Why Saltydog investor just added to three core holdings

A few key funds have just driven one of Saltydog’s demonstration portfolios to an all-time high.

29th June 2020 12:27

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

A few key funds have just driven one of Saltydog’s demonstration portfolios to an all-time high.

The Saltydog principles of investing are remarkably simple. We’re not greedy and trying to double our money every couple of years, and we’re not claiming to have a magic system which can conjure up ten-baggers like pulling rabbits out of a hat.

What we do believe is that, by actively managing your investments, you can take control of your financial future, limit the amount of risk that you are taking, and get better results than by sitting back and doing nothing.

To eliminate the risks associated with owning shares in individual companies, we advocate investing in funds.

There are tight guidelines controlling how funds are operated and what they can invest in - especially for Unit Trusts and OEICs.

For example, if you manage a UK All Companies fund, you have to invest at least 80% in UK Equities ... no ifs, no buts.

This is great because as an investor you know what a fund is investing in, but it does create another problem. If the sector is underperforming, then the chances are that all of the funds in that sector will be struggling. It’s hard work fighting against global macro-economic trends.

That’s why we believe in identifying the best-performing sectors first and then investing in the top funds from those sectors.

For some people that may be enough, but there is a further consideration - the faster things go up, the quicker they may fall.

That means that if you’re always chasing the top sector you may be in for a bumpy ride, so you must be able to take the rough with the smooth. It also raises the question of whether the increased risk associated with the most volatile funds is always worth it.

That’s why we introduced the Saltydog Groups.

- Safe Haven

- Slow Ahead

- Steady as She Goes

- Full Steam Ahead

The nautical names of these groups give an easily recognisable indication of the volatility of the sectors and funds that are allocated to them. When markets are doing well, the funds in the ‘Full Steam Ahead’ Groups will do better than those in the ‘Slow Ahead’ Group, but they will fall further when markets turn south - we’ve seen this happen consistently over the years.

In our demonstration portfolios we hold some core funds from the ‘Slow Ahead’ Group to help limit the overall volatility.

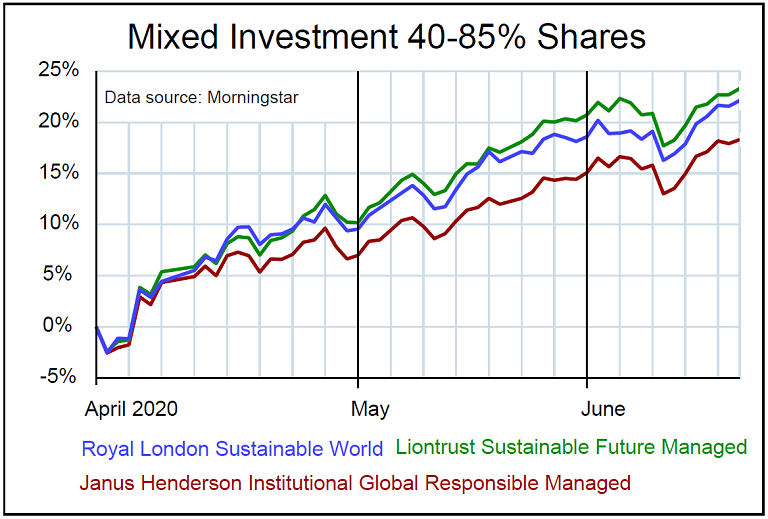

For almost 18 months our three largest holdings have come from the ‘Mixed Investment 40-85% Shares’ sector and are:

- Janus Henderson Institutional Global Responsible Managed

- Royal London Sustainable World

- Liontrust Sustainable Future Managed

We first went into these funds in February 2019, and they were the last funds that we sold at the end of February/beginning of March this year when stock markets around the world started to collapse.

At the beginning of April, we began reinvesting in these funds and have been gradually increasing our holdings. They’re up by over 15% in the last three months.

Past performance is not a guide to future performance.

Last week we added to them again.

These funds have been instrumental in the recovery of our demonstration portfolios. When we reviewed them last week the Tugboat was just ahead of where it was at the beginning of the year and the Ocean Liner was at an all-time high.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.