Why we just bought this ‘old favourite’ fund

After shifting into cash before the worst of the crash, Saltydog investor has been buying again.

20th April 2020 13:37

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After shifting into cash before the worst of the crash, Saltydog investor has been buying again.

The first signs of recovery

The major downturn in the markets, because of the global spread of Covid-19, didn’t really get going until the end of February. But once the possible scale of the pandemic was appreciated, the fall was dramatic.

Within a couple of weeks stock markets around the world were showing double-digit losses.

However, there has been a slight recovery, and this is starting to show up in our weekly numbers.

Every week, we review the performance of thousands of Unit Trusts, OEICs, Investment Trusts and ETFs. We start by narrowing the list down to the ones which are domiciled in the UK and readily available through the large fund platforms.

We then classify them using their Investment Association sectors and finally combine these sectors to form our own Saltydog groups.

The groups are:

- Safe Haven

- Slow Ahead

- Steady as She Goes

- Full Steam Ahead

The groups are based on the historic volatility of the sectors that they contain and, as the names would suggest, the ‘Safe Haven’ sectors have been the least volatile while the ‘Full Steam Ahead’ sectors have been the most volatile.

The first section of our analysis looks at the relative performance of the sectors within each group.

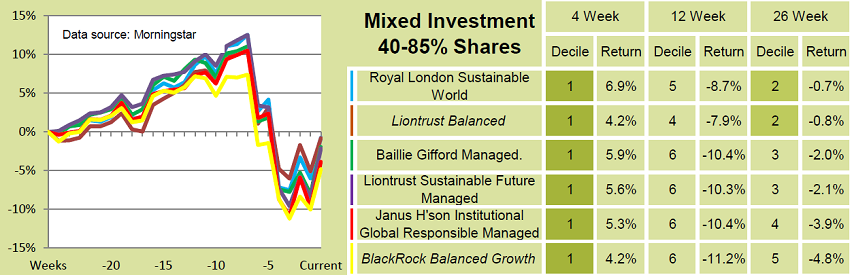

This is how the analysis for the ‘Slow Ahead’ Group was looking last week:

We calculate a weekly average for each sector based on the funds in our analysis, and also work out cumulative returns over four, 12 and 26 weeks.

The four-week period is important because we feel that it’s pretty hard to justify anything being a trend in a shorter period of time. Even after four weeks it is still early days, but some momentum is gaining.

One of the interesting things about last week’s table is that one of the sectors, ‘Mixed Investment 40-85% Shares’, was showing a gain over the last four weeks. It’s over a month since any sector from this group has had a positive four-week return.

As well as providing information about the different sectors, we also highlight a few funds from each sector based on their performance over a couple of different time frames.

This table is from last week’s report and shows some of the funds from the ‘Mixed Investment 40-85% Shares’ sector.

Three are particularly familiar to us. For most of last year our demonstration portfolios held the Royal London Sustainable World, the Liontrust Sustainable Future Managed fund and the Janus Henderson Institutional Global Responsible Managed fund. We only sold them earlier this year at the beginning of the recent crash.

We noticed that they had stopped going lower a couple of weeks ago, and made a speculative initial investment into the Royal London Sustainable World fund – so far it has paid off. Last week we added to it and bought the Janus Henderson Institutional Global Responsible Managed fund.

Last week, we also saw a number of sectors from the other Saltydog groups showing cumulative four-week gains for the first time since the major falls at the end of February and the beginning of March.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.