This Warren Buffett stock and a fellow income play are undervalued

26th October 2021 09:08

by Rodney Hobson from interactive investor

Decent results are not reflected in the share price, but both stocks pay shareholders big dividends while they wait for other investors to wise up.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Well-run telecoms companies can offer an attractive investment, especially when a new generation of mobile telephony is being rolled out. New entrants into this field find high-cost barriers in the way, while incumbents are currently benefiting from the rapid spread of 5G. Two American companies that have just produced third-quarter results are faring well, yet the performance is not reflected in either share price.

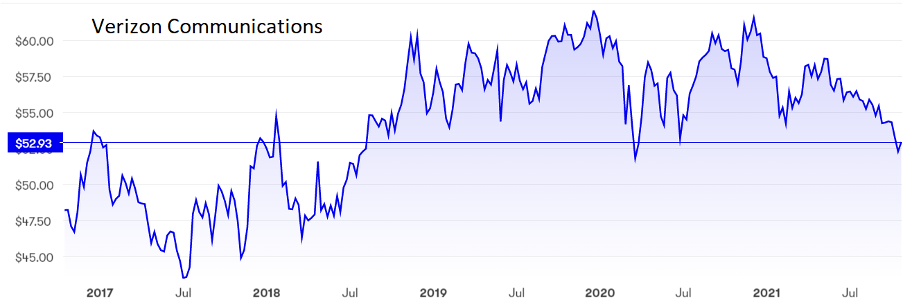

In fact, the share price performance at Verizon Communications (NYSE:VZ) over this summer has been frankly disappointing, all the more so as the results have been well up to scratch.

- Special offer: For one week only, no trading fees on US shares.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Read more of Rodney's articles here

It all promised so much when, back in July, the telecoms group reported an excellent second quarter, so good that it raised its guidance for the full year. Net income at that stage was up 23% on the previous second quarter and revenue had increased 11%. Important factors were the 5G phone roll-out, the consequent revenue growth from wireless services and greater reliability of the network. Verizon boasted that it had more connections on its network than any rival. The group raised its forecast for wireless service revenue growth from 3% to at least 3.5%.

Verizon’s latest figures, for the third quarter, show further progress. Revenue rose 4.3% to $31.5 billion, a respectable if unspectacular improvement. More importantly, pre-tax profit leapt 43% to nearly $8.4 billion and earnings per share at $1.41 beat analysts’ forecasts. Once again, the company raised expectations for the full year, with the acceleration of the roll-out of 5G across the US playing a key role.

Source: interactive investor. Past performance is no guide to future performance

Growth in full-year earnings per share is now likely to hit 4%, right at the top end of the guidance three months ago, taking the figure from $4.90 in 2020 to at least $5.35 this year. Service revenue edged up only 0.5% in the third quarter, but is likely to hit 4% growth in the final three months, while wireless equipment revenue is running 30% ahead.

Comparisons with 2020 will now be distorted by the sale of the Verizon Media arm, comprising Yahoo and AOL, to private equity outfit Apollo Global Management for $5 billion at the end of the third quarter.

AOL and Yahoo were early internet stars that failed to adapt to changing technology and consumer demands, allowing them to be squeezed out by the likes of Google and Facebook. Verizon bought AOL in 2015 and Yahoo in 2017 but failed to stop the rot. It is retaining a 10% interest in case Apollo can do better, but at least the distraction of running fading businesses is removed.

- Three of America’s top companies, but only one is a buy

- Subscribe to the ii YouTube channel for interviews with popular investors

Despite this progress, Verizon shares have slid for most of this year after hitting $61.55 last December and now stand at $53. Among disappointed investors is the fabled Warren Buffett, who bought in heavily at the start of 2021. He is, however, a patient man who will be proved right in due course.

Making more profit even when revenue falls is a good habit in a company and AT&T (NYSE:T) achieved that feat in the third quarter, almost doubling profits despite a 5.7% fall in revenue to just below $40 billion.

The $7.8 billion pre-tax profit figure was, however, deceptive, as it was boosted by $2.3 billion in one-off factors, while last year’s £3.9 billion total was trimmed by £231 million in exceptional costs. The genuine underlying rise was a still impressive 32%.

The shares topped $32 in May but are now at $25.50, where the yield is at a massive 8%.

Source: interactive investor. Past performance is no guide to future performance

Hobson’s choice: I suggested following Buffett’s lead in March when Verizon shares were around $55.75, with a buying price up to $58, and that advice still stands. I did say, however, that this was a share for dividends rather than capital gains and, with the yield currently at 4.7%, that comment also still stands. Buy AT&T up to $27, which looked like providing a floor in September and could be ceiling on the way back up. Even more so than at Verizon, the dividend is a comfort even if the shares fail to move higher

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.