Why stockmarket investors should go global in 2019

21st January 2019 10:31

by Tom Bailey from interactive investor

We reveal the best investment ideas worldwide and likely danger zones for equity investors this year.

This article was written in early December, before the December sell-off. Market figures are likely to have changed since.

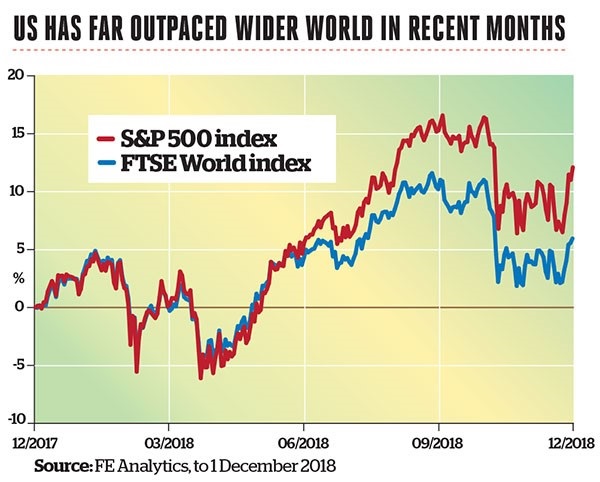

United States

"US stocks should end 2019 in the red," says Luca Paolini, chief strategist at Pictet Asset Management. The US market, he notes, is the most expensive in the world – but this won't last.

First, US economic growth may start to stumble in 2019. "Declining business, consumer and investor confidence, as well as potential for more monetary tightening, set up a challenging environment," he says. Second, US earnings growth is due to slowdown significantly. He adds: "We expect US corporate growth to more than halve in 2019 from this year's 2% – the biggest drop among the major regions – as the effect of president Donald Trump's tax cut wanes."

Paolini is more bearish than most market commentators. Nevertheless, he has identified two serious concerns for most market-watchers considering the prospects for the US in 2019: weakening economic and corporate earnings growth.

Kelly Bogdanova, a portfolio analyst at Royal Bank of Canada, believes economic and earnings growth should push market prices moderately higher in 2019. She says:

"We think the economy will grow by more than the 2.3% average. Our forward-looking indicators are signalling that the expansion will persist for the next 12 months."

That, she adds, should support earnings, despite expected slower earnings growth in 2019. "Year-on-year comparisons with 2018’s white-hot growth rates will be challenging. But we think S&P 500 earnings can grow at a rate of mid-to-high single digits because of the strength in the economy."

Another factor on investors' radars is US Federal Reserve policy. The strength of the US economy led the Fed to maintain the pace of its steadily tightening monetary policy, causing a few wobbles in US equity markets. But will it keep tightening in 2019? That depends on the continued strength of the US economy and on inflation expectations. If growth drops off, the Fed may ease its tightening, which should support stocks – although, countering this, a drop in growth would hurt US stocks.

Risk round-up

On the other hand, if the US economy roars ahead again, the Fed will continue on its course, potentially adding to stockmarket volatility.

Mark Sherlock, head of US equities at Hermes, notes that, while the underlying domestic economy "appears robust", increased stockmarket volatility could be on the way. Behind this volatility, he says, "will be concerns about the timing and pace of interest rates rises, and the effect a reduction in liquidity will have on asset prices and company earnings".

Peter Westaway, chief economist and head of investment strategy at Vanguard, believes the Fed will stop tightening mid-year. He notes that as the benefits of expansionary fiscal and monetary policy abate, US growth in 2019 should fall to a more sustainable level of 2%.

Following the dramatic rises and falls in the prices of major tech stocks in 2018, the sector’s robustness for 2019 is questionable. Several factors seem set to bedevil big US tech firms in the year. The sector is vulnerable to interest rate hikes, which make bonds more attractive compared with equities and leave relatively highly valued tech stocks looking stretched. Adding to fears are the US/China trade war – which is forcing the costly rerouting of global supply chains – and the threat of further regulatory scrutiny of tech firms. Falling unemployment in the US is also a potential drag, as evidenced by Amazon recently agreeing to raise its minimum wage.

Aneeka Gupta, associate director of research at WisdomTree, says:

"We remain cautious following the recent tech sector sell-off and favour more defensive sectors such as healthcare, utilities and consumer staples."

Bull or bear?

Bull case: the US economy is still going strong and should remain solid into 2019. Despite the waning fiscal stimulus, the strength of the economy should help underpin continued earnings growth.

Bear case: as the boost to earnings from Trump’s corporation tax cut loses its impact, earnings growth is likely to slow, undermining the US's already highly valued market.

How to buy the US

S&P 500 exposure is a basic building block for many investors' portfolios. Trackers for this market offer some of the lowest fees around: the Vanguard S&P 500 ETF (LSE:VUSA) has an ongoing charge of just 0.07%. However, investors may want to consider other routes to passive exposure to the US market. If you believe growth stocks such as tech shares are now due a tougher time and that there will soon be a shift to value shares, the iShares S&P 500 Value ETF offers a way to play that rotation.

interactive investor's Super 60 investments list includes the Vanguard US Equity Index Fund.

For more investment ideas click here.

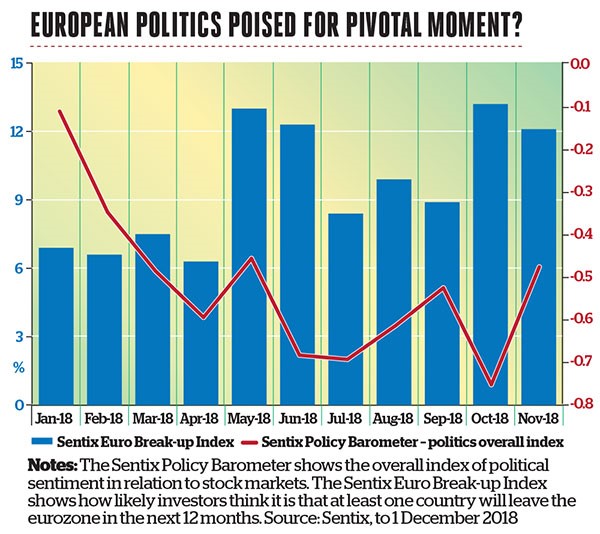

Europe

Political risks loom large

At the start of 2018, hopes were high for Europe. Growth was expected, while the election of Emmanuel Macron as president of France seemed to herald an end to Europe's populist outburst. But events soon derailed this narrative. Populist politics continues to attract support while growth has disappointed – a situation likely to persist in 2019.

James Bateman, chief investment officer for multi-asset at Fidelity International, identifies two key political risks: Italy's budget dispute with the EU, and the contest to replace Angela Merkel when she steps down in 2021. Regarding the latter, the concern is over a lack of a clear successor to Merkel. Moreover, the handful of candidates vying to succeed her might ramp up the rhetoric in a bid to differentiate themselves from rivals, spooking markets. Bateman says:

"They could also take a tougher stance on the EU. Do I think this could sway markets? Yes I do."

The elephant in the room, however, is Italy's showdown with the EU. The dispute over Italy's budget has not been fully reckoned with by Italian markets. This is a risk also noted by Stéphane Dutu, a fundamental risk analyst at Unigestion, a boutique asset manager. He says:

"Should Italy's budget deficit be larger than the EU thinks is reasonable, this could destabilise Italy's financial markets and economy."

Meanwhile, Europe's economy is sensitive to the performance of the US and Chinese economies. James Rutherford, head of European equities at Hermes, says:

"The potential for a full-blown US/China trade war has affected the region perhaps more than any other developed region."

George Lagarias, chief economist at accountancy firm Mazars, says equities could start the year well if volatility subsides, as investors can buy large-cap names at decent valuations. But, he adds:

"We would be wary in the second half, when slowdown in China and the US could damage profitability."

However, despite the political risks and general gloom, Rutherford believes there is upside for Europe. He suggests a weaker euro "could be a tailwind for European firms," especially exporters. Despite general weakness, moreover, Europe is set to deliver earnings growth in 2018.

Paolini suggests specific industries may appeal to investors.

He says:

"Investors should be able to uncover opportunities in sectors such as financials, and in cyclical industries where valuations have improved, such as energy."

There may be a bullish case to be made for property in Europe. Rogier Quirijns, manager of the Cohen & Steers European Real Estate Securities fund, says that following the fallout of both the 2008 crash and the European sovereign debt crisis, Spain's economy has picked up due to "structural labour reform, surging exports and a revitalised service sector". This has driven up demand for office space, particularly in Madrid.

Bull or bear?

Bull case: a weaker euro could help certain regions and sectors by boosting exports.

Bear case: Populism will continue to destabilise the continent.

How to buy Europe

The iShares STOXX Europe 600 ETF tracks 600 stocks, about 98% of the developed Europe market, providing broad access to European equities.

The tracker's ongoing charge of 0.2% makes it relatively cheap. You may prefer to opt for a more concentrated holding through the iShares Core EURO STOXX 50 ETF, which has an ongoing charge of just 0.1%.

interactive investor's Super 60 investments list includes the low cost Vanguard FTSE Developed Europe ex UK ETF (LSE:VERX).

For more investment ideas click here.

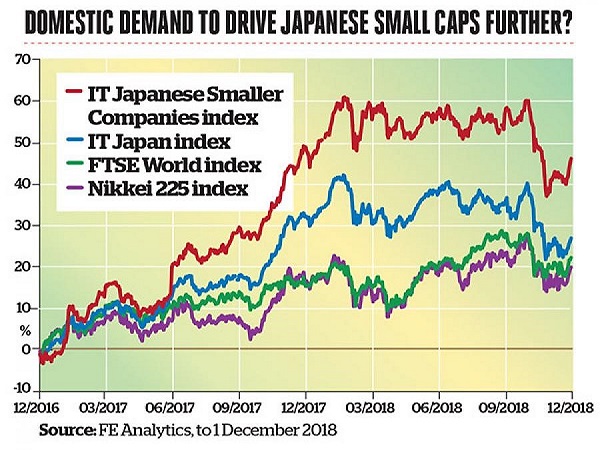

Japan

Sunrise or sunset for the latest revival bid?

Despite Japan disappointing investors in 2018, market commentators are generally bullish for 2019. Japanese equities are seen as being greatly undervalued, while optimism stemming from economic reform in the country remains high.

According to Jasper Koll, Japan senior adviser at WisdomTree, Japan's small and medium-size companies in particular are poised to perform well.

Domestic demand is in "a multi-year structural upward trend, led by rising domestic consumer spending and, importantly, a forceful reinvestment cycle among small and medium-sized companies rushing to upgrade their local capital stock".

This should mean that small- and medium-cap equities in Japan perform strongly. Koll says:

"2019 is poised to be a good year for Japanese risk assets in general and Japanese small-cap equities in particular."

Stronger performance

Stefanie Mollin-Elliott, an analyst at Unigestion, says she anticipates strong performance from domestic-facing Japanese firms. She expects to see wage increases of more than 3% this year, which should feed into increased consumption, GDP growth and inflation. She adds:

"We expect the Bank of Japan to maintain a relatively loose policy to offset any negative economic impacts from the October 2019 VAT hike."

Other factors should bring buoyancy. Pictet's Luca Paolini says Japan ought to be a bright spot, thanks to its attractive evaluations, its "political stability, low corporate leverage and the yen, which tends to appreciate when risk aversion rises".

However, some risks will persist for Japan in 2019. Its economy is highly integrated with the global economy and is therefore vulnerable to global headwinds. More sluggish growth in China and the country's trade war with the US threaten Japanese growth. Koll says:

"Japan's overall market is highly dependent on global economic fortunes and as much as 64% of Topix index earnings depends on overseas sales."

Large-cap stocks in particular are at risk. According to Koll, the performance of large Japanese companies will depend on the economic performance of the US and China, their primary customers. He says: "Neither the world’s largest nor its second-largest economy is likely to accelerate significantly in the coming nine to 15 months.”"

Mollin-Elliott also flags up the risk of a trade war. The downside risk to the Japanese equities market would be a more protracted slowdown in trade, she notes.

"It seems that share prices and valuations are already pricing in a 60% probability of a trade war between the US and China. Thus, a full-blown trade war could create downside for global equities, including Japan."

Lagarias has a more sceptical view of the country's economic future. He believes economic reform will be slow. He says: "Morgan Stanley's Ruchir Sharma has argued that reform impetus slows significantly after the first two to three years of an influential leader's governance, and market appetite to embrace reform declines shortly thereafter. Shinzo Abe has been in power since 2012." Lagarias doubts that Abe will now produce new reforms that will significantly address Japan’s long-standing structural problems.

"We don't expect the story to be any different from the narrative of past 30 years," he says. Japan's economy is characterised by shallow and volatile growth alongside low inflation or deflation.

He adds: "A pick-up can be expected in the first half of the year as investors focus on undervalued fundamentals. But once those fundamentals are fully priced, the growth rate to support investment is simply not there." That could mean a disappointing year for domestic market-focused small-cap companies.

Bull or bear?

Bull case: increasing domestic investment and demand should help Japanese small-cap companies perform well.

Bear case: reforms in Japan will remain modest and result in minimal real economic change and share price growth.

How to buy Japan

Investors can invest in the broader Japanese market through the HSBC Japan Index, which has an ongoing charge of just 0.19%. But tracking the FTSE Japan index will give exposure to Japanese large caps – not an area spoken of with much optimism. For those targeting gains through the more exciting route of Japan small caps, the iShares MSCI Japan Small Cap ETF, which tracks the MSCI Japan Small Cap index, may be more attractive. It has an ongoing charge of 0.58%.

interactive investor’s Super 60 investments list includes the low-cost HSBC Japan Index Fund.

For more investment ideas click here.

Asia Pacific

China's stellar rise still has traction

The Chinese government has been trying to deleverage and rebalance China's economy, but investors have been spooked by the prospect of a hard landing for the economy.

Such fears should recede in 2019, however, according to Ewan Thompson, head of emerging market equities at Neptune. He says:

"We expect 2019 to be a year of moderation and recovery."

While China is avoiding a 2008-style stimulus package that threatens its debt reduction goals, the country's authorities are cautiously activating levers of economic growth by cutting interest rates and tax rates. "We would not anticipate much further slowdown without it being met with significant economic stimulus," says Thompson.

A similar point is made by Luca Paolini of Pictet. He says: "Investor pessimism toward the world's second-largest economy looks hard to justify at a time when Beijing is supporting growth." He notes that the People's Bank of China is the only major central bank still in easing mode. Moreover, China offers the best value among its regional peers, with a 12-month price/earnings ratio of 10 times.

Vanguard's Peter Westaway adds:

"China's growth will remain near 6%, with increasing policy stimulus applied to help maintain that trajectory."

However, the big risk remains trade war with the US. "Unresolved US/China trade tensions remain the largest risk factor in our view," says Westaway. Paolini agrees: "The economic impact of a hike in US import tariffs has been negligible, but this could change if relations worsen," he says.

And the prospect of worsening relations should not be discounted. Jay Roberts, head of investment solutions at Royal Bank of Canada, points out that there has been a shift in US/China relations. The trade dispute has escalated into "a larger struggle over national security, underpinned by ideological differences."

However, Greg Kuhnert, portfolio manager of the Investec All China Equity fund, says investors "should not ignore China’s ongoing transformation, which is being driven by government reforms and economic innovation".

The outflow of international investors has created attractive valuations for quality firms with operating momentum, particularly in financial, utility, and communication services sectors, he adds. Many of these cater to China’s growing domestic economy, which the government believes must be encouraged to grow.

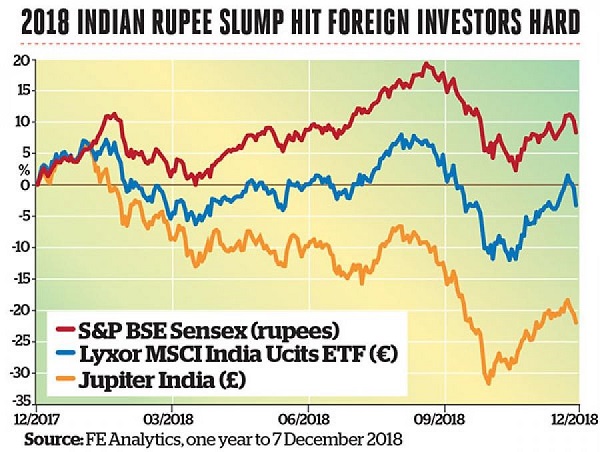

Indian equity markets suffered a correction in 2018, having hit some all-time highs. India's currency, the rupee, has been notably volatile, proving a headwind for sterling-denominated active funds. Yet its forward price/earnings ratio remains above the historical average. This is justified, according to Craig Farley, lead manager of the Ashburton India Equity Fund.

He says: "With growth recovering and earnings showing signs of strength, India’s slight equity premium is warranted. Several factors support this, including India's comparatively strong corporate governance across multiple sectors, prime minister Narendra Modi's reform agenda and growth opportunities in the world's fastest-growing major economy."

However, Lagarias says the Indian economy faces significant hurdles. He argues that despite the country's favourable demographics, "its diverse terrain, state politics and lack of infrastructure often make its economy unmanageable".

Hugh Young, a veteran Asia hand and managing director at Aberdeen Standard Investments, says:

"To get India to deliver to its potential, you need a proper banking system, but it is currently a mess."

Frontier economies such as Vietnam have been tipped to benefit as supply chain businesses are squeezed out of China by tensions with the US, but lack the infrastructure required for them to integrate into large international supply chains.

Bull or bear?

Bull case: the Chinese economy should continue to get support from the Chinese government, easing investor fears.

Bear case: China's dispute with the US has escalated beyond just trade. Long-lasting tensions may continue to weigh on markets.

How to buy Asia Pacific

Asia Pacific trackers tend to be more expensive than those for most other regions. But low-cost options can be found. TheLyxor MSCI Emerging Markets ETF (LSE:LEML), which has an ongoing charge of 0.12%, tracks the MSCI Emerging Markets Asia index. Investors optimistic about the growth of tech and e-commerce in the region might consider the EMQQ Emerging Markets Internet & Ecommerce ETF, which tracks regional internet-related businesses, including large Chinese e-commerce and tech¬ firms, and is a potential play on Chinese consumer growth.

interactive investor's Super 60 investments list includes the low-cost iShares Pacific ex Japan Equity Index fund.

For more investment ideas click here.

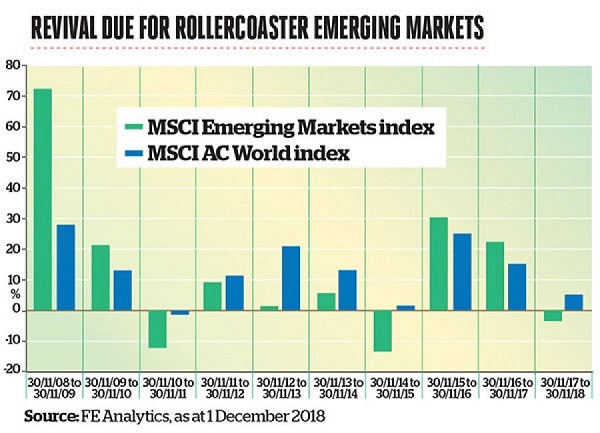

Emerging markets

Emergent nations on promising path

There's a maxim in investing that you can be either long the dollar or long emerging markets. The two are rarely able to rise together, as a stronger dollar puts pressure on emerging market economies.

This was demonstrated again in 2018. A booming US economy helped push up the value of the dollar against other currencies, wreaking havoc in emerging markets and pushing most of their stockmarket indices into bear territory.

Dollar determinant

The key question for emerging markets in 2019, then, is whether the dollar will remain strong. Peter Westaway says:

"Emerging market countries don’t control their own destiny and will be proactively forced to tighten along with the Fed."

Ewan Thompson believes the dollar will weaken. He says: "The trajectory of the US dollar is difficult to predict over the shorter term."

However, he argues that as the US economy cools off and other economies see a pick-up in growth, the dollar will lose ground and the performance gap between the US and the rest of the world will recede.

Gerrit Smit, head of equity management at Stonehage Fleming Investment Management, argues that the emerging market currency index indicates emerging market equities should rebound soon. Emerging market currencies appear to have stabilised. As a result, the region's shares have "recently turned a corner".

Importantly, this sell-off has made these equities cheap. WisdomTree's Aneeka Gupta notes that emerging market assets have "the lowest valuations among major asset classes globally". Valuations are currently at a discount of almost 30% on average, relative to developed markets.

Most commentators agree that this will attract investors back to emerging markets. George Lagarias says:

"We wouldn't be too surprised to see better performance."

Large investment houses have also taken a bullish stance. Morgan Stanley announced in November that it had gone from underweight to overweight in emerging markets.

Of course, the emerging markets category covers quite disparate economies. While the strong dollar has proved to be a general drag on emerging market performance, in 2018 many emerging markets endured their own idiosyncratic problems, including Venezuela, Argentina, South Africa and Turkey. That said, Gupta argues that "these are not accurate representatives of emerging markets". She also points out that significant economic strides have been taken within these countries.

One emerging market tipped to perform well in 2019 is Brazil . Thompson says: "Brazil has potential for market-friendly policies following the rejection of the left-leaning Workers' Party at the polls." But not everyone is as positive. Paolini says there is limited upside and valuations are hard to justify in Latin America, and especially in Brazil, where he thinks “newly elected president Jair Bolsonaro will find it difficult to deliver his business-friendly policies".

Bull or bear?

Bull case: an end to dollar appreciation, plus cheap valuations should help propel emerging market equities back up.

Bear case: idiosyncratic risks for countries will persist and act as a drag on those markets, even if the dollar weakens.

How to buy emerging markets

One of the cheapest ways to track emerging markets is through the Amundi IS MSCI Emerging Markets ETF, which has an ongoing charge of 0.2%. That's even cheaper than the Vanguard FTSE Emerging Markets ETF, charging 0.25%. Those seeking less volatility could opt for the iShares MSCI Emerging Market Minimum Volatility ETF, which tracks equities deemed to have lower volatility relative to the broader emerging equity markets.

It has declined less in downturns as a result. The downside is that it sees lower growth in good years. Its ongoing charge is higher at 0.4%.

interactive investor's Super 60 investments list includes the low-cost Fidelity Index Emerging Markets.

For more investment ideas click here.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.