Ways to protect your portfolio against spike in inflation

We discuss two potential catalysts for 70s-style inflation - and assets that offer a hedge against it.

18th October 2019 16:22

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

We discuss two potential catalysts for 70s-style inflation - and the assets that could offer a hedge against it.

Life on Mars: could inflation take us back to the '70s?

Thomas McMahon, senior analyst at Kepler Trust Intelligence.

We discuss two potential catalysts for inflation - and the assets that could offer a hedge against it...

Inflation has been relatively tame for the past two decades, yet history suggests it would be unwise to reject the possibility of a damaging period of higher inflation out of hand. Central banks' post-crisis quantitative easing policies have not led to the high inflation expected by some, but periods of high inflation in the past have been due to very different causes.

When looking at the historical record, we see clear signs that the threat of inflation cannot be written off, and so taking out an insurance policy might be wise. Below we consider the potential sources of an inflationary shock to the global economy, and some assets and trusts that offer protection.

Bomb boom

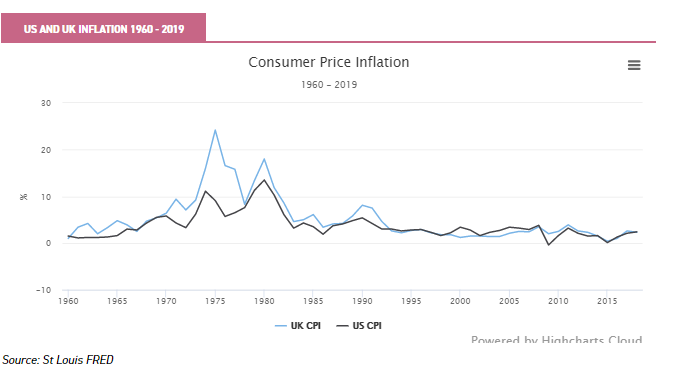

The baby boom that followed World War II saw the population in the developed world swell, bringing significant extra demand to the economy. While this was an inflationary force, it was only when this new generation began starting its own wars that inflation really took off. In the US and UK inflation was positive but moderate after the ructions caused by WWII had subsided.

Then, US inflation rose significantly following the increased government spending to pay for the Vietnam War. In the US, consumer price inflation was 6.4% in 1970, up from an average of 3.5% in the 1960s.

A second impetus behind inflation, more global in scope, came from the Middle Eastern conflict. The Yom Kippur War of 1973 led to the Organisation of Arab Petroleum Exporting Countries (OAPEC) implementing an embargo on oil sales to countries it saw as supporters of Israel against the Arab countries.

(The Yom Kippur War followed a surprise attack by Egypt and Syria aimed at gaining territory lost during the 1967 Six-Day War. The capitalist world supported Israel and the Soviet Union the Arab coalition.)

The resultant spike in the oil price had far-reaching consequences, including a major rise in US and UK inflation. In the UK, Consumer Price Inflation (CPI) rose above 10% in 1973 and remained in double figures for the rest of the decade (barring a slight dip in 1978). In the US, inflation rose from 6.3% in 1973 to 11% in 1974.

Source: St Louis FRED

Blood and oil

From the introduction of the oil embargo to its lifting in March 1974, the oil price rose from $3 to $12, or by 400%. In the US and UK fuel was rationed, and the UK introduced a three-day work week for a period.

Greater union activity in Britain provided further impetus to inflation and was one reason the UK average for the decade remained higher than the US.

The Iranian Revolution of 1979 provided a second oil price shock, as the production of this major exporter slumped. CPI in the UK in 1979 hit 17.3%, and in the US inflation peaked at 13.5% in 1980.

Since then, the UK has had one period of elevated inflation, from 1989 to 1991, with an average rate of 6.8%. This was kicked off in orthodox style by the economy expanding too fast after a boom caused by deregulation.

This was then compounded by the unwise decision of the UK to join the precursor to the euro, the ERM, which led to sterling coming under attack.

Everything in moderation

The period between the bursting of the tech bubble in 2000 and the 2007/2008 financial crisis has become known as the 'great moderation', as the chairmanship of Alan Greenspan saw the US enter a period in which growth and inflation remained moderate and the central bank seemed to maintain control of the economy. (Although in hindsight perhaps Greenspan helped contribute to the excessive risk-taking which led to the crash.)

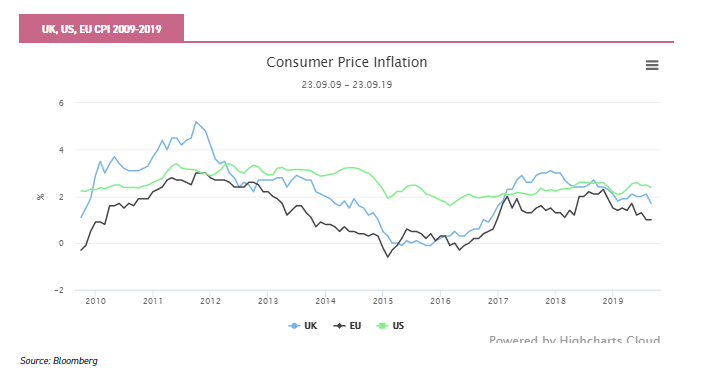

Through this period and after the crisis, inflation has remained muted in the US and UK. Indeed, a greater concern for policymakers in recent years has been keeping inflation high enough.

Source: Bloomberg

One reason for this is that the demographic picture has shifted across the globe, with the working age population in the developed world having peaked and started to decline. China is following us down this path too.

Another potential reason is the level of debt in the global economy is throttling investment in the real economy, which would otherwise lead to greater demand and therefore greater inflation.

We think it is worth considering that the debt burden is more important than the level of debt, and low rates mean the burden of interest payments is still relatively manageable.

However, a higher level of debt is still likely to make corporates and governments less keen to spend, as they may view their situation as more precarious.

Historical conclusions

Economic orthodoxy teaches us to expect a rise in inflation at the end of an economic cycle as the economy grows faster than its potential growth rate, which then requires rates to rise to throttle it and this in turn leads to a slowdown in economic activity.

However, in reality, this 'set piece' cause has not triggered the most worrying periods of high inflation since World War II.

Instead these can be traced back to fiscal expenditure (Vietnam, 1970s UK), political turmoil and union power (1970s UK, 1990s UK) and oil price shocks (the global experience in the 1970s).

History would also indicate that loose monetary policy has not been a major cause of inflation either – as is evidenced by QE so far not yet having led to a spike in inflation.

In our analysis, in the normal course of events, it would seem unlikely inflation will rear its head. However, the risks should it do so indicate that investors should be prepared at the very least.

The key issue is how? Building on the historic experience, we see two potential inflation risk vectors: politics and war. As we discuss below, both remain very live risks as a catalyst for an inflationary shock.

Politics

In our view, excessive fiscal spending is the most likely way we could get a sharp rally in inflation. Sentiment seems to have shifted against austerity and in favour of more government spending on both sides of the Atlantic.

In the US, Donald Trump has overseen a clear uptick in government spending from the relatively restrained Obama years. US government expenditure was $3.9 trillion in 2016 and is forecast to be $4.5 trillion in 2019.

Meanwhile, the Democratic presidential candidate race has seen major candidates make expensive spending pledges. Bernie Sanders has promised to make university education paid by the taxpayer, and Elizabeth Warren the same – with student debt forgiveness added on to the bill.

The Green New Deal, proposed by supporters of Sanders, would be even more expensive to the state, with an estimated cost of $10 trillion, according to its proponents.

While these are all policy proposals by candidates and a long way from law, both parties recently signed off on the Bipartisan Budget Act of 2019, which raised discretionary spending by $300bn, so fiscal expenditure is in vogue in the US.

For comparison's sake, in 2011 the US DoD estimated that the Vietnam War had cost roughly $950 billion in real terms, which would convert to £1.0 trillion in 2019 dollars.

Closer to home, it is clear that the current UK prime minister is leaning towards more spending (although exactly how much will be requisitioned from previous budgets is not clear).

Extra no-deal preparations funding is also new money, although at around £4 billion at most in total there is little chance of an inflationary impact from current commitments.

An upcoming election is likely to loosen the Conservative Party's fiscal spigots yet further. The Labour Party's policies pack even more of a punch, and the ongoing debate over Brexit may have led many to overlook how much they intend to spend.

The last Labour manifesto promised £50 billion in extra spending, with major commitments in the recent conference season being taxpayer-funded social care for all over-65s and a 'universal basic services' deal which seeks to extend the NHS model of taxpayer-funding.

Labour also promises to give unions more control over pay and conditions, which was a major cause behind the 1970s period of high inflation in the UK. Meanwhile, lurking in the background are the ideas of Modern Monetary Theory (printing money to pay for services) and Universal Basic Income (paying everyone for doing nothing).

War

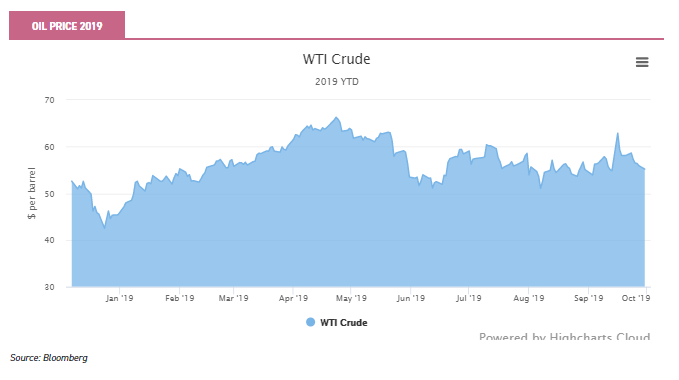

The drone attacks on Saudi Arabian oil facilities in September this year had an immediate impact on the oil price, sending it up to $68 from $60 (Brent Crude Spot) on an end-day basis, a rise of approximately 13%.

The price has already slipped back to $61, with Saudi Arabia being quicker than expected to restore production (at the time of writing the FT is reporting that 75% of capacity has been restored).

In the short term, the price is under control, although some managers tell us they are sceptical about how quickly the supply was supposedly restored and suggest reserves may have been used.

In any event, the risk remains that any sustained conflict between Saudi Arabia and Iran or its allies could see much of Saudi Arabia's product cut off.

On the other hand, the risk of a significant oil price shock may have reduced – in recent years, US shale producers have ramped up drilling when prices have spiked, which means global oil supply may be more elastic.

In the Permian basin, breakeven prices vary between $48 and $54, while the Federal Reserve Bank of Dallas estimates there is potential supply globally of 35 million barrels a day profitable at $60 or below (compared to 12 million barrels in total supplied by Saudi Arabia daily).

Whilst this may be reassuring, the US shale production industry as a whole is cashflow negative to date, which suggests it may not possess the ability to profitably produce as much oil as it claims it does.

Source: Bloomberg

Index-linked bonds - Ruffer and Capital Gearing

One way to protect a portfolio against a spike in inflation – however it is caused – is to buy index-linked gilts. These instruments have coupons and capital values which rise in line with RPI.

If inflation is higher than expected, holding index-linked bonds will do better than holding conventional bonds of the same maturity. The bonds with the longest maturities are more sensitive to inflation rising ahead of expectations. Ruffer Investment Company (LSE:RICA) holds significant positions in the two longest-dated index-linkers in the market: 6.9% of NAV in the 2068 bond and 6.2% in the 2062.

The managers, Hamish Baillie and Duncan MacInnes, believe that the current state of the world economy after the financial crisis means that an inflationary environment is likely, and governments are likely to encourage it, as it would allow current high debt levels to be reduced in real terms.

They have almost tripled their money in the long-dated gilts since buying them in 2009. RICA holds a total of 27.5% of its portfolio in index-linkers. We have published a full note on the trust this week.

Capital Gearing (LSE:CGT), run by Peter Spiller since 1981, is another trust with significant holdings in linkers. Like Ruffer, the trust has a mixture of UK and US inflation-linked bonds, with a total of 34% of the portfolio held in these instruments.

Peter and his team believe that any recession will be followed by more loose monetary policy that could see inflation spike. QE this time may take a different form, he opines, which raises the possibility of MMT, or 'helicopter money' – a form of money printing which would see the cash flow into the real economy rather than onto the balance sheets of banks as on the last occasion.

Property - BCPT and BREI

Commercial property as an asset class has long been established as providing protection against inflation. Property values have been found to appreciate in real terms in times of high inflation, although it is not a hedge in a pure sense (there is no direct impact on property prices from rising inflation).

While rents are not often directly linked to inflation, they are typically renegotiated periodically, with inflation rates being one input used to reset demands.

Within the commercial property sector, BMO Commercial Property Trust (LSE:BCPT) and BMO Real Estate Investments (LSE:BREI) stand out for their focus on core locations and high-quality assets, which implies a readiness for more troubled economic times.

At the current time, commercial property has been out of favour due to concerns about Brexit and the retail sector. However, we note that discounts on the sector have moved considerably wider this year, which may mean there's a value opportunity here for the long-term investor.

And should there be any more positive resolution to the Brexit impasse than no deal, we think that given the generally sound state of the UK economy, a spurt of investment could follow, which could drive up inflation and close their discounts to NAV.

Real assets with an inflation link - JARA and UKW

A more diversified portfolio of real assets is offered by new launch JPMorgan Global Core Real Assets (LSE:JARA). JARA raised £149 million at IPO to invest in privately-owned real assets spread across US and Asian real estate, global infrastructure assets and global transport assets, with another allocation to listed real estate securities.

The infrastructure assets offer more of a direct link to inflation than real estate, as their prices are typically linked to inflation through regulation or contractual agreements allowing prices to be raised (utilities or toll roads, for example).

Other assets typically have pricing power (operating in near-monopoly environments) which allows them to pass on inflationary costs (ports, for example). JARA is targeting a 4%-6% yield when fully invested, and 2%-3% in the first 12 months.

Greencoat UK Wind (LSE:UKW) invests in wind farms and generates cashflows with a strong inflation link. Around 50% of its earnings are directly indexed to inflation, with the rest driven largely by electricity prices.

The latter should have a strong link to inflation too. Since launch, the trust has consistently grown its payout ahead of inflation, and yields 5% on a prospective basis.

The company also aims to maintain the NAV in real terms, rather than merely nominal. As such, reinvesting cashflows in assets which provide attractive returns is crucial to the company achieving its objectives, as we discussed in our recent note on the trust.

Gold - Ruffer, Personal Assets and BlackRock World Mining Trust

Another asset often used as an inflation hedge is gold bullion. In this role its effectiveness has been much exaggerated, and there is no long-term correlation between inflation and the price of gold.

However, in times of high inflation, such as the 1970s, gold prices have spiked. The historical record suggests it is as much of an uncertainty hedge as an inflation hedge, however. For example, gold saw strong returns during the eurozone crisis of 2011/2012, during which eurozone CPI didn't rise above 3%.

Gold therefore does have a potential role as a tail risk hedge, including as a hedge against a dramatic spike in inflation. As such, RICA has an 8.2% weighting to gold and gold equities.

Another trust to hold gold is Personal Assets (PAT), which has 8.1% in bullion. The manager, Sebastian Lyon, believes that debt levels in the developed world will need to be reduced through inflation or default, and gold will provide a hedge against either scenario. It is no surprise to see that it also contains a significant position in index-linked bonds – 27.8% in US TIPS, and 3.3% in UK index-linkers.

BlackRock World Mining Trust (LSE:BRWM) offers even punchier gold exposure. The trust has doubled exposure up to 26.6% over the past year, taken through the miners rather than directly in bullion.

When we met the managers recently, they told us that they view gold as the ultimate safe haven asset in times of stress. Furthermore, it is more attractive than in past cycles as interest rates are so low, meaning that the other classic safe havens (high quality bonds) are largely negatively yielding, whether in real or nominal terms.

The trust currently trades on a hefty discount to NAV of 15% and yields 5.2%. We will be publishing a full update on the trust next week.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.