Why VCTs are retaining their pulling power

Plenty of investors are still gravitating towards tax-efficient venture capital trusts.

10th March 2020 10:14

by Cherry Reynard from interactive investor

Plenty of investors are still gravitating towards tax-efficient venture capital trusts.

It has been a gloomy time for investors in smaller UK companies. Investors concerned that they are too vulnerable to the volatile UK economy in the wake of Brexit have shied away.

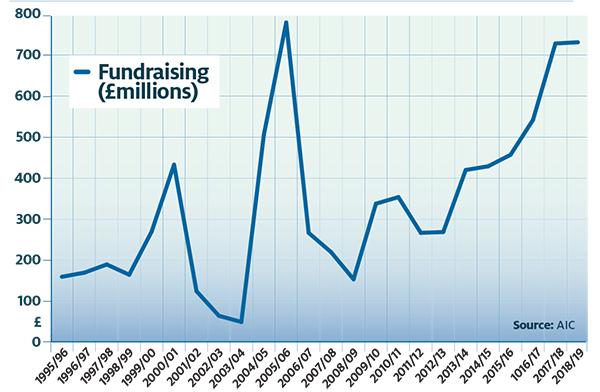

In this context, the popularity of venture capital trusts (VCTs), which have raised record amounts, is an anomaly. Figures from the Association of Investment Companies show that investors committed £731 million to the sector during the 2018/19 tax year, up from £728 million in the previous year and an impressive 70% higher than the £429 million invested five years ago.

Investors have already committed £210 million into VCTs so far in this tax year, more than the amount raised during the same period last year, according to analysis from Wealth Club. Popular VCT groups such as Albion Capital have already closed fundraising for the 2019/20 tax year. As at 28 November, Octopus Titan had raised £60 million, while Mobeus had raised £38 million.

- Top tips to minimise your tax bill for this tax year and the next

- 10 little-known tax traps and how to avoid them

- Pensions vs Isas - which is best for a lump sum at tax-year end?

Income-seeker shelter

The bonanza can be partly explained by changes to the pension rules that restrict tax credits for high earners. Chris Hutchinson, manager of the Unicorn AIM VCT, says: “High earners are seeking out tax-efficient investment products that can help them offset the reduction in their pension allowances over recent years. In their most severe form, tax-free pension contributions are now tapered to just £10,000 a year (for those earning more than £210,000). What’s more, an increasing number of senior professionals have reached their maximum lifetime allowance for their personal pensions.”

VCTs offer upfront tax relief while building up a tax-free dividend stream. VCT popularity has tended to trump that of other products such as enterprise investment schemes (EIS). This is because the small companies VCTs back while they are at an early stage in their development are, nevertheless, more established than the start-up businesses held in EIS schemes.

However, the pension restrictions don’t completely explain the popularity of VCTs at a time when there has been little wider appetite for smaller company investing. At the margins, the decline in buy-to-let investing has also played a role. A recent report from Simply Business, an online broker of business insurance, shows that 26% of landlords are looking to sell at least one buy-to-let property in 2020, a trend that has been intensifying in the face of a stagnating buy-to-let market and changes to the rental income tax rules. This has left people with spare ‘risk’ capital that they are keen to invest, for which VCTs are a natural home.

Chris Morris, manager of tax-efficient investments at LightTower Partners, believes the recent election result will also have an influence. He says: “The political backdrop has likely played a part in VCTs’ popularity, as the threat of any radical changes to the sector has reduced following the election result.” Under a Jeremy Corbyn-led Labour government, a lot of incentives to invest in small firms would probably have been eliminated, but Labour’s defeat has removed this risk. Alex Davies, chief executive at Wealth Club, agrees. He says that increasing political certainty should ensure demand for VCTs in the current tax year outstrips that of last year, and that popular offers are filling up fast.

In the face of the tax incentives to invest in the sector, performance considerations have become a distant secondary priority for many investors. Nevertheless, performance has been creditable, albeit some way behind mainstream equity markets. Over five years, the average generalist VCT has risen by 36.1%. This compares with 81.2% for the average UK all-companies investment trust. Aim VCTs have fared better, with the average trust up 53% over five years.

Historic VCT fundraising figures excluding enhanced share buybacks

Solid performers

The question is, can performance hold up from here or would investors be better off forgoing the tax breaks? Ben Yearsley, a director at Shore Financial Planning, believes recent performance has suffered because VCT groups have been overzealous in their fundraising: “To my mind, performance has slipped because many of these companies are holding huge amounts in cash.”

He says VCTs have made hay in a buoyant fundraising environment, but have often raised more than they can deploy quickly and effectively. “There is a danger then that they are overpaying for deals, because there is greater competitive pressure,” he adds. “I’m still investing in the sector, but the returns over the next five to 10 years are likely to be lower than they have been over the past five to 10 years.”

Cash acts as a drag on portfolio returns in a number of ways: it is money that is not invested, so is not generating dividends and capital growth; and the interest rate on cash is generally below inflation, which erodes capital over time. Equally, investors will be paying fees on that cash. They may be paying a 2% management fee on a cash holding that is losing 1% a year in real terms.

Some VCTs have addressed the problem by implementing a tiered pricing structure and charging a lower rate for cash holdings. This, says Yearsley, is welcome, but he is still keen for boards to put a brake on capital raising.

The recent changes in the rules on qualifying companies for VCTs mean it has become more difficult to pick trusts based on past performance. Managers have been pushed into smaller, higher-risk investments, so their historic track record has less relevance.

Yearsley sees a similar problem with dividends. He says: “Many people look at their regular annual dividend per share but don’t recognise that it is coming out of capital reserves. The performance of a manager over the past two to three years will be driven by what they were doing six or seven years ago, but they can’t make the same investments today. Past performance – of dividends or capital growth – often doesn’t provide a fair comparison.”

Against that, the sector has seen a significant shakeout in recent years. After the global financial crisis hit, there was considerable consolidation among VCT managers. Many weaker players exited the sector, and assets became concentrated in the hands of a small group of more experienced managers. While the cash issue is undoubtedly a problem, assets are generally in good hands.

However, the greater appeal of VCTs means good offers close more quickly, so investors need to be alert to new offers opening and those nearing capacity. Hutchinson says: “A number of managers still have VCT offers open, although the largest and most popular of these are typically approaching capacity, as demand increases toward the end of the current tax year.”

Yearsley says that some of his favoured VCT offers have already sold out, although Pembroke remains open and would be his pick for this tax year.

Aim VCTs may be due a resurgence. The Aim market has seen weaker relative performance as part of the lack of appetite for UK smaller companies. It has seen a considerable bounce since September 2019 and should be a beneficiary of greater certainty in UK politics and around Brexit. Yearsley suggests holding around 10%-15% in Aim VCTs, and favours Unicorn and Amati.

Recovery mode

Morris adds: “Now that the new pension rules are a few years old, people have had time to understand them and learn how to best maximise the tax-efficient products available. But people still need to be on top of their research and due diligence. What’s more, they need to complete it as soon as possible, as the best offers are likely to fill well before the end of March.”

VCTs have their place in investors’ portfolios, especially those of investors who have run out of other tax planning options. There is some concern that the level of cash being raised will hit performance. However, VCTs may receive a boost from a better environment for smaller companies, as the UK political and economic climate stabilises.

VCT tax allure

We have looked at reasons to be cautious about VCTs. However, for someone who has exhausted their annual Isa and pension allowances or exceeded their lifetime allowance, the tax breaks still look generous. Investors get 30% income tax relief on subscription on sums up to £200,000 as long as they hold the shares for five years. Dividends and capital gains are tax-free. Just as important for some investors, they are supporting small firms that may otherwise lack funding.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.