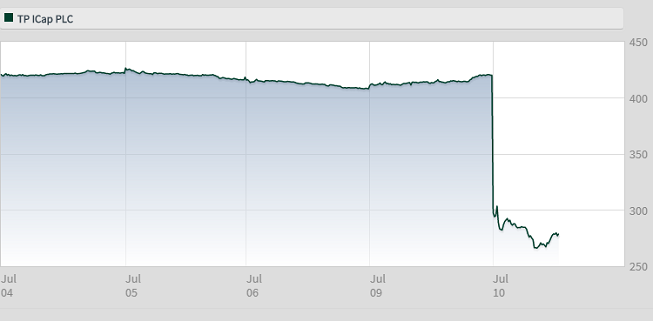

Why TP ICAP just crashed to multi-year low

10th July 2018 12:55

by Graeme Evans from interactive investor

It's all gone wrong for mid-cap interdealer broker TP ICAP, but one small-cap has had a stroke of luck. Graeme Evans reveals who.

The reversal in fortunes for interdealer broker TP ICap and its chief executive John Phizackerley has been swift and brutal.

Only four months ago, Phizackerley was talking up prospects after a "good first year" since the company's creation out of the merger of Tullett Prebon and ICAP's global voice broking business. As recently as May, TP ICAP was "firmly on track" to deliver £100 million of deal synergies by 2020.

Now Phizackerley is out the door, with that synergy target cut to £75 million a year and shareholders sitting on holdings that have almost halved in value since March thanks to today's 36% slump in share price.

On top of the reduced synergies target, TP ICAP said profits for 2018 will be impacted by additional cost headwinds of around £10 million relating to Brexit, MiFID II, regulatory and legal costs, and IT security.

This means earnings per share (EPS) will be towards the bottom end of the forecast range of between 34.9p and 39p. What's more, those additional cost headwinds will rise to £25 million by 2019.

Ahead of the market open Tuesday, finnCap analyst Jeremy Grime shared fears that the stock — currently trading with a price earnings ratio of 17x and 3.6% dividend yield — would only get cheaper.

Source: interactive investor Past performance is not a guide to future performance

Echoing Brexit developments at Downing Street, he added: "When Theresa May has her bad days she can console herself that she isn't a voice broking interdealer broker. It's hard to see any catalyst for this one."

The nature of Phizackerley's departure after four years at the helm of Tullett Prebon and TP ICAP highlights the urgency of the company’s position.

He departs with immediate effect, with not so much as a "thank you for all your hard work" in today's RNS from chairman Rupert Robson. The new boss is Nicolas Breteau, who joined Tullett Prebon in 2016 and currently leads TP ICAP's largest business, Global Broking.

Robson, who himself is due to leave at the end of this year, said: "We are confident he has the skill-set to deliver the future growth of the business and conclude the integration."

There are still a few good reasons to be positive, not least a return of market volatility and rising interest rates. As the world's largest interdealer broker, TP ICAP should be well placed to benefit.

The MiFID II regulatory changes have also passed without major alarm, with the company hopeful that the new rule book's focus on best execution will make it a "go-to-hub" for best liquidity, pricing and data and analytics.

But that is offset by the impact of Brexit, which is moving from the planning stage to decision-making and action without TP ICAP having full understanding of the outcome of negotiations between the EU and UK.

In today's other market-moving developments, Cambian surged 35% after it confirmed it was considering a 220p a share takeover approach from fellow residential care firm CareTech Holdings.

Cambian looks after 2,100 children and employs 4,300 people at 224 residential facilities, specialist schools and fostering offices. Its shares were as low as 141p earlier this month, having struggled since climbing to 230p last summer.

Sky News reported last night that AIM-listed CareTech has the support of a number of Cambian's institutional shareholders. CareTech share were 3p higher at 378p today.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.