Why Tesco shares are worth much more than this

Ahead of this week's results, one industry expert thinks Tesco shares are significantly undervalued.

11th June 2019 14:23

by Graeme Evans from interactive investor

Ahead of this week's results, one industry expert thinks Tesco shares are significantly undervalued.

As Tesco (LSE:TSCO) boss Dave Lewis prepares for another go at winning over a sceptical City, the supermarket giant has been boosted by the support of one leading broker today.

UBS analysts think that Tesco shares are significantly undervalued at their current price of 229p, with the chain meriting a price of 315p given the impressive headway made during a "broad-based and sustainable recovery" over the past four years.

Lewis, a former Unilever (LSE:ULVR) executive, will reveal further insight on Tesco's progress at Thursday's first quarter trading update, as well as at its annual capital markets day in Welwyn Garden City on June 18. He's already primed retail analysts to expect a "pretty full day" as the Tesco management team sets out the "untapped value opportunities" available for the chain.

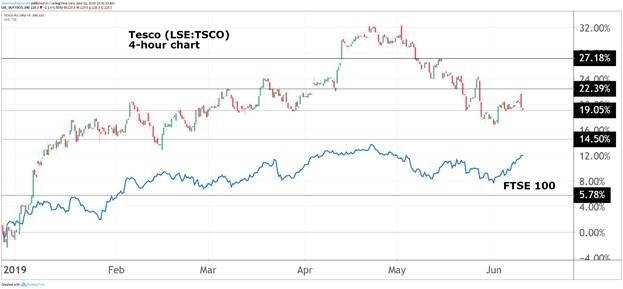

Source: TradingView Past performance is not a guide to future performance

UBS analyst Sophie Wu thinks these opportunities are greatest in the UK, where the recently combined Tesco and Booker entity has a particularly strong position in the higher margin food service channel. She's also looking for an upside in Asia, where Tesco is capable of driving margins through own-brand products and scale in the Thai market.

She believes the market has significantly undervalued the stock, which continues to trade where it was last autumn despite a strong set of full-year numbers in April and a strengthening of Tesco's competitive position following the Sainsbury's (LSE:SBRY)-Asda merger collapse.

Wu said:

"Consistent margin rebuild in its UK business and like-for-like growth outperformance reflects genuine reconnection with shoppers and superior terms of trade that culminates from innovative approaches with suppliers."

She notes the market's current consensus of 19.8p for earnings per share in the 2021 financial year is 7% below the company's own targets for its long-term incentive plan. UBS is more positive about Tesco's mid-term growth potential at 8% above the 2021 consensus.

The broker also thinks there's scope for Tesco to start a buy-back programme once it has hit its leverage target after the 2021 results. That would be a significant landmark for a company that slashed its dividend in 2014 in order to give Lewis the firepower to rebuild the supermarket.

Lewis has already pledged to grow the dividend to around two times cover in this financial year before adopting a 50% pay-out ratio.

One reason for the market's caution is likely to be ongoing fears over UK consumer confidence and the continued expansion of discounters Aldi and Lidl. Faced with strong comparatives as well, UBS thinks Thursday's update will show like-for-like sales growing by a modest 0.7% at Tesco and 4.5% for Booker.

Tesco is still likely to have benefited from the merger distractions facing its two biggest rivals, Sainsbury's and Asda.

Tesco's own high-profile acquisition of Booker is already integrated and looks to be a strategic triumph, with the cash-and-carry chain adding £196 million of profits and £79 million of synergies to Tesco's recent full-year operating profit of £2.2 billion.

Tesco has now met the vast majority of its turnaround goals, including in terms of competitiveness. One of the most significant targets has been to achieve a margin of between 3.5% and 4%, which the chain managed in the second half of last year with a figure of 3.96%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.