Where to invest in Q3 2023? Four experts have their say

18th July 2023 08:10

by Jim Levi from interactive investor

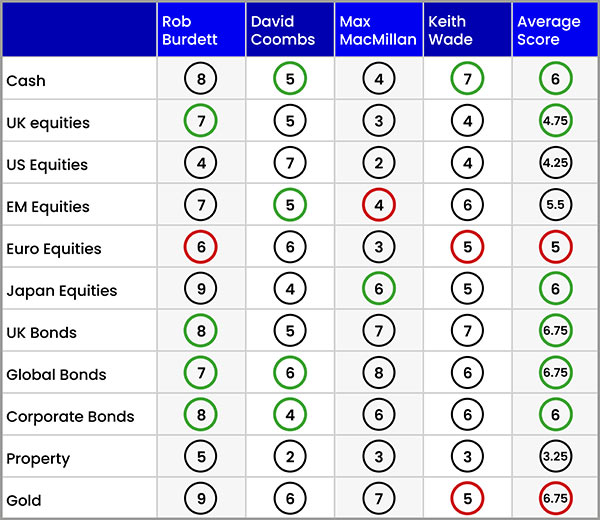

Our panellists are finding more value in bonds than equity markets, and are not carried away with the mania surrounding artificial intelligence. Jim Levi runs through the latest views across the main asset classes.

One of the bravest decisions a fund manager can make is to decide to go underweight US equities - such is Wall Street’s dominant role in global financial markets.

In our last asset allocation survey, published in April, three out of four of our panel held those underweight positions. To be fair, Keith Wade of Schroders, sensing what might happen in the second quarter of this year, did edge his US equities score up from 3 to 4.

- Invest with ii: Top ISA Funds | FTSE Tracker Funds | Open a Stocks & Shares ISA

But the damning clarity of hindsight is inescapable. Now the Wall Street stance of Rob Burdett at Columbia Threadneedle and Max MacMillan at abrdn, as well as Wade, now seems more foolhardy than brave. Driven by a reviving fashion for big technology stocks such as Tesla (NASDAQ:TSLA), Meta (NASDAQ:META), Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) and NVIDIA (NASDAQ:NVDA) (the darling of the artificial intelligence fans) the S&P 500 index rose nearly 10% in the second quarter.

MacMillan is not going to change his position now on US equities, and neither are Burdett or Wade. MacMillan says: “We think the latest rally has been overdone with its emphasis on technology stocks looking unsustainable.”

Wade suggests the mania for shares with an AI connection - Nvidia shares have trebled in the past year - may be overdone. However, he is for now stopping short of calling it a bubble.

- Equity: is this tech rally the real thing?

- The funds and investment trusts profiting from AI excitement

In the meantime, MacMillan claims support from respected Goldman Sachs guru Peter Oppenheimer. “His research has found that it is not unusual for equity markets to have a final hurrah in values before a downturn and it is associated with quite a narrow performance in growth stocks,” points out MacMillan.

This is clear when you compare the second-quarter performance of the Dow Jones Index (up only 4.6%), with the Nasdaq Composite index of growth and technology stocks (up 15.2%).

At any rate MacMillan is sticking to his bearish guns and holding his US equities score at 2. He says: “Timing a setback on Wall Street is treacherous but our view remains that the US will go into recession at about the turn of the year.”

Burdett has been underweight US (with a neutral score being five) for some time. He admits it looks wrong. But again, he is sticking to his score of 4. He says: “I am cautious not bearish and with my cash score high at 8, I stand ready to buy stocks if the market does a whoopsie.”

US recession expected to be mild

Burdett agree that a recession is coming, although he notes this has got to be the most predicted recession ever.

He adds: “Ever since the financial crisis 15 years ago, governments and central banks have tended to step in whenever there was a problem to bale out the affected area.” He suspects that game is now over.

Wade holds his score at 4, admitting the US economy has shown more resilience than expected. “We have raised our growth forecast for the US economy for this year from 0.3% to 1.5%, but we still think a recession will happen, but it will be mild and postponed to next year.”

Wade forecasts zero growth for the US next year. He adds: “It will be a mild recession. There will be higher unemployment and a lower rate of inflation.”

David Coombs at Rathbones was the only panel member to stay overweight US equities with a score of 7. “It was a good call and it helped that we hedged the currency because the pound has been strong against the dollar,” he says.

Coombs stays at 7 now because, in his view, there is a risk that the much-forecast recession will not happen. He adds: “I admit US growth stocks are expensive, but I am willing to pay the price for that superior growth. I look at the list of those growth stocks and I have decided those are the sort of companies I want to invest in.”

Coombs also proved the odd man out in bond markets back in April. He kept his scores both for UK bonds and global bonds at a neutral 5, while lowering his score for corporate bonds to 3.

- Why Terry Smith sold Amazon, and how his portfolio is performing

- Merryn Somerset Webb: the scariest chart in the world

That again proved a good short-term call as the whole fixed interest sector had a poor second quarter as interest rates rose and worries about inflation persisted. His view then had some support from Burdett, who took some profits in bonds last time although remaining a touch overweight.

Now all the panel members seem convinced fixed interest markets may soon hit the recovery road on hopes interest rates and inflation levels may be near their peak. Burdett raises all his bond scores, giving gilts a two-point boost to 8. “I think you can lock in the high yields on bonds now with inflation coming back under control,” he says. Even the sceptical Coombs has now gone overweight in global bonds. MacMillan, however, is more cautious.

Has the time come for the Land of the Rising Sun?

Japanese equities outperformed all other major markets in the April to June quarter as the central bank refused to follow the US and Europe’s central banks on rising interest rates. At one point, the Nikkei 225 Index hit a 33-year high as the yen weakened to boost prospects for Japanese exporters. This proved an eventual vindication of Burdett’s long-held view that Japanese equities offered the best value. He kept his score at 9. Other panel members are much more cautious although MacMillan - underweight in all other equities - pushes up his score for Japan from 5 to 6.

- Should you invest in Baillie Gifford funds or investment trusts?

- Beyond wealth preservation trusts, nine other defensive options

Wade thinks the Bank of Japan will soon have to tighten up its policies and raise interest rates. “That might be quite a shock for the equity market and end the weakness of the yen,” he says. He keeps his score at 5. Coombs supports that caution. Japan is the only equity sector where he is underweight.

Outlook for other equity regions

Enthusiasm for Europe’s equity markets has become more muted. Both Burdett and Wade have edged their scores lower. Wade says: “The story that Europe and Germany in particular might benefit from a recovery in China has seemed to have run out of steam.”

UK equities are slightly more supported than American shares but only Burdett is overweight - upping his score to 7. “There are some signs now that inflation is on the wane and that could soon start investors looking for interest rates to peak. Valuations look cheap.”

Even though generally bearish on equities, MacMillan acknowledges the longer-term attractions of the UK. He notes: “It is not expensive and could outperform other markets and should deliver superior returns. But looking at what is in front of us now, we think the Bank of England’s policy on interest rates will roll the economy over into recession.” He scores a 3.

While the property sector remains the most out of favour - “it is in a complete mess,” says Coombs - gold remains well supported, Wade is a bit mystified by the continued strength of the yellow metal given the recent recovery in real interest rates. Perhaps that simply reflects the heightened fears of a geopolitical nightmare being triggered by the war in Ukraine.

Note: the scorecard is a snapshot of views for the third quarter of 2023. How the panellists’ views have changed since the second quarter of 2023: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is head of multi-manager solutions at Columbia Threadneedle Investments.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at abrdn.

Keith Wade is chief economist and strategist at Schroders.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.