World-class funds to buy for high income

18th January 2019 15:53

by Jennifer Hill from interactive investor

We identify the most promising asset classes, regions and sectors for income-seeking investors in 2019.

Income-seekers should proceed with caution amid growing headwinds – a mature economic cycle, rising interest rates, the withdrawal of fiscal stimulus and a return to financial market volatility.

"There has been a significant search for yield over the past few years, and as we're nearer the end of the investment cycle than the beginning, the risks associated with a hunt for income have increased," says Justin Oliver, deputy chief investment officer at Canaccord Genuity Wealth Management.

"Investors need to exercise increased care. Assets that have been buoyed primarily as a result of their income-generating capabilities could quickly be undermined, and investors should be very wary about being trapped in illiquid markets when some of the fundamental support is removed."

During most of the past decade, falling interest rates provided tailwinds to income sources, supporting or inflating their prices. Now, some of these tailwinds are dying off and in some cases reversing.

The US Federal Reserve has hiked interest rates three times (as at end November) to 2.25% in 2018, and policymakers have pencilled in three more increases in 2019 and one in 2020. In the UK, the Bank of England increased the base rate twice in 2018 – from 0.25% to 0.75% – and "might hike [again] once the process of Brexit progresses", according to Nick Samouilhan, EMEA solutions strategist at T Rowe Price.

"As yields fell on conservative income sources such as gilts and Treasury bonds, income-seekers turned to riskier ones, such as dividends from stocks or coupons from high-yield corporate bonds," he says.

"This has not been an issue for most investors as risk assets have mostly performed strongly over the past decade. These conditions, however, are likely to be challenged in the coming years and some riskier sources of income might come with capital losses. Investors must be selective when seeking income."

Much of the outlook for income-biased investments around the world depends on the prevailing interest rate environment. Given the likelihood of further hikes in 2019, the relative attractions of cash will rise – increasing the pressure on competing income options.

"Higher rates are not going to be good news for some expensive equities out there, especially for the stocks of companies that have gorged on cheap liquidity for the last decade, as among other things they mean higher borrowing costs," says Mark Whitehead, head of equity income at Martin Currie.

For Eugene Philalithis, manager of the Fidelity Multi Asset Income fund, the year ahead will be characterised by a continued shift from quantitative easing to quantitative tightening, with increased structural volatility arising as a result. His focus for 2019 is on capital preservation; he will be looking to 'play defence' by avoiding overvalued sectors and focusing on areas that have low correlation to traditional asset classes.

Against this backdrop of rising volatility and tightening monetary policy, we ask investment experts for their recommendations for three types of income-seeker – and tips on what to avoid.

Buy: UK equities for balanced income

As concerns over global trade wars exacerbate the stock market volatility that returned in January 2018, investors’ mindsets have shifted from a 'Goldilocks' environment (neither too hot nor too cold, with sustained, moderate growth and low inflation) to end-of-cycle considerations – and in the process to solid dividend payers, according to Nick Clay, manager of the Newton Global Income Fund.

"Recent support for more defensive companies with sustainable cash flows is happening because investors are starting to remind themselves of what has worked over the long term, rather than simply focusing on a fairly short-term period of underperformance of dividend income," he comments.

UK equities are one of the most consistent sources of dividends and have held up well, helped partly by the fall in sterling. They are Premier Asset Management's top pick for balanced income seekers at present, largely because of Brexit.

"That statement is likely to raise an eyebrow or two, given the parlous state of the process," says multi-asset fund manager Simon Evan-Cook.

"We are not saying that Brexit itself is a good thing; in fact we are just as bewildered about the process as anyone. We are instead firm believers in the Buffettism that you should be fearful when others are greedy and greedy when others are fearful. And there is certainly plenty of fear surrounding anything UK-related at the current time."

He points to a 4.4% yield on the FTSE All-Share index – a figure that compares very favourably with other global equity markets. "The UK's culture of dividend-paying and solid corporate governance means that, political concerns aside, this is effectively a good-quality asset trading at a reasonable valuation – a rare thing in today’s world," says Evan-Cook.

Chelsea Financial Services likes large UK companies and tips the Schroder Income and Rathbone Income funds, which have 87% and 66% respectively in companies of this size.

Threadneedle UK Equity Income Fund has 75% in large caps and deputy manager Jonathan Barber highlights the income credentials of constituents GlaxoSmithKline (LSE:GSK) and Imperial Brands (LSE:IMB). Both companies are highly cash-generative and their shares yield 5.1% and 7.9%, respectively, on consensus expectations.

Buy: Emerging market debt for high income

For those seeking high income, emerging market debt is the most widely recommended asset class. T Rowe Price, Fidelity and Morningstar all favour this area.

"Bonds issued in emerging economies offer access to different interest rate cycles, attractive levels of income and diversification," says Samouilhan at T Rowe Price, which invests in both 'hard' currency bonds (denominated in US dollars) and local currency bonds.

For Mark Preskett, a portfolio manager at Morningstar Investment Management Europe, the "standout high income opportunity" is local currency emerging market debt. This can be accessed at a "yield to worst" (the lowest yield an investor can expect) of 6.9% – a level that is “tough to find from traditional asset classes".

Currency risk is a key factor to consider, as are the idiosyncratic risks of each country.

"For example, Brazil and Mexico both make up 10% of the index, and we have seen recent volatility in their bond markets following tight-run general elections and the uncertainty that new political leadership brings," says Preskett.

"That said, on balance, we feel the reward of a combination of depressed currencies and attractive bond yields makes this a great high-income play and have been adding to the asset class on weakness in our income portfolios."

Philalithis at Fidelity also likes local currency emerging market debt. "This asset class was hit quite hard in 2018 due to the traditional headwinds of US dollar strength, higher US interest rates and a shrinking Federal Reserve balance sheet. These economies are particularly vulnerable to these conditions, due to their large current account deficits and high levels of US dollar debt," he says.

To take advantage of the strong fundamentals, cheap valuations and attractive yields, Fidelity has hedges in place across six emerging market currencies. "This effectively helps us hedge out a meaningful part of our emerging markets foreign exchange exposure and ultimately protect capital," adds Philalithis.

Chelsea likes the M&G Emerging Markets Bond Fund, which invests in both dollar-denominated and local currency bonds, and the Ashmore Emerging Markets Short Duration fund, which holds hard currency bonds only.

Buy: Japanese equities and infrastructure for growing income

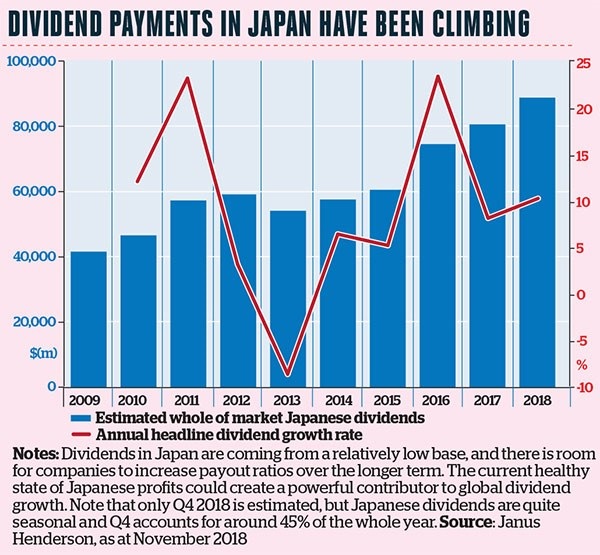

Japan is often overlooked when investing for income. The Tokyo Stock Price index (Topix) yields just 2%, but a dividend culture is developing in Japan. BMO Global Asset Management points to dividend growth since the introduction of corporate governance and stewardship codes in 2015 – from ¥9 trillion per year in March 2015 to ¥13 trillion in March 2018. Around 10% of companies now yield more than 3%.

Companies still hoard large amounts of cash on their balance sheets – 57% of Topix constituents trade on net cash, compared to 20% for the S&P 500 constituents. "Domestic Japanese investors have petitioned company management to increase the dividend payout ratios, which still average a lowly 30%," says Paul Green, a multimanager at BMO.

"There's a long way to go, but therein lies an opportunity for active managers to identify businesses whose policies are becoming increasingly aligned with shareholders. We are cognisant that the acid test of these cultural changes will only occur during periods of market stress and during the next downturn."

His favourite fund is Coupland Cardiff Japan Income & Growth, which yields 3.1%, having grown dividends by an annual 11% over the past five years.

Infrastructure, including renewables, is Mattioli Woods' highest-conviction idea for growing income. The wealth manager uses several investment trusts investing in concession-based assets that are subject to long-term government contracts offering inflation-linked income. One of its core holdings is International Public Partnerships, which has a net yield of 4.5%.

Shore Financial Planning, a Plymouth-based adviser, likes the income growth potential of funds investing in infrastructure, student accommodation and social care homes – all structural growth areas that are less dependent on the economic cycle to thrive.

"Investments with inflation-linking look interesting – I'm talking renewable energy and infrastructure – as we seem to be going into a period of higher inflation, which should have a knock-on impact on income," says director Ben Yearsley. He likes VT Gravis UK Infrastructure Income for a UK play and First State Global Listed Infrastructure for more global diversification.

Avoid: Developed market government bonds and high-yield corporate bonds

For Morningstar, high-yield corporate bonds are too expensive to own with any degree of confidence.

"Credit spreads – the difference in yield between the asset and its government equivalent – are at cyclical lows and we feel investors are better served by avoiding this asset class entirely," says Mark Preskett.

Philalithis at Fidelity has also been reducing exposure to European and US high-yield bonds to fund his move towards Chinese government bonds.

While most investors regard developed market government bonds as a reliable source of income, this might change in a rising interest rate environment. "Some apparently safe core government bonds appear pricey and could well be a risky investment, delivering negative returns," warns Samouilhan.

As bond prices have risen – the result of many years of monetary expansion – yields have fallen to extremely low levels. The exception is the US, where the yield on benchmark 10-year Treasury bonds has risen from less than 1.5% in 2016 to 3.25% today.

"While normally attractive – at least some investors currently think so – we are sceptical," says George Lagarias, chief economist at Mazars.

"Despite the huge influx of dollars in the US, bond prices keep falling and yields keep rising. What will be the case when these flows peter out, especially if one considers the growing deficit and the probability of more volatility during a potential debt-ceiling battle between the president and a Democratic house?"

Lagarias advises income-seekers to take a cautious stance. "We believe investors have to be very careful when pursuing income strategies for the next six to 12 months," he cautions.

How to buy the world for income

Among passive strategies, Morningstar prefers funds that are well diversified to minimise the chances of unintended sector bets.

The Vanguard FTSE All-World High Dividend Yield ETF is the most diversified among the funds Morningstar currently rates, holding more than 1,400 stocks. It offers an above-average yield of 3.55%. Another key positive is its low cost of 0.29%.

The iShares MSCI World Quality Dividend ETF is also worth considering. "What we like about this fund is its process of testing whether companies are healthy enough to pay and sustain their dividends before they are included in the portfolio," says Morningstar analyst Dimitar Boyadzhiev.

"It might be not as diversified as the Vanguard fund, but we think that its rigorous quality screens make it a decent option for income seekers."

It yields 2.4% and has an annual ongoing charge of 0.38%.

Seven Investment Management likes the WisdomTree Emerging Asia Equity Income ETF, which tracks the top 30% of dividend-payers from China, Indonesia, South Korea, Malaysia, the Philippines, Taiwan and Thailand. The fund yields 5.05% and has charges of 0.54%.

These funds are popular options among income-seekers. The Vanguard and iShares funds attracted $115 million and $16 million of new assets respectively in the first 10 months of 2018, while the WisdomTree fund saw inflows of $12 million from the start the year to 18 November.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.