Venturing into Japan: the fund I just bought

20th September 2021 14:45

by Douglas Chadwick from ii contributor

Japanese stocks are on a strong run, and Saltydog Investor is keen to take advantage with this top-performing fund.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Although Saltydog’s primary focus is on fund performance, we do keep an eye on some of the most common stock market indices to help us keep up to speed with what is happening in the major global economies.

So far, it has been a pretty good year for stock markets around the world, with most continuing the recovery that started last year. In the first quarter of 2021, nearly all the indices that we track went up. The notable exceptions were the Shanghai Composite, which lost 0.9%, and the Brazilian Ibovespa, which went down by 2%.

In the second quarter, it was Japan that was struggling, with a 1.3% loss.

| Index | Country | 1st Jan to 31st March | 1st April to 30th June | July 2021 | Aug 2021 | 1st Sept to 18th Sept |

| FTSE 100 | UK | 3.9% | 4.8% | -0.1% | 1.2% | -2.2% |

| FTSE 250 | UK | 5.0% | 4.0% | 2.6% | 5.0% | -1.8% |

| Dow Jones Ind Ave | US | 7.8% | 4.6% | 1.3% | 1.2% | -2.2% |

| S&P 500 | US | 5.8% | 8.2% | 2.3% | 2.9% | -2.0% |

| NASDAQ | US | 2.8% | 9.5% | 1.2% | 4.0% | -1.4% |

| DAX | Germany | 9.4% | 3.5% | 0.1% | 1.9% | -2.2% |

| CAC40 | France | 9.3% | 7.3% | 1.6% | 1.0% | -1.6% |

| Nikkei 225 | Japan | 6.3% | -1.3% | -5.2% | 3.0% | 8.6% |

| Hang Seng | Hong Kong | 4.2% | 1.6% | -9.9% | -0.3% | -3.7% |

| Shanghai Composite | China | -0.9% | 4.3% | -5.4% | 4.3% | 2.0% |

| Sensex | India | 3.7% | 6.0% | 0.2% | 9.4% | 2.5% |

| Ibovespa | Brazil | -2.0% | 8.7% | -3.9% | -2.5% | -6.2% |

| RTSI | Russia | 6.5% | 12.0% | -1.7% | 3.6% | 3.6% |

Data source: Morningstar

The Nikkei 225 also went down in July, falling by 5.2%. It did not do as badly as the Shanghai Composite or the Hang Seng, but it was the worst of the developed markets that we look at. In August, the Japanese market started to pick up, with the Nikkei 225 making 3%, and this month it has been going like one of their super-fast bullet trains. It has already gone up by 8.6% in September and we have still got more than a week to go to the end of the month.

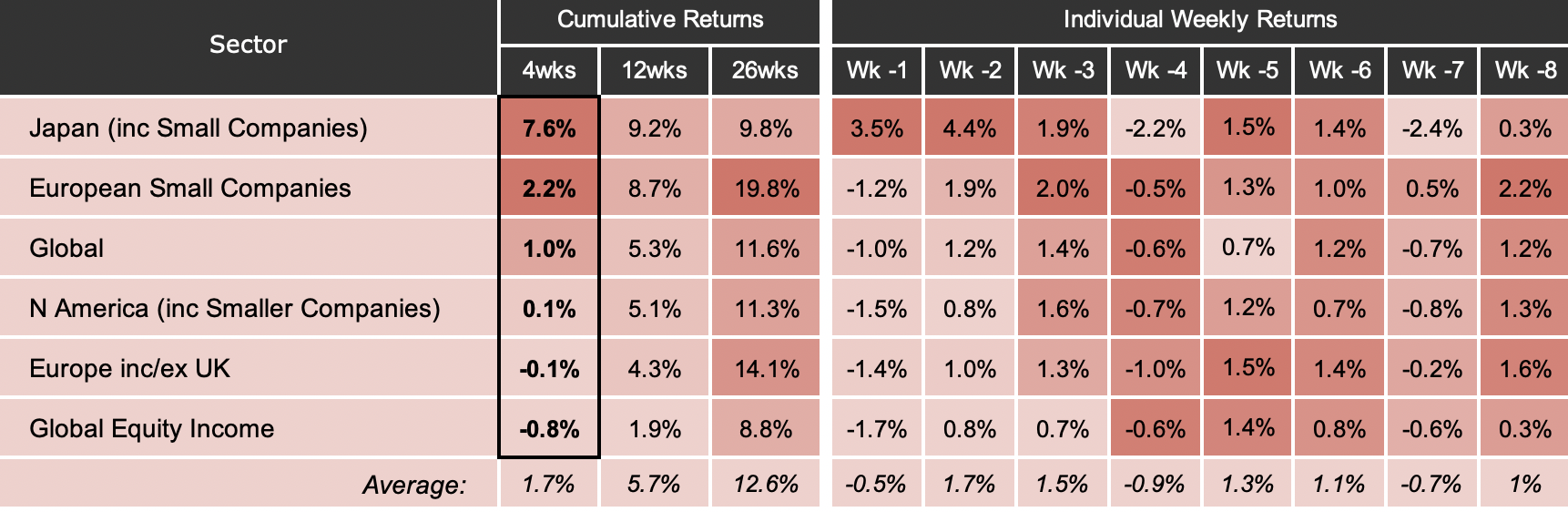

Not surprisingly, we have also seen the Japanese sectors starting to rise to the top of our tables.

- Japan’s prime minister to step down: why are markets rallying?

- Japan’s stock market: the basics every investor should know

- Chart of the week: is Japan about to rise again?

The Investment Association (IA) has two sectors for funds investing in Japan. The main one is Japan, for funds which “invest at least 80% of their assets in Japanese equities”, but there is also Japanese Smaller Companies, for funds which “invest at least 80% of their assets in Japanese equities of companies which form the bottom 30% by market capitalisation”. There are not many funds in the Japanese Smaller Companies sector and so we combine them when doing our sector analysis.

In the reports that we generated last week, covering fund performance up until the end of the week before, the combined Japanese and Japanese Smaller Companies sector was at the top of our ‘Full Steam Ahead – Developed’ Group with a four-week return of 7.6%. It now leads over 12 weeks as well, but has some catching up to do to get ahead over 26 weeks.

Data source: Morningstar. Past performance is no guide to future performance.

This Group compares the sectors which can invest outside the UK, but mainly in the developed markets. Funds in the Global sector can invest anywhere in the world, but tend to have a bias towards the US, UK and Europe.

Japan has had a difficult time getting on top of the Covid-19 outbreak. Hosting the Olympics, and having visitors from all over the world, probably did not help, and their vaccine roll-out was not as advanced as many other countries. However, Covid-19 cases are now falling in Tokyo, and other major cities, and the number of people getting vaccinated is rapidly increasing.

The relatively new prime minister, Yoshihide Suga, has come under a lot of pressure due to his handling of the pandemic and will stand down. This has driven speculation that any new government will put forward a substantial economic package to support a strong financial recovery by the end of the year.

If that happens, then maybe this sector could continue to do well.

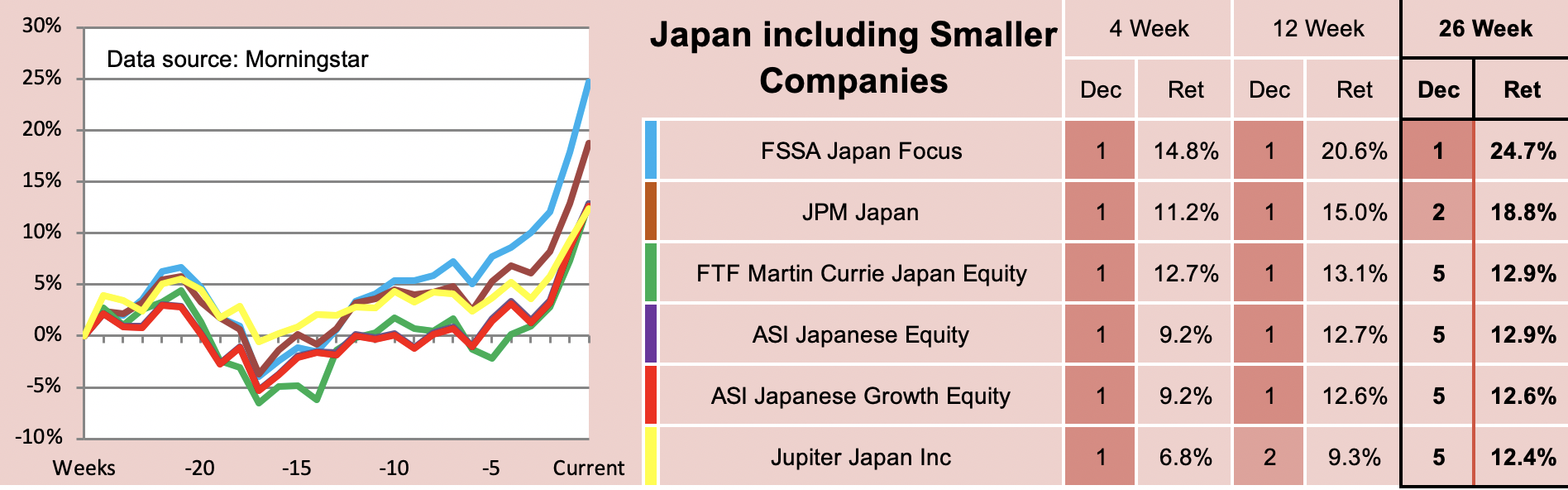

Last week, our ‘Ocean Liner’ portfolio invested in the FSSA Japan Focus fund, that was at the top of our table showing the best-performing funds in this sector over the last 26 weeks.

Data source: Morningstar. Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.