Where to invest in Q1 2022? Four experts have their say

21st January 2022 09:07

by Jim Levi from interactive investor

Our panellists have upped their allocation to cash to both protect and take advantage of market volatility.

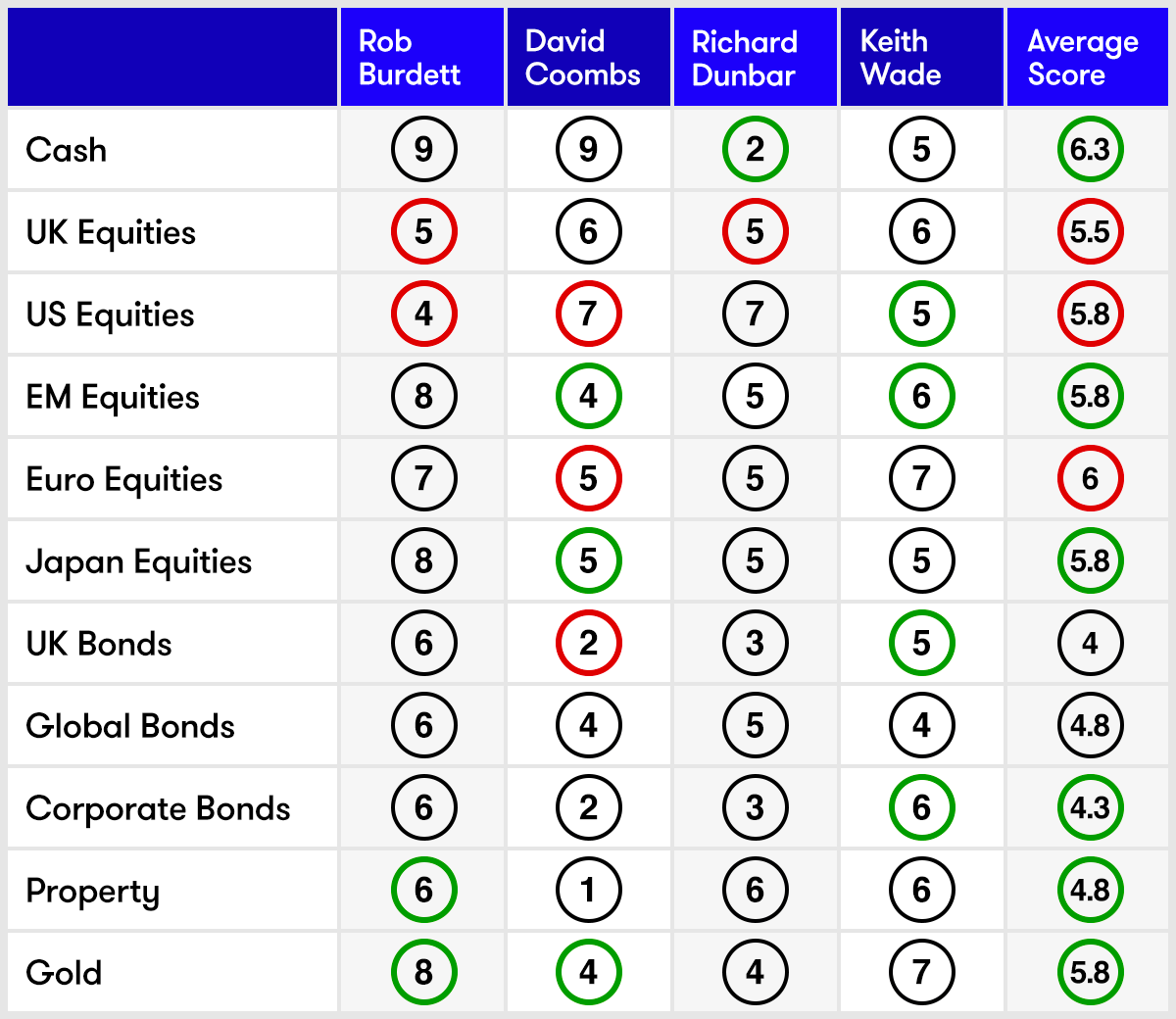

For the first time I can remember (probably for the first time ever) cash has become the most favoured sector in our quarterly asset allocation survey, which I have been writing for around a decade. An average score of 6.3 with two panellists (David Coombs at Rathbones and Rob Burdett at BMO both scoring 9) aptly reflects the nervousness about what will happen this year as the cost of living rises and central banks threaten higher interest rates.

“We are in for a pretty perilous ride over the next couple of quarters,” says Coombs. “You absolutely have to have cash at this time because markets are going to be volatile. If you have cash, volatility is your friend. If you do not have cash, it is your enemy.”

Going into cash means less emphasis on equities: the panel’s average equity scores for the UK, the US and Europe (ex-the UK) have all been slightly shaved back. The other side of the coin is that traditionally more defensive sectors - gold, property and corporate bonds - now have slightly higher average scores.

The last time I did this survey - back in mid-October - nobody had even heard of Omicron. That was a genuine bolt from the blue although virologists had predicted that this pandemic’s ‘end game’ might be a milder akthough highly transmissible variant of the virus.

“I hope this is where the pandemic turns endemic and in three months’ time we are not talking about another variant and another Greek letter of the alphabet,” says Coombs.

- Funds and trusts four professionals are buying and selling: Q1 2022

- Four big fund trends in 2021, how will they fare next year?

- Bull and bear points for major equity markets at start of 2022

Meanwhile, Omicron continues to hinder the global recovery. Bottlenecks at major ports remain a problem. According to Keith Wade at Schroders one in 10 workers at the Port of Long Beach in California is off with the virus. “On the other side of the Pacific, the big Chinese port city of Tianjin is in lockdown,” he says.

There are enough reasons to think global equities are overdue for a correction. But then we thought that at the start of 2021 when the virus was raging, and the vaccine roll-out had only just begun. “Instead we got double-digit returns on risk assets like equities and even government bonds turned out not to be as weak as expected,” abrdn’s Richard Dunbar points out.

This year however, Dunbar does not believe he will be getting such good returns. “We are looking for decent global growth this year and next,” he says, “but that growth will be less than we were expecting a few months ago. The growth/inflation blend will not be such an attractive cocktail this year and therefore we expect more modest returns from equities.” He stays overweight the US with a score of 7 (a score of 5 is neutral). But, having trimmed his UK score from 6 to 5, he is neutral in all other equity sectors.

Burdett has a different approach. His caution is reflected in a high cash score and a score of 8 for gold. He has also cut his UK equities score to 5 and gone underweight in US equities, with a score of 4.

“Overall, we are cautious not bearish,” Burdett says. “It would be great if we are starting to see the end of the pandemic, but we are seeing signs of some of the froth coming off the equity markets. For example, unprofitable technology stocks on the Nasdaq market have fallen sharply since the autumn. Interest rates are rising so we think it prudent to hold cash at high levels.”

- A guide on how investors can protect against inflation

- Interview: Ian Cowie on inflation, value stocks, and healthcare

- Tactics the pros use to combat rising levels of inflation

But his enthusiasm for Japan remains undimmed, despite the undistinguished performance of that equity market last year. He remains overweight also in Europe, where unlike the US and the UK he does not expect interest rate rises.

He scores an 8 for emerging markets. “Rising inflation in developed markets is quite good for emerging markets,” he argues. “I see value there and the other big attraction is the technology component of Asian emerging markets is now about 30%. Ten years ago, it was almost zero.”

One issue he is highlighting among investment professionals is the growing concern about environmental, social and governance (ESG) issues - so-called sustainable investing. “We see it in the oil giants trying to re-position their businesses and we hear of big investors deciding to get rid of all the cement content of their portfolios because they are major emitters of carbon dioxide,” says Burdett.

Wade stresses the simple point that higher inflation reduces real growth. “We already have evidence of that from weak US consumer sales in early January,” he says. “Inflation is squeezing real incomes and it is going to get worse.”

He hopes that by the summer the outlook will look better. “But we are in for a bit of a difficult period before we get to those sunnier uplands,” he says. “And Omicron is going to make supply chains worse before they get better.”

Although he keeps a cash score of 5 he is by no means bearish on equities - retaining overweight positions in Europe and the UK, while raising his scores by one for the US and emerging markets, to 5 and 6. “I didn’t feel comfortable being underweight in the US,” he says.

Wade’s most intriguing move is to double his score from 3 to 6 for corporate bonds. “We have changed our view here and we are primarily interested in investment grade bonds, particularly in Europe.” He has also raised his score for UK bonds from 4 to 5.

All this is based on his view that central banks don’t have to squeeze too hard to get inflation back under control. Those views find an echo with Coombs, who also thinks the central banks’ bark is often worse than its bite.

“We think there will be much less tightening than markets currently expect,” he says. “We see interest rates rising but the peak will be much lower than markets are anticipating. In recent years, the US Federal Reserve has learned to talk tough but has acted a bit less tough and I suspect that will be the pattern from here on.”

He adds that central bankers are well aware of the position of heavily indebted companies where, on the one hand, inflation has the effect of reducing their debt burden but, on the other, too high a level of interest rates can make them go bust.

Containing inflation would be warmly welcomed by bond investors, as increases in the cost of living erodes the value of the income that bonds pay.

Coombs remains overweight in the US and the UK, while edging up his scores in emerging markets and Japan but trimming Europe to a neutral 5. Unlike Wade, he has little time for fixed-interest investment and keeps his corporate bonds score at 2.

- Watch our latest fund manager interviews by subscribing for free to the ii YouTube channel

- Top-performing fund, investment trust and ETF data: January 2022

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

He admits that the Rathbones team has talked a lot about gold. “It has not proven to be much of an inflation hedge in recent weeks ,” he says. “Gold does not like US interest rate rises.” But he does feel it could be a hedge against geopolitical crises in the Middle East or over Ukraine or Taiwan. He grudgingly raises his score from 3 to 4.

There is consensus among three panel members over the property sector - all with overweight scores despite the problems created in retail and office sectors by the growth in online shopping and working from home.

Dunbar has gradually raised his property score from 3 to 6 over the past year. “We are now even seeing transactions and values being established in some of the less attractive areas of the property market,” he says.

Overall, the panel has opted for marginally less risky portfolios with probably lower returns expected from equities with more cash on the sidelines to deal with the bumps in the road they are definitely expecting. “Expectations are really now more modest than they have been for some time,” says Dunbar.

Note: the scorecard is a snapshot of views for the first quarter of 2022. How the panellists’ views have changed since the fourth quarter of 2021: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is co-head of multi-manager at BMO Global Asset Management and a research team leader.

David Coombs is head of multi-asset investments at Rathbones.

Richard Dunbar is head of multi-asset research at abrdn.

Keith Wade is chief economist and strategist at Schroders.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.