We just bought this UK fund, but cut back on old faithfuls

Brexit activity is affecting the pound, so Saltydog analyst has been buying and selling these funds.

28th October 2019 10:26

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Brexit activity is affecting the pound, so Saltydog analyst has been buying and selling these funds.

Brexit activity is affecting the pound, so Saltydog analyst has been buying and selling these funds.

As well as providing market analysis and performance data each week, Saltydog Investor also run a couple of demonstration portfolios. These were initially launched to help show how the data that we produce can be used to build a balanced portfolio.

To control the overall volatility of the portfolios we invest in a mixture of funds from the various different Investment Associations sectors.

First, the sectors are grouped together based on their historic volatility. The groups are:

- Safe Haven – very low risk, but also very low returns.

- Slow Ahead – normally a low risk level and often with adequate returns.

- Steady as She Goes – generally medium risk, with potentially higher returns.

- Full Steam Ahead – higher risk, with potentially the best returns. There are quite a few sectors that fall into this risk category and so we split them into Emerging Markets and Developed markets.

This year, our largest holdings have been in funds from the 'Mixed Investment 40-85% shares' sector, from our 'Slow Ahead' Group. We first started investing in these funds at the beginning of February.

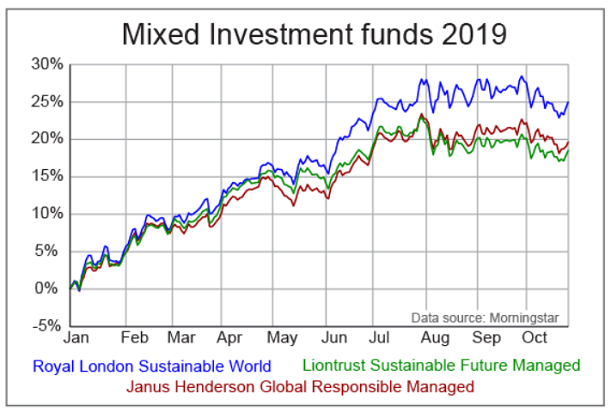

The three funds that we chose were Royal London Sustainable World fund, the Liontrust Sustainable Future Managed fund and the Janus Henderson Global Responsible Managed fund.

They performed relatively well up until the beginning of August, but then levelled off for a couple of months and have gone down in the last few weeks.

These funds are allowed to invest in bonds and equities from all around the world. Because of their exposure to foreign investments, there is a currency risk. If the pound strengthens, then any overseas earnings are automatically devalued. This has had a negative impact on these funds during October.

We've already reduced our holdings in some of these funds and cut them further last week.

In last week's analysis, the UK Smaller Companies sector from our 'Steady as She Goes' Group had the best one-week performance. We've been increasing our exposure to UK funds since the end of September and last week added the Franklin UK Smaller Companies fund to our portfolios.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.