Why these two US-listed electric vehicle wannabes are a high-risk punt

6th April 2022 09:38

by Rodney Hobson from interactive investor

These electric vehicle manufacturers want a slice of a rapidly expanding pie, but can they rival Tesla, or will they end up on the scrap heap? Our overseas investing expert assesses prospects.

Electric vehicles may be the future but this is a tough, not to say expensive, market to break into. Two smaller outfits have caught the imagination of investors, but this is a high-risk game with an uncertain outcome.

Arrival (NASDAQ:ARVL) claims to be reinventing the automotive industry with a new approach to the design and assembly of electric vehicles, initially specialising on vans and buses. It is a British company governed by Luxembourg law with a listing in New York.

If that sounds a bit unfocussed, listen to this: “We are a technology company, a product company, a supply chain company, an automotive company, a mobility company, a fintech company and a service company - all rolled into one.”

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Two US corporate bidders I’d buy shares in

In contrast to traditional vehicle manufacturing in large purpose-built factories, Arrival plans to set up microfactories in unused factories and warehouses. It sounds like the sort of idea that Del Boy would have inthe TV hit Only Fools and Horses.

This approach may sound as if speed is of the essence, but Arrival was founded in 2015 and yet it is boasting that 2021, six years later, was “a transformative year for Arrival where we saw our key technologies coming together in readiness for delivering vehicles to our first customers.”

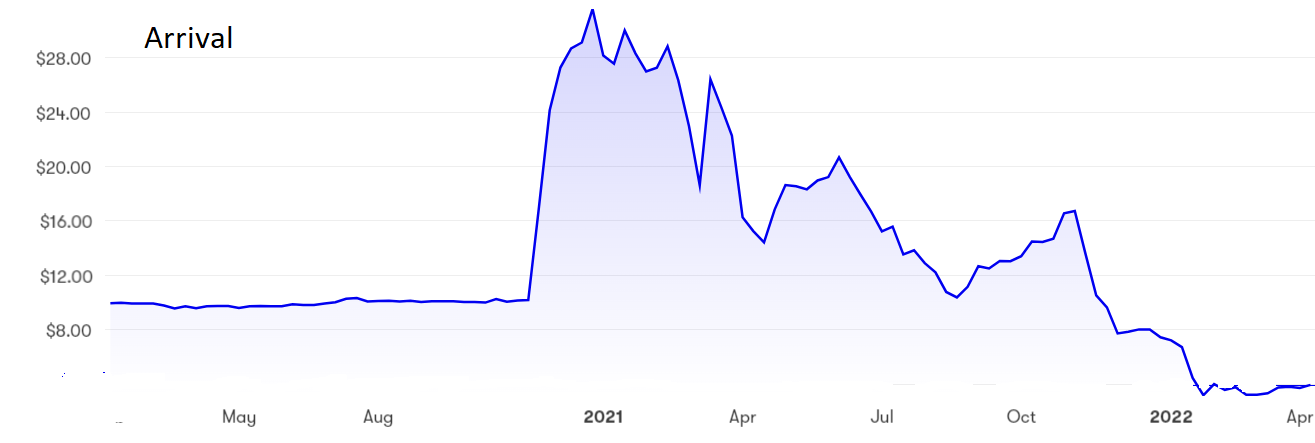

Source: interactive investor. Past performance is not a guide to future performance.

This year kicked off with “a major achievement” as robots assembled the structure of a van but this is still not producing the first vehicle that can actually run on the roads. Research and development is taking place at Banbury for a new passenger bus that allows social distancing, just in time for pandemic restrictions to be lifted. Bus production in the US has been delayed until later this year and could well be delayed again or be started with reduced capacity.

In the meantime, Tesla (NASDAQ:TSLA) has dominated the headlines for electric vehicles, and traditional petrol and diesel vehicle makers have been rolling out new electric and hybrid lines. Arrival does have potential orders for about 134,000 vehicles but these are non-binding and some are no more than expressions of interest.

- Tesla and the electric car revolution

- Top 10 things you need to know about investing in the US

- Read more of Rodney's articles here

- Chart of the week: has Nio turned the corner?

With no vehicles to sell, Arrival has been running up quarterly losses of more than €30 million and, as capital spending is ramped up, that situation will only get worse. There is a serious danger that the company will eventually run through its €796 million cash pile.

Lucid (NASDAQ:LCID)designs and makes electric vehicles using its own equipment and factory. It, too, has scaled down production forecasts after receiving only moderate interest in its first electric vehicle, the Lucid Air, compared with orders for the Chevy Silverado from General Motors (NYSE:GM) and the Mustang Mach from Ford (NYSE:F).

Lucid has one advantage over Arrival, a huge cash pile of $6 billion, so it can finance higher production – if it gets the orders.

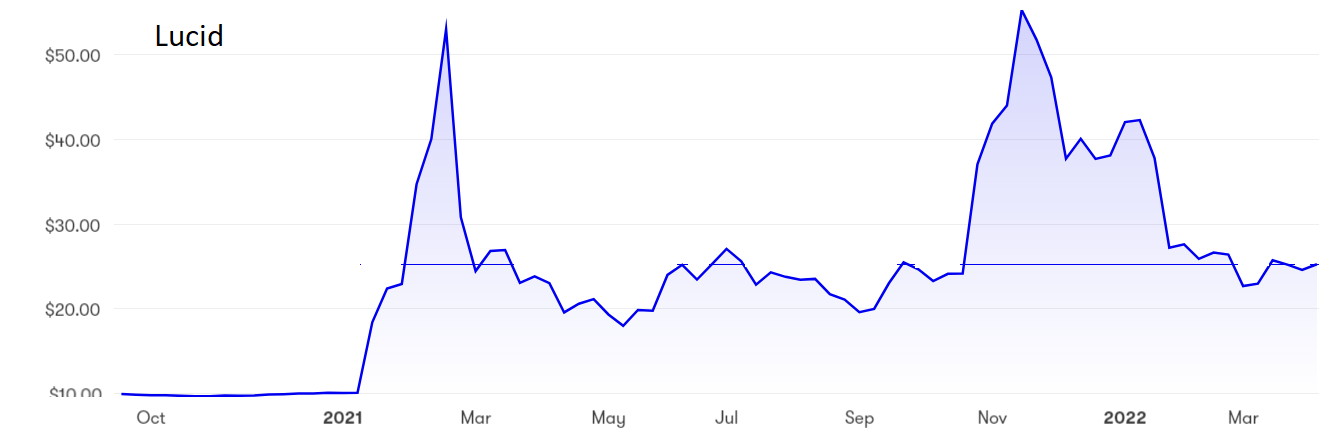

Arrival shares suddenly shot up from $10 to $31 at the end of 2020, but they have been sliding since and now stand below $4, giving the company a valuation of $2.5 billion. Lucid shares have swung heavily between $10 and $55 since the start of 2021 but seem to be settling around $25, valuing the company at just over $40 billion.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Don’t even think about receiving a dividend from either company for several years as cash is needed to plug losses and, one hopes, to finance production. The only hope is for capital gains if either takes off, which is frankly doubtful.

I rate both shares a sell but, if you fancy a high-risk punt, I think Arrival has the better prospects. It has more potential orders and is at least doing things differently with its microfactories. Also, the commercial vehicles market may prove slightly less crowded than cars.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.