uptrend since 2016, the shares have presented a fresh buying opportunity.

29th January 2020 08:45

by Rodney Hobson from interactive investor

In a slow and steady uptrend since 2016, the shares have presented a fresh buying opportunity.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

A dramatic reversal of fortunes has occurred among European vehicle manufacturers. Production in the UK, which raced away for much of the 2010s, has slumped alarmingly, while European counterparts enter the new decade in forward gear.

Sales of new cars rose 1.2% in the European Union last year, according to industry figures released this month, with more than 15 million vehicles registered. This marked the sixth consecutive annual increase.

- US and international trades are free with ii on 29 and 30 January

- Get exposure to the world’s biggest companies via these ii Super 60 recommended funds

The achievement is particularly noteworthy because 2019 started off badly, with new emission standards introduced in September 2018 overhanging the market for several months. Most of the 2019 improvement came in the final quarter of the year, with sales in December up a remarkable 22% on the same month the previous year.

Investors should bear in mind that for much of 2019 the figures were running below 2018 levels; it was the Christmas present for carmakers that made the difference. Nonetheless, it does look likely that the momentum will carry forward at least into the early months of the current year, when comparative figures will be weak.

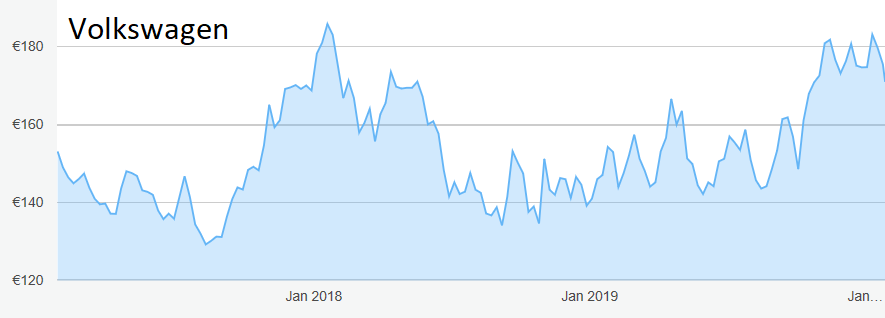

Source: interactive investor Past performance is not a guide to future performance

Germany has been by far the most active market, with sales up 5% over the year, easily outstripping gains of 1.9% in France and 0.3% in Italy. In the absence of reasons to the contrary, investors should arguably favour German manufacturers. Europe may have open borders but consumers in any country still have a preference for home grown products, which is why Volkswagen (XETRA:VOW3) led the way in Europe in 2019 with sales of 3.7 million cars, up 3.1%.

The German manufacturer is the largest motor group in the world, and it accounts for nearly a quarter of all car sales across the European Union. Its subsidiaries include Audi, Skoda, SEAT and Porsche.

Most recently published figures, for the three months to the end of September, showed revenue up 11.3% year on year and net income 42.3% higher with improved profit margins.

- Why the US remains a great place to invest in shares

- Want to buy and sell international shares? It’s easy to do. Here’s how

The big question is how well Volkswagen, which was caught up in the scandal over European car manufacturers faking diesel emission tests, can redeem itself in the eyes of the green lobby by outsmarting Tesla (NASDAQ:TSLA) in the race to produce electric and hybrid vehicles.

Tesla this month saw its stock market capitalisation top that of Volkswagen for the first time but the German international group sells far more vehicles and makes a profit, while it would take a brave investor to forecast when Tesla can hope to make meaningful profits, let alone pay a dividend.

Volkswagen chief executive Herbert Diess is buying software companies and increasing investments in electric vehicles and battery cells. He has allocated about €60 billion to invest in electrification, hybrids and related technology with plans to start production of electric cars at a factory near Shanghai.

Diess was quoted at the World Economic Forum in Davos as saying it was an open race against Tesla, which undisputably has the advantage in electric cars and the technology behind them. Tesla, which began production in Shanghai last year, even plans to build a factory near Berlin in what looks a tit-for-tat move.

One further factor that investors should bear in mind is the continued threat of President Donald Trump to impose tariffs against European vehicle exports to the United States. This could be another difficult year for carmakers.

Volkswagen shares did partly reflect the rise in the group’s European sales by moving up from €148 in early October to €182 a month later but they have tailed off over the past three weeks. I tipped the shares at €157 last March, suggesting they were a buy at up to €165, so anyone following that advice is showing a profit. They are currently trading around €171, which opens up a new buying opportunity. The yield is a reasonable if unexciting 2.8% but the price/earnings ratio is an insultingly low 6.4.

Hobson’s choice: Buy Volkswagen up to €177. The immediate target is to break decisively through a ceiling around €183, in which case they should easily top €190.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.