Why Fundsmith Equity Fund makes it onto our buy list

23rd January 2019 12:20

by Dzmitry Lipski from interactive investor

Our investment analyst explains in detail why he likes this popular fund and its manager Terry Smith.

Fundsmith Equity Fund was the most-bought fund on the interactive investor platform in 2018, and also forms part of our Super 60 list – a range of active and passive funds, investment trusts and ETFs identified by the interactive investor Investment Committee.

This is why the fund deserves its place among our high-conviction investment ideas.

Background

The Fundsmith Equity Fund was launched in November 2010 and is managed by Terry Smith. The manager targets long-term growth by investing in developed world equities. He invests in a concentrated (around 20-30 stocks) portfolio of large, liquid stocks (market cap greater than $2 billion) then holds them for the long term - this is a buy-and-hold strategy.

The fund is invested in "quality growth" (defensive) companies that are able to sustain high rates of return on capital, in cash, often through intangible assets such as brands or franchise that deter competition. Therefore, consumer staples businesses feature heavily in the fund.

The manager focuses the investment case on individual companies rather than basing investments on his outlook for the economy or particular sectors.

Why we recommend the fund

Terry Smith is one of the best-known managers in the UK, who has developed a very strong track record on this fund. He has had a long and distinguished investment career and is sometimes referred to as "the English Warren Buffett". He has also written a bestselling book, Accounting for Growth, which examined why a number of high profile FTSE 100 companies went bust in the nineties.

Prior to setting up the Fundsmith business in 2010, he was CEO of Tullett Prebon and the advisor on their successful pension fund from 2003 to 2014.

This is high conviction concentrated strategy that could deliver good returns for investors over the longer term. As at 31 December 2018, there were only 28 stocks in the portfolio with an active share of 92%. As a long-term strategy, the portfolio turnover is very low (less than 5% per year).

At country level, fund exposure to the US market is 63.6% with weightings of 18.8% for the UK and 16.7% for Europe. The main sectors of focus are in Technology (30.8%), Consumer Staples (27.0%), and Healthcare (25.4%). The manager is still avoiding economically-sensitive sectors such as consumer discretionary, industrials, finance, energy and materials.

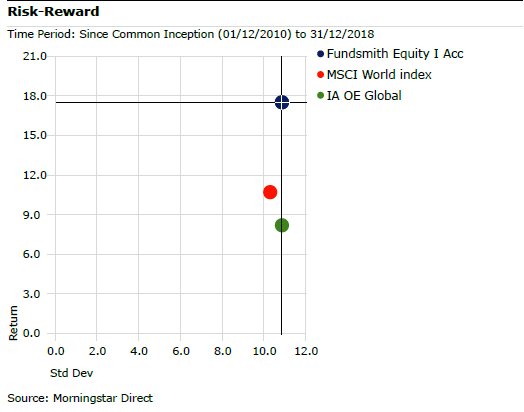

The fund has delivered strong returns and beat its Investment Association (IA) Global sector and MSCI World index benchmark in every full calendar year since inception. Among its peers, the fund stands out as the best performer not only on an absolute return basis but also on a risk adjusted basis.

| 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | Since Inception - 01/12/2010 | |

|---|---|---|---|---|---|---|---|---|---|

| Fundsmith Equity | 2.3 | 22.09 | 28.34 | 15.98 | 23.62 | 25.64 | 12.8 | 8.46 | 267.69 |

| MSCI World | -3.04 | 11.8 | 11.8 | 4.87 | 11.46 | 24.32 | 10.74 | -4.84 | 127.35 |

| IA OE Global | -5.72 | 13.87 | 13.87 | 2.85 | 7.05 | 21.79 | 9.66 | -9.34 | 89.19 |

Source: Morningstar Direct as at 31st December 2018. Total returns in GBP. Past performance is not a guide to future performance.

Past performance is not a guide to future performance

The fund is reasonably priced for an active strategy. The ongoing charges figure is 0.95%.

The fund is a very popular choice among retail investors. The disciplined process, the fund's strong returns and the manager's experience has led to a surge in inflows in recent years. The fund reported total assets of £15.8 billion at the end of December.

We acknowledge the following potential risks for investors

Manager track record: The manager's track record running the strategy is relatively short (since 2010) and he is currently considered untested in prolonged bear market. That said, Smith’s experience at Tullett Prebon demonstrates his ability to add value over the longer term in different market conditions.

Portfolio concentration: The fund operates a concentrated portfolio in terms of both the number of holdings and with respect to sector bets, allowing each investment to make a significant impact on returns. This is a higher-risk strategy as the fund could deliver good returns for investors while defensive sectors continue to perform well, but performance could be affected when these areas begin to lag.

Valuations: The growing belief that the world economy will continue to experience a combination of low but positive growth with low inflation has been good for bonds and for high-quality global companies. In times of uncertainty these companies provide investors with stability and in many cases a rising dividend. Therefore, some investors are concerned about the level of its significant outperformance and about valuations in this area. Looking at the fund’s performance attribution since inception, it is evident that fund outperformance has been driven by both bias to consumer staples and healthcare as well as strong stock selection by the manager.

Changing return environment: The fund could experience less favourable market conditions if the interest rates start to normalise as the world economy enters a more sustainable growth path. Defensive high-quality equities tend to underperform as central banks begin to tighten monetary policy and bond yields rise. While the funds’ performance was hurt during the 'Taper Tantrum' in 2013, when bond yields rose quite sharply, and consumer staples were among the hardest hit, the fund held up well in 2016 outperforming its peers and the benchmark when there was a very strong rotation from growth stocks into value.

Role in ii Super 60

The manager's investment horizon is long term and relies on building a high-conviction portfolio of quality growth stocks unconstrained by benchmark, geography and sector. Therefore, the portfolio will not outperform in all market conditions. This means that in some market conditions, quality growth investing will underperform other approaches. Sometimes low-quality cyclicals beat quality, or value beats growth. In all such cases, it has nothing to do with manager strategy, but is simply a case that this preferred market is out of favour.

The quality growth strategy employed by the Fundsmith Equity Fund can be diversified by blending it with other funds that carry different characteristics, styles or market cap such as Artemis Global Income - a value-focused fund, or SLI Global Smaller Companies - a global small-cap fund.

If you enjoyed this article, you may also like other funds picked for interactive investor's Super 60 range of high-conviction investment ideas. Click here to find out more.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.